The Tide For Fresh Kelp Is Rising And It Hopes To Flood Every Grocery Aisle

In the natural food world, where sustainability, sourcing practices and nutrient density have become key consumer interests, seaweed is starting to surface. Brown seaweed, most commonly referred to as kelp, has caught the attention of CPG companies for its regenerative, low impact characteristics, paving a way for fresh seaweed to grow as a marketable ingredient in the U.S. market.

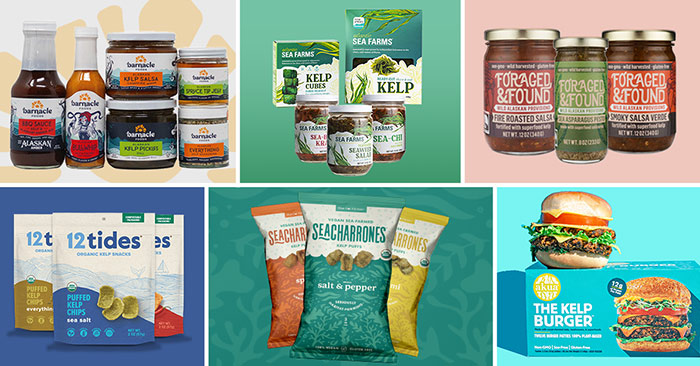

The sea-faring superfood has worked its way into a range of formats, bringing an umami flavor and unique nutritional profile. New products range from Alaska-based Barnacle Foods’ kelp-filled Chili Crisp, which launched last month, to a Sea Veggie Burger from Maine-based Atlantic Sea Farms (ASF), which will roll out nationally at Sprouts in November.

Investment in the seaweed space has grown in recent years with supplier and brand Atlantic Sea Farms raising over $3 million last October. The total number of seaweed investment deals reportedly doubled between 2020 and 2021 as the total amount invested grew 36% to $168 million. Notably, the majority of these investments came from family offices and private individuals, with only a small portion stemming from venture capital firms.

Although fresh seaweed has been consumed by indigenous, Asian, and many coastal communities for centuries, it is now migrating deeper into the U.S. natural food scene. Prior to 2018, nearly all of the seaweed consumed in the U.S. had been imported as an extract or in a dried form, or purchased by consumers from small scale operations, often at farmer’s markets, explained Jesse Baines, CMO at ASF. Brands like Gimme and Ocean’s Halo have created a market for dried seaweed in snack forms, however the majority of those products are used for sushi or rehydrated and “pumped with sugar and dyes” before it reaches U.S consumers, said Baines.

“Seaweed is not that color,” she said. “Those are the same dyes that are going into Mountain Dew.”

In 2018, Atlantic Sea Farms shifted its focus from a science-based organization working to perfect the kelp cultivation process to a company determined to develop a commercial-scale fresh kelp market in the U.S. ASF, which was founded in 2009, has since fortified that goal with three separate business arms – CPG, foodservice, and an ingredient supply program – which it believes will help bolster kelp’s presence in the diets of U.S. consumers.

Other seaweed-focused organizations like Blue Evolution and nonprofit Greenwave are also looking to build a domestic supply chain for fresh ocean plants. The former cultivates multiple varieties of seaweed, including kelp, at its farms in Alaska and Southern California and sells the crop though its ingredient program as well as in finished products for foodservice.

Greenwave is tackling the seaweed market through a range of initiatives that support the growing network of regenerative ocean farmers, primarily harvesting kelp and other forms of seaweed and sea vegetables. The nonprofit launched the Regenerative Ocean Farming Hub in April with hopes to support 10,000 ocean farmers over the next 10 years with training opportunities, new seaweed research and innovations as well as through its Kelp Climate Fund; the fund provides “climate-conscious” ocean farmers with direct-payment subsidies.

These companies share a long term vision that honors sustainable, regenerative aquaculture practices, values the contributions of ocean farmers, and is supported by demand from U.S. consumers. However, these stakeholders agree that any realized vision relies on making kelp a common ingredient within consumer’s diets.

Seaweeds have found space in fermented foods like pickles, kimchi and sauerkraut, but also beer, condiments, salsas and sauces. It has also led to the creation of seaweed-focused brands with novel products like Akua’s kelp jerky and Seacharrones’ and 12 Tides’ respective versions of a puffed kelp chip. Other formats include Sea Asparagus pesto from Alaska-based Foraged & Found and frozen kelp smoothie cubes from ASF.

Will Kelp Kick Kale To The Curb

U.S. consumers are obsessed with protein and increasingly interested in plant-based protein sources. While kelp is not a significant protein source, it offers a unique nutritional complement for those who get their protein from plants. Notably, kelp is “one of the few vegetarian alternatives” for cobalamin (Vitamin B12) and “a primary source” of Iodine. Both are common nutrient deficiencies for those who follow a strict vegetarian or vegan diet as they are typically found in animal-based products. Incorporating kelp can potentially boost the nutritional value to level with animal-based proteins.

Although the bioavailability of nutrients in kelp varies depending on the species, cultivation area, growing conditions, and when it is harvested, groups like Greenwave, ASF and Blue Evolution are working to standardize kelp farming as they build out their networks. Once those processes are standardized, kelp may generate interest to those outside the ocean farming world, said Barb Stuckey, chief innovation and marketing officer at Mattson, a food and beverage insights, strategy, creative and development firm.

“If there were more opportunities to use it, I think we would be excited,” she said. “It has that savory [umami] character [and] there’s a lot of good stuff that comes along with it.”

Atlantic Sea Farms and Akua have both created plant-based burgers featuring kelp as the first ingredient. Akua, which also launched kelp-based crab cakes this spring, originally began making kelp jerky and also sells a seaweed-based ground beef alternative.

“In a [plant-based] burger nutrition [panel], it also has the potential to reduce the usage of the fat and still give you the fat mimetics that you would get in a [regular] burger,” explained Edwin Palang, senior commercialization manager at Mattson.

However, kelp processing has not yet been standardized, which is a limiting factor for food scientists looking to use the ingredient due to the lack of documentation surrounding its physical and nutritional properties, said the team at Mattson. They also noted that the environment seaweeds are grown can affect more than just its nutritional profile, but also creates the potential for cross contamination and food allergies related to shellfish. ASF kelp farm sites have all been approved for shellfish farming and water quality is monitored, said Baines, but for product developers, this may be a deterrent.

Kelp Complements: A Regenerative Engine for Aquaculture

Kelp is naturally organic, non-GMO, does not require the use of arable land, fertilizer, pesticides or freshwater. It also helps restore aquatic ecosystems and can support the revival of reefs and biodiversity in marine life. Baines claims that as climate change and industrial fishing continue to degrade natural kelp beds, the farming practices developed by industry will also help the science community as it works to restore those ecosystems.

Kelp can also potentially offer an advantage to companies looking to make good on net-zero promises. Experts have cited the potential for kelp farming to become a lucrative market for carbon trading credits, a method many large CPG companies have adopted to offset emissions. While there is debate whether or not kelp sequesters carbon long term, with Baines saying more research is needed, others claim seaweed farming sequesters three times more carbon per hectare than a tropical forest.

Additionally, with climate change causing ocean waters to warm, kelp farming will help buffer coastal economies that rely on fishing, said Baines, who grew up in Maine and hails from a family of lobster fisherman. She highlighted the numerous fish species that have disappeared from Maine waters due to the changing environment. Despite the state’s strict sustainability laws regarding commercial lobster fishing, it may also begin to see that population dwindle as ocean temperatures rise.

However, in Maine, kelp is grown in the winter and harvested by early spring meaning it is the offseason for commercial fishermen. ASF currently has 30 kelp farming partners, nearly all of which are also lobster fishermen. These farmers already had the inputs when they added kelp to their rosters, she noted, including the proper boats, equipment, knowledge and labor force.

“And they’re wildly good at it,” Baines stated. “They’ve innovated more in the last few seasons than the scientists who were working on the process of kelp farming in the 15 years beforehand… They have everything they need to be successful at it, but what they didn’t have was a market.”

Making A Market For Marine Plants

While the market for fresh seaweed will entirely depend on consumer demand, it also hinges on standardized, stable and sustainable production. Currently, there are about 240 kelp farms operating in the U.S. across Maine, California and most recently, Washington and New York. The permitting process has been cited as the main deterrent for farmers and in Alaska, another key seaweed supplier, the majority of the kelp is sourced from wild-growing kelp forests.

According to Jennifer Brown, founder of kelp-focused food brand Foraged and Found, she and fellow Alaskan seaweed-forward food makers have seen a lot of interest in the idea of bringing kelp farming to the state. However, the largest barrier she has faced in the kelp-abundant state is the lack of infrastructure for intermediate processing – a necessity, since the crop has a short shelf life after being harvested.

On the east coast, ASF believes it has a strong enough supply network to keep up with growing demand. Baines highlighted that the company has expanded its Atlantic Sea Farms CPG line of products to nearly 1,500 stores over the past two years including Whole Foods and Sprouts, in addition to independent and specialty retailers. While she said these retailers have helped the company generate initial consumer interest, broader scale distribution will be necessary to growing the kelp food industry long term.

“We’re not going to be able to drive a market or positive impacts both to the ocean… and to the people who grow it if we’re not having conversations with large companies,” said Baines. “Finally those conversations are starting…. I love that we’re [already] at Whole Foods. I love that we’re at Sprouts. But we’ve proven this out when we are in conventional grocery all over the country.”