Expo East: Innovations in Chilled Kids Offerings, Drumroll Rebrands

Lil Gourmet Moves Toward Category Standard Pack

Baby Food Brand Lil’Gourmet is switching to a more standard packaging form factor, showing off its new (3.5 oz) pouches at Expo East showing off its new pouches.

While the company plans to stick with the chilled set and focus on offering fresh, minimally processed baby foods, customers said pouches are simply more convenient, CEO and founder Shibani Baluja said. The format allows parents and caregivers to either use the product on the go or squeeze it into a bowl and use a spoon, as they did with the prior square tubs.

Most importantly, Baluja said, the new packaging provides the chance to build a bigger “billboard” on store shelves. Lil’Gourmet had hoped retailers would merchandise the prior containers on their sides facing outward, but most stacked them on top of each other. The result, she said, was that the brand only had a very small label with which to catch the consumer’s attention.

Along with the pouch swap, Lil’Gourmet’s also introduced refreshed branding which now sports more photorealistic ingredient images and a new tagline of “inspiring adventurous eaters.” While Baluja said the company was previously concerned that parents would want more familiar flavors, consumer research showed caregivers were instead excited about introducing global flavors to a younger audience and hopefully building a more adventurous palate earlier on.

Within baby food, chilled options are a growing segment, however, the category has struggled with retail placement, with consumers typically heading to center store for these products. While venture-backed Once Upon a Farm has partnered with retailers on in-aisle coolers, typically these are limited to the brand’s own products. Other chilled baby food brands are typically slotted in with dairy products, such as yogurt, where the pouch format is most familiar.

Happy Wolf Brings Refrigerated Bars to U.S. Retail

Canadian kids refrigerated bar startup Happy Wolf is getting its paws wet in the U.S. market. The year-old brand sampled its four-flavor line (Apple Cinnamon, Choco-Banana, Chocolate Chip and Strawberry) at Expo East, hoping to build momentum ahead of its brick and mortar retail debut this month.

Speaking to NOSH at the show, co-founder Jana Goodbaum said she developed the brand after struggling to find non-allergenic snacks for her own children.

“I wanted to create a bar that only used ingredients that I personally use in my own kitchen when I am baking for my own kids. So there’s no natural flavors, no preservatives, no seed oils. There’s nothing weird, nothing that’s not trusted by your mom or grandma.”

Happy Wolf launched at Pop-Up Grocer this week and will be rolling out to Gelsons stores in Los Angeles in the coming weeks. In retail, the line will sell for $8.99 per 5-pack and online ships for $19.99 per 10-pack.

Happy Wolf is Goodman’s first entrepreneurial venture following a long career in CPG marketing, most recently at Tim Horton’s for over six years. For the project, she partnered with Derek Beigleman – a friend of her husband’s – who founded and later sold pet food brand Open Farm.

Happy Wolf is based in Toronto, but Goodbaum said they opted to launch the brand in the U.S. where the refrigerated bar category is more developed.

“We wanted to be where the people already knew what refrigerated bars are and we don’t have to do as much educating,” she said. “There’s still gonna be a lot of educating, but there’s so many levels in Canada that you have to educate people on it. Whereas here it’s like a whole country is comfortable with Perfect Bar and knows it and this is just a nut-free option.”

The refrigerated brand space has seen numerous entrants, to varying degrees of success. Perhaps most notably, snack and confectionery producer Mondelez acquired Perfect Snacks in 2019, but subsequently sunsetted the brand’s kid focused line. Meanwhile, Hormel also discontinued nut butter brand Justin’s own chilled bars less than two years after the line launched. Meanwhile, beverage founder Lance Collins’ Core Bar has continued to press on with chilled bars and confections.

Mr Bing Debuts Smaller Size to Drive Trial With Perimeter Placement

Condiment company Mr Bing wants to broaden how consumers use chili crisp, launching a 4 oz jar it hopes will land the brand secondary in-store placements.

The new format is available in mild and hot varieties and retails for $6.99, three to five dollars cheaper than Mr Bing’s standard seven ounce jar. While the latter is usually placed in the condiment, hot sauce or global flavors sets, a sales team member at Expo East told NOSH the hope is that the smaller jar size will be merchandised in the perimeter of the store in deli or cheese sections. Currently, both Pavilions and Mothers Markets have brought in the smaller jar.

Meanwhile, the company has almost fully completed its shift from glass to plastic jars, the team member added. The move comes after Mr Bing saw significant breakage of its glass jars, in some retailers over 50%. While glass is often a more sustainable packaging option, the company representative said that once destroyed products were factored in, the environmental benefits were lost.

Moving into plastic and debuting a smaller jar size separates Mr Bing from other members of the burgeoning chili crisp space, such as Fly By Jing, which almost entirely use glass jars. That said, while awareness of chili crisp has grown, it still remains smaller than other hot sauce product types and the smaller jar may drive trial.

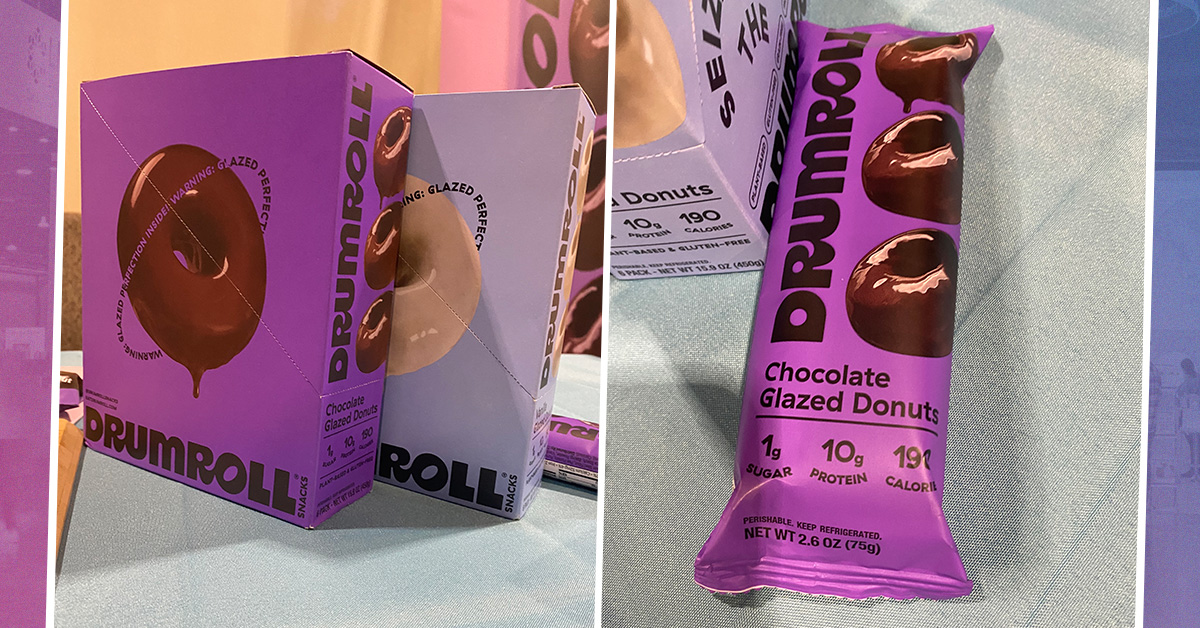

Drumroll Please: Greenhouse Foods Rebrands

Plant-based donut snack maker Drumroll, formerly Greenhouse Foods, exhibited at this year’s show with a new name and look, but the same original product inside its pack. The company executed a full rebrand of its mini functional donut line in June to better align with the product’s purpose and better position itself to pop on the produce shelf.

With 10 grams of protein in each donut pack, Drumroll aims to compete directly with Perfect Snacks, said John Davidowitz, Drumroll’s head of sales. The snacks come in two flavors – Vanilla glazed and Chocolate – and can be purchased in either a 3-donut single-serve sleeve ($5.83) or a 6-count (18 donut) box for $31.50.

Looks can be deceiving, though: it may look and taste like a donut, but the product doesn’t quite compare to Dunkin’ or Krispy Kreme with only 190 calories and 1 gram of sugar per pack. The grain-free donuts are made with a blend of almond flour, sunflower seed flour as well as pea and pumpkin proteins; the product is sweetened with a blend of Allulose, erythritol and monk fruit.

Davidowitz said the donut is positioned as an afternoon pick-me-up or a quick breakfast on-the-go, rather than a true donut replacement.

Drumroll snacks are already on shelf in over 11,000 stores and the brand is working to gain additional placement in grocery store produce sets – where buyers are used to working with highly perishable, fast-turning products and don’t typically follow standard category review cycles, Davidowitz noted – as well as refrigerated grab-and-go locations, such as foodservice or gyms.