IRI: Recession Could Give Opportunity to Private Label Brands

A tougher economic climate could provide a boon to retailers hoping to expand their private label footprint, according to market research group IRI.

During a Wednesday webinar titled “Consumer Demand for Private Brands,” the data company explained that private label sales have grown this year as inflation and recessionary pressures have made shoppers more cost-conscious, creating an opportunity for retailers to capitalize by strategizing around how to reach consumers who shift between name and store brand products.

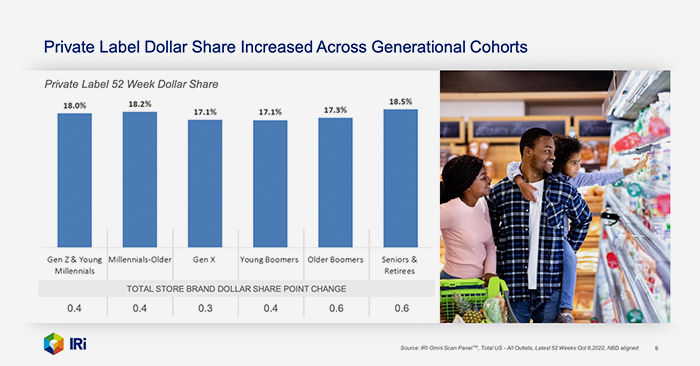

According to IRI, store brands represented 17.5% of the total shopper dollars spent in the 52-week period ending October 2, up from 17.2% during the same period last year.

If retailers want to increase private label adoption, choosing which generational cohort the products are targeting is tantamount.

There is a high penetration for store brands across departments; especially the general food aisle where there’s a lot of assortment and variety, said IRI principal of Center Store Solutions Mary Ellen Lynch during the webinar. “In fact, nearly everyone is a store brand consumer to some degree whether they realize it or not.”

Private brand loyalists lean towards seniors, retirees and older millennials, according to IRI. These loyalists tend to also fall into a less affluent demographic – about 54% of private brand shoppers have household incomes less than $70,000 – and often are buying for larger households.

Lynch highlighted that although the younger cohorts like Gen Z consumers might not be the biggest private label shoppers, they will grow into a much bigger buying force as the group ages and earns more disposable income.

“Their habits are forming. It’s really important to gain their trust, especially if you’re a store brand,” she said.

Pulling shoppers from name brands to a private label product is also about more than just finding cheaper options. IRI reported that trust in a private brand is a key purchase driver and that shoppers who favor store brands tend to spend more time looking at labels.

“Consumers are not necessarily shopping for the lowest price,” Lynch said. “It’s gotta be the right product at the right price and it’s gotta be a good product.”

There is opportunity in winning over a larger share of consumers if retailers prioritize store brands with a strategy built on what IRI calls the Four Ps: packaging, promotions, placement and pricing.

Marketing can be an important tool for food and beverage retailers, drawing consumers to private label brands when month-over-month food inflation remains high – around 1.4% in October versus September. Retailers can lean into in-store promotions and shelf placement as ways to bring more shoppers to a private label.

Store brand products continue to have a strong presence in the beverage category with shelf-stable coffee creamers, drink mixes and bottled water growing the most year-over-year. Fresh eggs, oils and shortening, and refrigerated spreads like hummus have had the most dramatic growth in packaged food.

According to IRI, inflation and a possible recession could provide retailers with an ideal time to expand their private label offerings and to experiment with what resonates with consumers.

IRI pointed to how some large retailers are helping lift private label products with shoppers. Walmart provided its store brand essentials for the Thanksgiving Day holiday at 2021 pre-inflation prices. ShopRite and Whole Foods have prioritized convenience and meal short cuts during the pandemic to bring in shoppers looking for easy meal solutions.

“Winning shoppers during this period with store brands can secure your loyalty for the future,” Lynch said.