Squaring the Circle: As Circular Packaging Systems Evolve, Are Sustainable Solutions Getting Closer?

The CPG industry has taken many approaches to reducing packaging waste as it works to make good on carbon reduction commitments and other environmental sustainability goals, missions and initiatives. Circular models, where products are sold in infinitely reusable packaging, have emerged as an idealistic solution for one simple reason: there’s no waste created.

Drawing inspiration from the old milkman delivery model, a handful of companies, including Loop, Dispatch Goods and The Rounds, are engaging in the challenging work of making circular packaging a reality for modern, large-scale operations. But while they work to scale up, the ideal packaging format, shifting consumer behavior as well as building out the necessary infrastructure and logistics have remained persistent challenges.

For some, growing their businesses beyond urban areas and brick-and-mortar pilot programs still remains a critical unsolved hurdle to their businesses going mainstream; however, others believe they have a plan to steadily ramp up and usher in the adoption of circular economies.

Loop-ing Consumers Into Circular Models

Global reuse platform Loop, founded in 2019 by recycling company TerraCycle, launched in the digital realm with Loopstore.com before entering physical retail. It created a pilot program with dedicated sets at stores like Giant Food and Kroger featuring products from well-known brands like Heinz and Stubb’s sealed inside reusable containers.

“We’ve been able to prove that, from a health and safety point of view, we can cycle something as sensitive as baby food. There’s nothing that you can’t cycle,” said Tom Szaky, CEO of Loop. “Reuse is the easiest, fastest adoption with the highest success rate out of the gate in beverage.”

Loop has shifted its focus over the past couple of years towards in-store retail partnerships outside of the U.S., specifically in Europe and Asia. According to Szaky, Loopstore.com was designed to have a short lifespan because the ecommerce portion of the business was intended to serve as a learning experience.

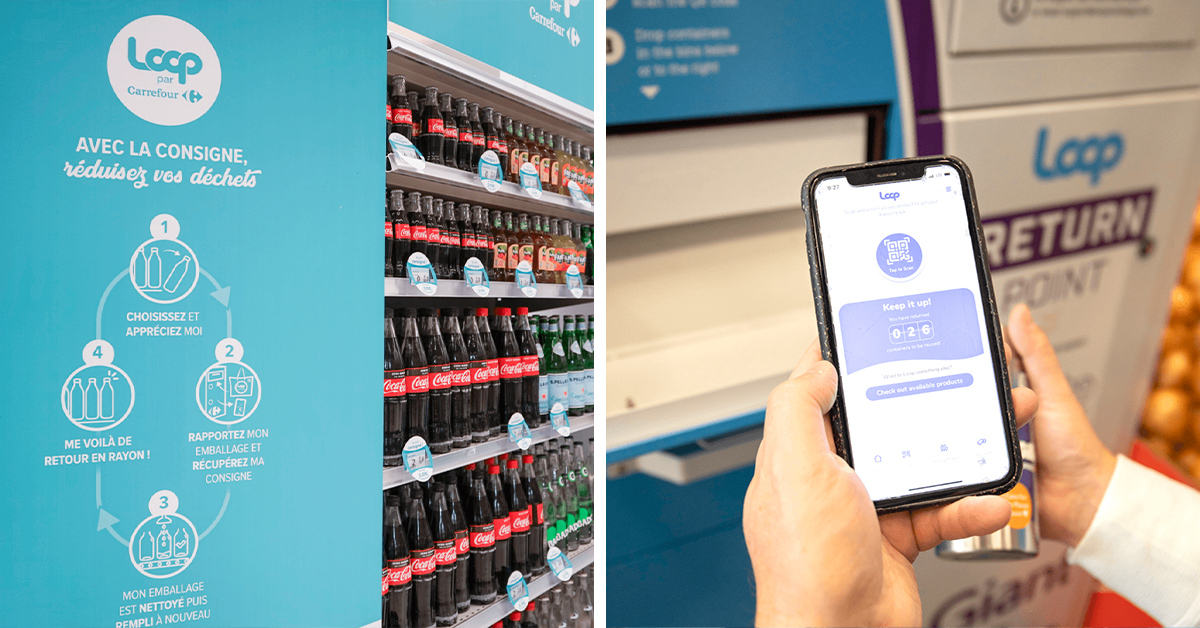

The in-store pilots proved to be far more successful abroad than in the U.S. The company has contracted five major partnerships overseas, including Carrefour, one of France’s largest retail chains, since 2021. By the end of the summer, Loop’s placement with Carrefour is expected to grow from roughly 150 stores to 300.

Through Loop, retailers offer shoppers refillable packaging options for products like glass yogurt jars and refillable dishwasher tablets from familiar brands like Danone, Nutella, Coca-Cola and Evian. Consumers pay a deposit fee upfront, which they get back via mobile app once they return the empty packaging to any of the designated Loop stations; they do not have to return the containers at the point of purchase. The packaging is then collected, washed and refilled by Loop and placed back on store shelves for purchase.

“[The system] provides as much of a throwaway feeling as possible. You can buy anywhere, return anywhere, and even mix all of your dirty vessels into something that resembles a garbage bag and drop it off. Because throwaway is bad from an environmental point of view but rocks from every other point of view,” said Szaky.

Stateside, Loop has just one operational program: a national, online-based reusable diaper partnership with Proctor & Gamble (P&G). According to Szaky, the international shift is only temporary; to date, Loop has raised approximately $40 million and “plans to do a lot more” both in the U.S. and abroad. Investors include P&G, Nestlé and Sky Ocean Ventures, among others.

“Our plan is to create scale in Europe and Asia and then bring it back to the U.S., hopefully dovetailing that when the U.S. legislation [regarding circular packaging] is a bit closer to reality,” said Szaky, claiming that it is primarily a lack of government regulation, not consumer willingness, that poses a threat to widespread adoption of circular packaging.

Elsewhere, The Rounds is utilizing a fairly direct interpretation of the milkman approach, but that has led the five-year-old company to remain fairly limited in the areas it can serve; presently, The Rounds operates in urban areas including Philadelphia, Miami, D.C. and Atlanta.

The company’s structure is simple: customers purchase a subscription and place weekly DTC grocery orders via its ecommerce platform. Partner brands supply products in bulk to be packed and sold in The Round’s containers; it also sources from early stage CPGs that use plastic-free packaging, like Heyday Canning Co. Orders are delivered on a set day each week in reusable tote bags and customers can return empty containers from previous orders at that time to be retrieved, washed and refilled.

However, many others have struggled to make ends meet in the circular space, particularly when it comes to changing consumer habits. Dispatch Goods aims to take a more measured approach that fills the infrastructure and logistics gaps while also incrementally training consumers to embrace circularity. It bills itself as an “end-to-end platform for businesses that want to launch circularity models” and continues to iterate the basic premise of what the milkmen created, explained co-founder and CEO, Lindsey Hoell.

Dispatch began with a focus on the restaurant industry, partnering with local businesses that would utilize its steel containers for takeout and delivery orders, but last year, it shifted focus to an area that it believes could start incrementally shifting consumer behavior: cold-chain, direct-to-consumer meal kit and grocery delivery.

Similar to The Rounds, Dispatch often delivers in reusable tote bags and began building in an arena where consumers are already “trained” around a weekly subscription service.

But its business is a bit more expansive and is steadily gaining ground in new geographies. Dispatch offers a slate of Á la carte services including packaging producement, last mile and middle mile fulfillment as well as cleaning, processing and reaggregation for reclaimed packages.

“For most of our [brand] customers, we launch with the packaging they’re already using, and we start to build the habit [among their customers] and build a partnership with their current packaging,” Hoell explained. “That means that some of it is reusable, some of it gets recycled but the consumers essentially start by returning packaging, which is a big consumer pain point.”

Dispatch has raised a total of $4.7 million to-date and currently works with Blue Apron, HungryRoot, Mighty, Meals, Good Eggs, Imperfect Foods, Thistle, Sakara and Misfits Market, among others. In terms of volume, Hoell said for larger clients Dispatch picks up and delivers orders three times a week and on average, is able to return sanitized, repalletized packaging to its partners within 48 hours.

“The goal is for them to be receiving refurbished inventory in a way that is exactly the same as what they’d be receiving new. So the pallet configuration is the same [and] it really seamlessly flows into their operations.”

The company operates two processing centers – one in Baltimore and one in Northern California – in addition to a handful of satellite centers around the country. This model allows it to serve all of their customers in select geographies with Hoell noting that Dispatch has penetrated the Northern California and Mid-Atlantic regions with current partners and is working on deepening its relationships in Southern California and the Midwest.

The ordering process on the consumer end is also intended to be seamless with Dispatch building out “microsites” that plug in for partners serving consumers in regions where they are currently active. Dispatch sees between 50% to 80% consumer participation for returns and Hoell claims that brands save, on average, 5% to 30% on packaging when working with Dispatch in a post-pilot period.

“That’s a big difference from what the perspective of the circular economy was as a whole,” she emphasized. “We think about ourselves more as a re-commerce play, where we’re finding stuff that has value and getting it back to the company that bought it at a cost that’s lower than buying it new.”

It’s What It’s Made Of That Counts

With its original restaurant approach, Dispatch learned that steel – what it thought was the ideal circular packaging material – was “over-gunned.” Hoell explained that the metal is designed to be reused thousands of times, but consumers are not “trained” to the point where there is a need for something so durable and the containers are typically lost before nearing their maximum reuse counts.

Since shifting gears to meal and grocery delivery, Dispatch has taken a more iterative approach where it begins by replacing “secondary packaging,” such as the cardboard box and insulation used to deliver food, with reusable totes. As it develops the brand partnership, it can collaborate on new primary packaging components and now, rather than steel, utilizes high-density polyethylene (HDPE), low-density polyethylene (LDPE) and polyphenylene ether (PPE) materials which can be sanitized and reused up to 50 times.

“You have to first solve for the missing infrastructure and the consumer behavior change and that’s what our focus is – like what products can help us shift those two things,” Hoell explained.

She said eventually, the company hopes to evolve into a large-scale returns aggregation platform. That means difficult to recycle packaging, like TetraPak containers which can only be processed in select municipalities with specialized infrastructure, could eventually be collected and recycled by Dispatch’s logistics network.

Within its current markets, the company has found that the majority of consumers will return packaging if given the option and Hoell said CPG brands have expressed interest in paying Dispatch to facilitate the responsible reuse of their packaging materials.

“Once a consumer is used to sending you stuff, they can just start sending you more stuff and that becomes like a habit… not every brand is going to use the logistics that can unlock circularity, but if we’re already in consumers homes picking up cold chain packaging, why not grab some other items that could be reused.”