Report: Alt-Protein Must Fine Tune Marketing, Innovation To Go Mainstream

While scale may be a near-term limitation to the success of alt-proteins, marketing to mainstream consumers remains the category’s most significant roadblock to achieving the its stated missions for positive environmental and human health impacts, according to a new report from The Good Food Institute (GFI) and Boston Consulting Group (BCG).

“There’s a big gap in what consumers say versus what they do,” said Neeru Ravi, Principal at BCG, during a webinar on the report. “Eighty percent of consumers, the core of mainstream consumers, say that they care about sustainability, but only 20% of these consumers are making their decisions based on sustainability.”

BCG and GFI believe that if alternative protein consumption increases to 8% of total proteins by 2030, the industry could achieve the emissions reduction equivalent to decarbonizing 95% of aviation emissions. However, according to the report, even a metric like that is not effective enough to convince consumers to give alt-meat a try.

Rather than relying on sustainability attributes, Ravi explained that companies can better appeal to consumers with nutrition-focused, positive health claims like “unprocessed” and “high in protein.” Generated from survey results with nearly 3,000 respondents from the U.S., Brazil, the E.U., India, China, and Japan, the report found that positive health callouts are more effective in driving consumers to purchase both alt-meat and alt-dairy products than “diet-restrictive claims” like “low calorie” or “low fat.”

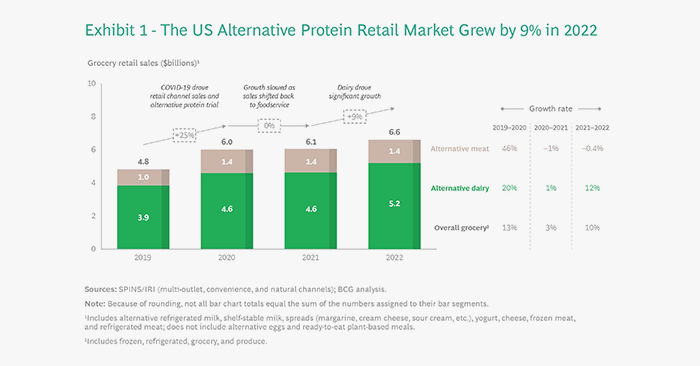

Thus far, alternative dairy appears to have executed this strategy with greater levels of success than plant-based meat. According to the report, alt-dairy sales outperformed traditional dairy in 2022 with 12% sales growth versus 10%, respectively; in contrast, alternative meat products saw a decline of 0.4% despite traditional meat sales rising 8% last year.

The survey also found that public perception of the taste and nutritional benefit of alternative proteins has declined since 2021. BCG and GFI recommend that companies limit the use of labels like ‘vegan’ and ‘vegetarian,’ make an effort to identify the protein source on front-of-pack, while also highlighting sensory appeal and nutritional value.

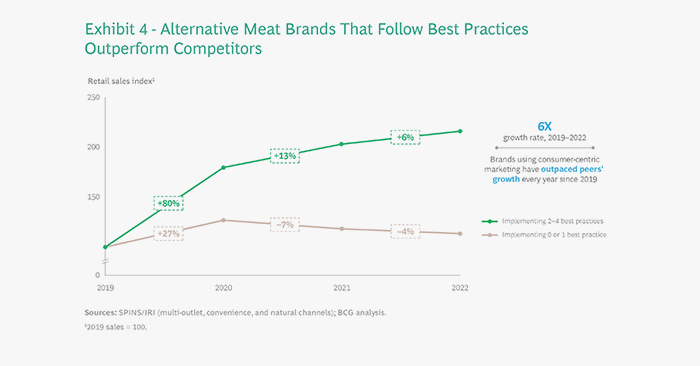

Consumers are unlikely to regularly purchase alternative products if brands don’t shift away from a sustainability-forward to consumer-led marketing strategy and the report found that alt-meat companies implementing at least two of the above recommendations outperform their competition in total sales six to one. Approximately 88% of the top 25 alt-dairy brands currently use at least two of the front-of-pack recommendations, the report states, while only 56% of the top 25 alt-meat brands follow these messaging principles.

GFI and BCG believe that data, when held in comparison the high penetration for alt-dairy versus lower acceptance of alt-meat, signal that these recommendations are key to developing a mainstream, alternative meat market.

“We know that there’s been significant improvements along [taste and nutrition] dimensions over the last few years, but in the minds of consumers, there still seems to be a gap between these products and traditional meat,” said Ravi. “There is room to still innovate and test new products to really understand what resonates with mainstream consumers.”

Messaging should also be adapted to fit various occasions, the report states. For example, products that lends themselves to “craveability” over nutritional value, like plant-based ice cream, should have refined callouts that cater to that occasion rather than trying to be everything, all at once, to every consumer.

“Taking that consumer first approach is what will then ultimately lead to being able to cater products better to the consumer,” said Ravi. “Start with the consumer versus trying to start with the product and seeing where it would fit.”

Despite the deceleration of plant-based meat performance, BCG and GFI believe that by 2030, 8% of all meat, seafood, eggs, and dairy eaten globally will be an alternative product. Though that prediction was first made in 2021, prior to the recent category slowdown, researchers believe that if companies can achieve parity in taste, texture, and price, as well as adopt more consumer-focused marketing tactics, the mainstream customers will drive that anticipated, continued growth.

“Appealing to [Gen Z and vegan] consumers is relatively easy because they are already doing their own research and they’re already making the effort themselves,” said Ravi. “The harder challenge is these mainstream consumers who care, but they’re not taking action yet. These are groups that we don’t normally think of, outside of the vegans and flexitarians. That’s where it’s important to win and for those consumers, it’s critical to focus away from sustainability and actually talk about taste and health.”