IRI and BCG Announce 2020 CPG Growth Leaders, Identify Post-Pandemic Trends

Pandemic-driven changes in consumer shopping habits had a significant impact on the U.S. CPG industry’s growth in 2020, driving unprecedented sales and establishing a wave of new trends that could continue post-pandemic. In their ninth annual CPG study published this month, data firm IRI and Boston Consulting Group identified the top companies and categories that drove CPG growth in 2020, and forecasted the possible strategies for success beyond the pandemic.

CPG sales grew 10.4% last year, nearly five times the growth the industry experienced in 2019, according to the report. These sales saw a significant spike in the second quarter of last year, up 30% in mid-March, and then saw sustained growth of 6% to 8% throughout the remainder of the year. While larger CPG companies saw growth 15 times that of previous years, small CPG brands still gained share as a result of out-of-stocks from large brands and decreased sales in the convenience channel, which, the report noted, is largely dominated by the CPG giants.

Last year was the first in over a decade in which CPG volume growth outpaced price/mix growth due to increased demand beginning at the onset of the pandemic in March of 2020. Large and medium growth leaders had overlaps with years past, while small growth leaders were made up of 60% new brands, in categories including frozen foods.

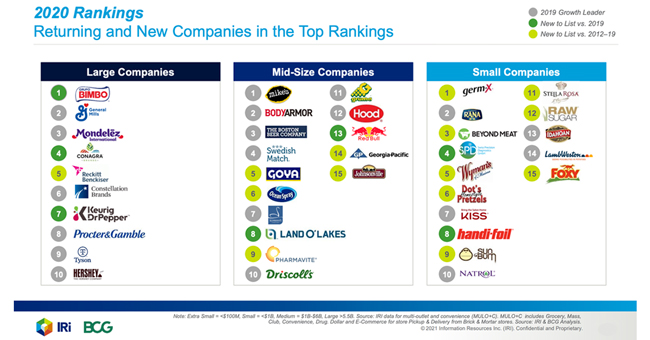

Top 10 Large CPG Growth Leaders

With 15.4% sales and 13.9% volume increase year-over-year, Grupo Bimbo was the growth leader among the top 10 large companies (greater than $6 billion in sales). Grupo Bimbo, along with Conagra and Keurig Dr Pepper (KDP), were new entrants to the list, while General Mills, Mondelez, Tyson, Constellation Brands and Hershey remained on the list from 2019.

Categories that drove growth for large companies reflected the trends toward at-home meal consumption and indulgence, with bakery, refrigerated dough, cookies and candy, frozen meals and poultry and carbonated soft drinks seeing the largest sales bumps. Grupo Bimbo saw the largest sales growth in bread and sweet baked goods. Meanwhile, Conagra’s growth was driven by frozen foods and snacks, gaining sharing in ecommerce and winning with younger consumers.

Hershey also benefited from continued innovation with new flavors, its Thins platform and multi-packs accounting for dollar sales increase, the report noted KDP saw success in new flavor innovations (Canada Dry Bold, Dr Pepper Cream Soda) as well as distribution 12-packs and 6-packs suited for at-home consumption.

In the report, CPG executives, including leaders from Keurig Dr Pepper, Bimbo Bakeries USA, The Hershey Company and General Mills, shared their strategies for success such as adapting to consumer demand shifts, adjusting digital, social and branding messaging, leveraging retailer and supplier relationships and inspiring their respective companies to “rise to the occasion.”

Shane Faucett, chief customer officer for Bimbo Bakeries USA, said that the company’s new mission and mantra “Feeding America while Staying Safe” became the priority for its 20,000 associates during the pandemic.

“As we strived to serve customers and consumers, it was exciting to see these efforts result in industry-leading growth,” he said.

Top 15 Mid-Size and Small CPG Growth Leaders

For medium companies (between $1 billion and $6 billion in sales), Land O’Lakes and Red Bull were new entrants, while Goya, Ocean Spray and Johnsonville returned to the list aftering not being included in 2019. Hood and BodyArmor returned to the list for a second year. Ocean Spray saw notable growth in its juice (23%) and dried fruit (9%) businesses, which the report noted were driven by targeted TV, digital and social media campaigns. Plant-based milk was the largest growth driver for Hood, with its Planet Oat brand seeing 221% YOY sales growth.

Beyond Meat (109% growth), and Dot’s Homestyle Pretzels (163.8%) were both new to the small companies list ($100 million to $1 billion in sales), while pasta and sauce maker Giovanni Rana and instant potato brand Idahoan returned from 2019.

Unlike the large and medium size category lists, which overlapped significantly with previous years, 60% of the top small companies were new to their list, able to be nimble and capture unmet demand in 2020.

Predicting 2021 Trends and Identifying Brand Priorities

IRI and BCG identified two “macro lenses” for 2021 trend predictions: trends that reflect a return to pre-COVID levels and trends accelerated by COVID that will be sustained post-pandemic.

Growth in categories like frozen meals, fruits and vegetables and desserts, refrigerated dough and baking will likely return to pre-pandemic rates as out-of-home dining returns and the convenience channel rebounds, the report said.

However, several 2020 trends have more staying power.

Food and beverage products, including perishables, saw 61% sales growth in the ecommerce channel in 2020, and the combination of premiumization and fewer promotions led to the acceleration of pricing last year, particularly seen in frozen food and indulgent items. Brands also took advantage of trends in indulgence (Hershey’s, Oreo), convenience (Jimmy Dean, Keurig) and taste exploration (Mission, Beyond Meat). These trends — the wider adoption of ecommerce shopping, the continued divide of CPG spend between premium products and value and private label brands and the demand for at-home indulgence, at-home convenience and taste exploration — will likely be sustained post-pandemic, the report said.

Looking ahead, IRI and BCG said food and beverage brands should prioritize leveraging data tracking and analytics to target consumers as their behaviors shift post-pandemic. They must also maximize supply chains for retail and ecommerce to meet consumers where they’re shopping and tap into emerging trends through innovation and M&A.

While brands should return their focus to in-store activations and placements as shoppers return to brick-and-mortar retail, the report notes that ecommerce will remain an important channel for sales and consumer connection beyond the pandemic. Brands should “value authenticity, inclusivity and sustainability,” to cater to the diverse e-commerce consumer base, it said.

“2020 was a year unlike any other in consumer products, and the short-term outlook for 2021 is still very unclear for most CPG companies,” said Peri Edelstein, managing director and partner at BCG, said in a press release. “However, we do see COVID as a clear tipping point in the impact of digital in CPG – ecommerce penetration and digital consumer engagement will continue to accelerate in importance.”