In Race for Acceptance, Plant-based Meat Must Reach Price Parity, The Question Is How.

Industry experts and plant-based meat leaders agree: achieving price parity with conventional proteins will be key to its success long term.

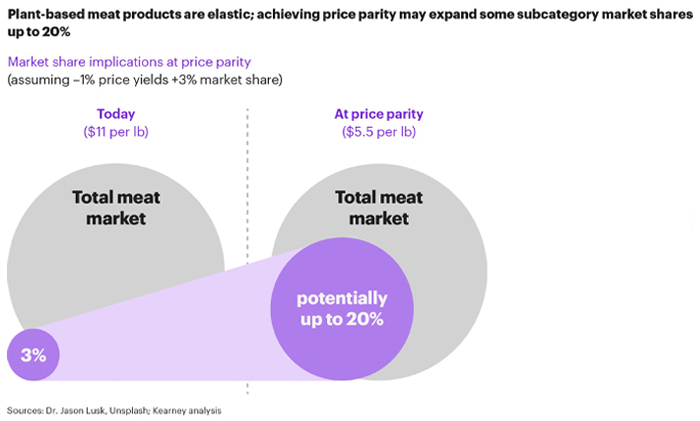

After taste, consumers rank price as the second most important factor when purchasing plant-based meat alternatives. According to a report from The Good Food Institute (GFI), in partnership with Mindlab, while 42% of consumers would pay the same price for plant-based products as conventional meat, nearly three quarters say they are more willing to pay the same price, or less. If producers are able to lower prices, consumer demand within the category may heat up and drive the volume brands need to scale.

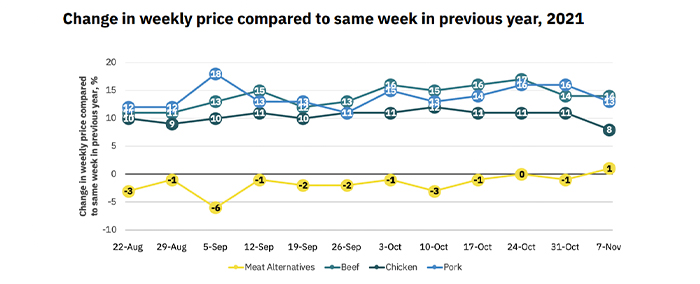

Current market conditions may be advantageous: while plant-based chicken, pork and beef still costs 50% to 300% more than conventional meat at retail, inflationary pressures have also had a greater effect on meat prices, driving the cost up 10% over the past year. This gives alternative protein brands an impetus and opportunity to close the price gap in the near term and, as inflation stabilizes, make the category more affordable and mainstream over the long term.

Deeply vested players like Beyond Meat and Greenleaf Foods have noted that paying back the R&D efforts that got them on-shelf, and supporting the marketing to keep them moving forward, are intransigent factors weighing on their margins and inhibiting price reductions. Other plant-based companies claim they will achieve price parity within the year — but Kantha Shelke, principal of food science and research firm Corvus Blue, notes these companies are betting on lower production costs and higher distribution volumes in the near term, but those are factors that usually come as a result of scale.

“The prevailing myopic vision may stretch it out to [between five to eight] years,” said Shelke. “Shortening this time means suppliers, manufacturers and retailers focusing on consumer wants and needs, over market share and margins.”

For now, while operations and logistics present an immediate challenge, animal agriculture holds the advantage of an established cost structure. After 60 years of factory farming that “brutally focused on cost optimization,” animal protein producers are able to sell meat virtually at a loss, explained Nate Crosser, principal at investment firm Blue Horizon.

“The true costs of conventional animal agriculture have been masked by decades of price support from governments, by insurance schemes, [and] by subsidies that have created very abundant, cheap meat,” added Emma Ignaszewski, associate director of industry intelligence and initiatives at GFI. “But when compared to deriving protein directly from plants, or eventually cultivating it from animal cells, I think we’ll see in the long term that deriving protein from livestock is very inefficient.”

Crosser said that the U.S. could do more to garner public support for alt-protein research and infrastructure, or enact pricing policies similar to those for traditional meat, citing the significant government investments in the space from Canada, Singapore, Israel, the Netherlands and other countries.

Growing a Supply Chain Advantage

Crosser, Ignaszewski and Shelke believe that the plant-based meat industry has the ability to derive more sustainable and stable long term success, but, Shelke said, “every node in the value chain needs to collaborate to help plant-based meats reach their full potential.”

That cooperation will support alt-protein companies as they work to shift their model from a high-margin/low-volume structure to the same low-margin/high volume strategy used by conventional meat producers. Not only will these efforts help the industry in the short term, but bringing prices down and increasing product demand is necessary to sustain long term growth.

When it has secured a grip, experts agree the value chain for plant-based meat offers greater stability than that of animal-based products, which are extremely sensitive to a range of changing input costs like feed and grain. For example, it takes 9 calories of grain to produce one calorie of chicken meat, so as the cost of grain rises, so does the end product. Also, demand for animal-based products is projected and locked in nearly two years in advance so an adequate volume of animals are raised, but when demand shifts, the rigid value chain does not flex with it.

The supply chain for plant-based proteins, such as pea and soy, however, is significantly less volatile due to its inherently more efficient input ratio and flexibility. Stable demand will also “kickstart” the ingredient market, enabling plant-based proteins to truly grab their market share, Ignaszewski said.

“The global food system is like a web,” said Shelke. “The tiniest tug on one side can, and will, affect every other cell in that network. The success of plant-based depends on achieving price and nutritional parity with animal-based and this will in turn create a cascade of events across the global food system, for the better.”

According to a report from consulting firm Kearney earlier this year, the success of plant-based meat also depends on its ability to be profitable “up and down the supply chain” which means that while price and taste are key factors, success ultimately hinges on consumer acceptance.

“That requires taste that brings consumers back and affordability that does not make them think twice about it,” said Shelke. “This is not the case today. People are buying plant-based meat alternatives based on curiosity…[but] market share today appears to be coming from conversion of tofu and tempeh buyers.”

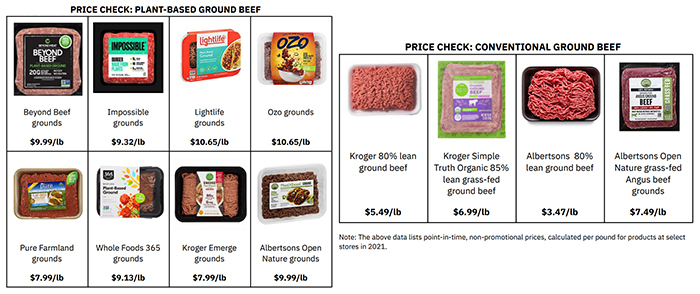

Operational efficiencies, consumer demand and stage of scale aside, plant-based meat brands face additional challenges to price parity simply due to the relative difference among prices of conventional meat. Plant-based beef, for example, is about 50% more expensive than traditional beef (about $10 versus $5.40 per lbs., respectively). For cheaper meats like chicken and pork, alternatives can cost nearly four times the conventional price.

“It’s a bit of a longer road to price parity with conventional chicken based on where [the industry] is right now,” explained Ignaszewski. “That said, there are companies like Rebellious… [who are] working from the ground up on the equipment and production design to work on reaching parity with plant based chicken [specifically].”

Meanwhile, environmental changes and other unforeseen challenges are also hitting the animal protein industry. Ignaszewski noted that JustEgg recently reached parity with premium egg prices. JustEgg is now available for $3.99; while that’s higher than conventional eggs’ typical cost, the price gap narrowed this year due to inflationary pressures and the impact of the avian flu outbreak on the egg industry which jacked prices up over 80% in the last year.

Retailers also play a key role in driving overall industry awareness for plant-based meat through private label products and merchandising efforts, which will in turn, grow volume.

During Beyond Meat’s last earnings report, the company said product demand was declining due to the current economic conditions, leading consumers to skip over premium products like plant-based meat. However the rise of private label alternatives could help commoditize the category and usher in a wave of broader consumer appeal.

Whole Foods, Albertsons, Kroger, Aldi and Sprouts have all introduced private-label plant-based meat lines, and according to data from SPINS, commissioned by GFI, sales in the category’s private label segment increased 72% in 2019.

But, on average, these products were only priced about a dollar less than their branded counterparts, and still well above conventional meat. Consumer perceptions that private label products offer a better value may help shift the position of the category as a whole and put private and branded plant-based proteins on a level playing field with animal-based products.

Ignaszewski and Shelke also believe a review of planograms favoring increased on-shelf visibility is key to driving the volume growth necessary to lower prices. Ignaszewski cited a study from Kroger and The Plant Based Food Association that recently found when traditional and plant-based meat were merchandised alongside one another, as opposed to in a dedicated plant-based meat set, sales for the latter increased by nearly 25%.

“That’s where the omnivore consumer is looking for these products,” explained Ignaszewski. “That’s where they’re shopping for their center plate protein. And so, when you move the plant based products to the meat aisle, you’ll see increases in sales.”

That was one of Beyond Meat’s merchandising principles from the start — though now, the brand can also be found in the freezer aisle.

Generational Change, Big Meat, and Winners and Losers

According to a report from Blue Horizon and Boston Consulting Group, between 11% to 22% of all proteins consumed by 2030 will be alternative. Currently, that figure is at less than 1%, said Crosser, so if projections stay on course, the industry is set to see a boom in consumer adoption over the next decade.

Younger generations, Gen Z and Millenials, make up the primary plant-based protein consumers; as they gain more purchasing power, their shopping habits will be an integral part of the industry’s growth. Experts believe that over time companies will be able to continue to scale appropriately to meet demand for these cohorts – but there will be some losers as that growth happens.

“There’s definitely going to be consolidation… and that’s going to be great [for the industry],” stated Crosser. “We’re going to be left with the best products and the best companies in five to 10 years and you won’t need to have 40 plant-based meat options on the shelf, just like in animal meat, you don’t have 40 options on-shelf.”

Large animal protein producers like Tyson, Smithfield, Maple Leaf and JBS have also gotten involved in alt-protein through investments, acquisitions and brand launches, presenting an opportunity to synchronize supply chains and drive the industry’s mainstream position.

“It’s an endorsement of the strategy and the consumer demand for the product,” said Ignaszewski. “For them to be able to lend their resources, to supply people with plant based products – that can be a different beast in terms of being able to get products to market quickly, experiment and see what works.”

As with any business, there is always the opportunity for mission and purpose to go awry under the pressure of profit margins and shareholder returns. Crosser, however, said he believes this industry will maintain its focus on being more “ethical and sustainable than the oligopolies that it is forced to replace.”

“It will take a village – there is a role for everyone in the ecosystem,” said Shelke. “Traditional animal protein processors can help by getting rid of their status quo and territorial mentality… a certain amount of sophistication will be needed in shelf and cooler planograms to welcome plant-based alternatives. Investors need to redirect their focus on the infrastructure, processing capacity, supply chain efficiency, and the development needed for taste enhancement for long-term stability.”