Loud, Proud and Flavorful: Next Gen AAPI Founders Seek to Reclaim Asian CPG

When she founded her whole bean and cold brew coffee business, Sahra Nguyen, founder and CEO of Nguyen Coffee Supply, set out to change the American perception of Vietnamese coffee.

While Brazilian and Colombian coffee, for example, both evoke images and the taste of pure arabica coffee beans, Vietnamese coffee has long been associated with cà phê sữa đá, a cold drink sweetened with condensed milk. Meanwhile, the nation’s traditional robusta beans have long been derided as inferior in flavor and treated as a cheap commodity. As a first generation American whose refugee parents raised her in an environment where food was her family’s “love language,” this dismissal of Vietnamese coffee culture never sat well with Nguyen and it helped drive her to found her own business to show the quality of coffee that American consumers had been missing.

Nguyen is just one of many young Asian American Pacific Islander (AAPI) entrepreneurs who have launched food and beverage brands over the past several years presenting a premium, high quality take on the cuisines they grew up eating and drinking. In the process, they’ve sought to disrupt the Asian foods aisle in the grocery store – which some entrepreneurs feel has been slow to match the macro CPG movement towards better-for-you and clean label – while challenging negative perceptions of East and Southeast Asian dishes that have been entrenched in mainstream American culture.

“When you have a dominant narrative that’s been promoted and perpetuated by leaders of the industry for decades, people follow those narratives,” Nguyen said. “It’s really hard to challenge the status quo.… And we’ve been willing to do that.”

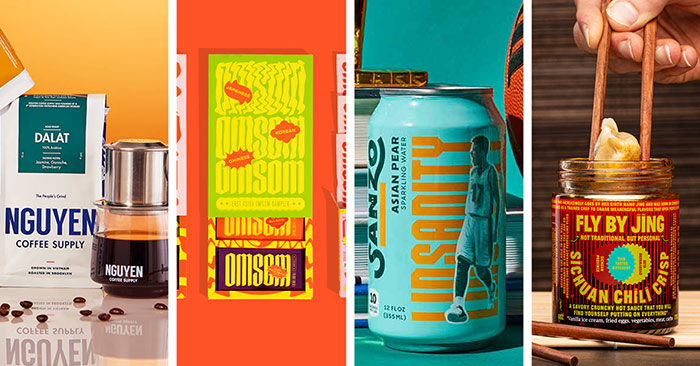

She’s not the only one. A new generation of AAPI owned and operated startup brands have launched online and in-store recently, sporting premium and better-for-you versions of products that look to reclaim the heritage of and rebuke stereotypes about Asian cultures and Asian foods. With vibrant, modern branding and messaging and an emphasis on authentic flavor, brands have emerged to sell new takes on ramen noodles (immi, One Culture, Nona Lim), Asian sauces (Fly By Jing, Omsom, Bachan’s), dumplings (Dumpling Daughter, Xiao Chi Jie), mochi ice cream (Sweety), boba and milk tea (Twrl, Bubluv), salmon chips (Tochi), functional drinks (Wildwonder) and yuba noodles (Hodo) – to name just a few. And that’s not to discount brands like sparkling water maker Sanzo, which is making its mark on established categories with Asian-inspired flavors like Lychee and Calamansi.

This movement has been broadly driven by millennial and Gen Z founders (with some Gen X representation as well), many of whom are first-generation Americans and who have felt stagnation within the Asian foods category. To these founders, the older product lineups leave miles of white space to disrupt the international shelf in a way that is modern, personal, and for many of them, resonant with cultural relevance and accuracy.

Searching for Homemade

Nadia Spellman, a former finance worker, started a small chain of Chinese restaurants called Dumpling Daughter in the Boston area back in 2014. Spellman had always envisioned launching her line of dumplings as a packaged product, but was told she would struggle to break into conventional retail if her brand wasn’t already a known entity. She grew up eating her mother’s fresh dumplings – Spellman’s parents previously owned a five star Chinese restaurant in Boston’s Chinatown neighborhood – but as a college student in the early 2000s and later as an associate at a New York City financial firm, she struggled to find premade dumplings that measured up to her home cooking.

The problem, Spellman explained, is that most frozen dumplings in a conventional grocery store are pre-cooked before being frozen and often contain preservatives and other added ingredients. Dumpling Daughter introduced its frozen line in 2020 – the company’s restaurants were closed to indoor dining, forcing the innovation – but the brand uses natural ingredients which are frozen prior to cooking – meaning consumers must take the extra step of boiling and then, optionally, pan searing their dumplings on their own, but with the payoff that the products taste as close to fresh as possible.

It’s now in over 300 stores.

So why was there a void in the market? According to Spellman, the dearth of authentic Asian foods in the CPG market is the result of various cultural forces at play. Some of it is simply due to the lack of familiarity mainstream Americans had with Asian cuisines for decades which brought with it stereotypes and confusion. Past generations of Asian food entrepreneurs often catered to undeveloped palates and prioritized convenience and affordability over quality, she said, creating an Americanized version of the cuisine that is ripe for maturation.

“I think in the next 15, 20 years, you’re going to see dumpling and noodle houses pop up in many suburban towns,” Spellman said. “Thirty years ago, it was Chinese takeout with General Gao’s, and I think in 15 or 20 years you’re going to see the change and the shift that the American palate is growing, and they constantly want something more.”

Burning Away Preconceived Notions

When Vanessa Pham co-founded Asian sauce brand Omsom with her sister, Kim Pham, one of the key goals for the company was to push back on the staid imagery and messaging of Asian brands in the international aisle by making a product that reflected their values and attitudes.

Originally operating under the brand name Oxtale, the two daughters of Vietnamese refugees ultimately decided they wanted to push back on the “model minority myth” that perpetuates the stereotype of Asian Americans as “submissive or obedient,” Pham said, and took the brand name from the Vietnamese phrase om sòm, which means noisy or rambunctious. It was a common phrase her parents would use to scold her and her sister growing up when they were misbehaving, she said, but when creating the brand she and Kim saw a chance to turn it into a statement of pride and celebration.

Turned off by an Asian food set with “diluted flavors” and built around dated iconography like “dragons and pandas and bamboo fonts and pagodas, ” the sisters decided to respond, launching Omsom in May 2020. Guided by its name, the brand has positioned its variety of premium sauces based on East and Southeast Asian cuisines – including Vietnamese, Thai, Filipino, Korean, Japanese and Chinese – to push back on the mainstream American perception of these traditional sauces in almost every regard, using chef-developed recipes that bring serious heat, and with messaging that better represents their lived experiences as younger Asian Americans. As part of these educational efforts, the company has also launched products and ads calling attention to, what many say, are the racist roots that led to the widespread villainization of MSG and – much like Nguyen Coffee Supply and robusta beans – seeks to reclaim and celebrate the ingredient.

“We want to be proud and loud and noisy,” she said.

Ultimately, one of the most important elements behind brands like Omsom, Sweety, Fly By Jing and others is what many small startups hope to communicate the most: authenticity.

For Nguyen, authenticity means growing up in a house where her Vietnamese parents “used food as their love language” and where cooking and eating were all-important rituals. It’s this type of firsthand knowledge and passion for the cuisine, she said, that has required this wave of premium brands to start with individual founders, rather than conglomerates.

“I’m not going to expect to Nestlé or Starbucks or Dunkin’ to talk about Vietnamese coffee the way I can talk about Vietnamese coffee, that is rooted in cultural integrity, that is rooted in my personal experience, that is rooted in my family’s connection to Vietnam, that’s rooted in my passion and vision for diversity, inclusion and equity,” Nguyen said. “And McCormick could have never done what Omsom is doing because they don’t have the lived experience that we have.”

Visual Cues

Bill Shen, an investor formerly with Encore Consumer Capital and a board member of plant-based protein brand Hodo, pointed to the vibrant, multicolor packaging of brands like Omsom and Fly By Jing as playing a significant role in recreating Asian food staples for Gen Z and millennial consumers.

In addition to the “loud and proud” message, Shen suggested that their radical approach to branding is helping to modernize the category with consumers of all backgrounds. Traditional packaging for Asian products – whether produced domestically or imported – has seen little disruption over the years with many mainstay brands rarely making changes to their design.

Those visual cues, he said, may reflect the values of older generations of Asian entrepreneurs and consumers, but they’ve left younger generations – many of whom are first-generation Americans – without brands that speak to them.

“The way [Omsom and Fly By Jing are] positioned in the market is very much targeting, I think, people that are like the entrepreneurs themselves,” Shen said. “They’re young, they’re hip, and they’re cool. And they don’t necessarily want the kind of the traditional – call it old school – packaging that my parents and my grandparents are expecting to find in an Asian grocery store. They want something that is more like them and reflects where they shop and their lifestyles.”

Everything Everywhere: Expanding the Market

These new approaches to staple categories are also catching the attention of major retail chains, where buyers are increasingly bringing in next-gen Asian brands, either within the international aisle or elsewhere around the store. While many brands established themselves online direct-to-consumer, retail chains such as Whole Foods, Sprouts and Target have been particularly active in bringing on buzzy brands like Nguyen and Omsom, while Fly By Jing has also branched out into the club channel through Costco. Sandro Roco, founder and CEO of Sanzo, said his brand has recently entered agreements with several conventional channel chains to further expand the brand in the coming months.

“To a degree, perhaps… the last few years came as a surprise to folks,” Roco said. “Now, especially within AAPI circles, we’re starting to enter into the conversation of [what’s the] next chapter? I think we all as brands, but also the general community, for a variety of reasons, have gone through this initial galvanization process. Now, we are starting to have more of a voice in the room and it’s basically like how do we continue to build?”

Shen suggested that the natural and specialty channels have led the way in bringing many of these brands to larger audiences, noting Whole Foods in particular has been a powerful partner for these early stage companies.

“These founders are growing and scaling their businesses in a really different way, in a really defendable way,” Shen said. “They’re building this core, rabid consumer base first, and that’s powerful stuff. I think when investors see just how loyal these consumers are, they see that kind of opportunity for these brands to continue to mainstream.”

While the overall investment landscape across CPG has slowed down amid the current economic uncertainty, many next-gen Asian brands have been able to close sizable funding rounds in recent years. Fly By Jing supported its retail expansion with a $5 million round in 2021, led by Prelude Growth partners. In February 2022, Sanzo announced a $10 million Series A led by CircleUp Growth Partners. Omsom closed an undisclosed financing round in August, featuring Potluck Ventures, while immi has raised over $3.8 million to date with investors including Constellation Capital, Siddhi Capital, and individuals such as Nik Sharma and Patrick Schwarzenegger.

Pham said that raising capital has gotten easier in recent years as more investors recognize the market opportunity for premium Asian foods, noting that when she first started the brand around 2019 many investors at the time told her the category was too niche.

Brands have also been able to secure funding and support from firms dedicated to AAPI companies, such as Gold House – whose portfolio includes Sanzo, immi, Omsom, Tochi Snacks, protein bar brand Afar Foods, Munchrooms, and Asian and Hispanic foods ecommerce platform Weee! – and Hyphen Capital, which is focused on investing in Asian American owned CPG and tech companies.

Hyphen founder Dave Lu, whose investments include Sanzo, Nguyen Coffee Supply and plant-based frozen dessert maker Must Love, notes that there’s a big opportunity these brands need to realize: while they’ve been able to launch outside of the Asian food markets, where they might once have made those place their first stop, they need to aim for the center of the store, rather than the international aisle. He’d like to see these brands further integrating – and normalizing – these products throughout the store, whether it’s Sanzo being merchandised within the sparkling water set or, ideally, Fly By Jing and Omsom sitting next to Heinz ketchups and mustards.

While the international aisle has been the starting point for many of these brands, some products have landed in conventional sets by means of repositioning. Bachan’s, which calls itself a ‘Japanese barbecue sauce,’ is sold by some retailers in the condiment and sauce set, rather than in the Asian category alongside other Teriyaki sauces. Mochi ice cream maker Sweety, a brand modeled after founder and CEO Stacey Lee’s old family ice cream shop, has brought more Asian flavors to the frozen aisle with offerings like Matcha Green Tea, Azuki Red Bean and Ube Purple Yam varieties (although Simply Strawberry and Alphonso Mango are its best sellers).

“I think that changes the game completely, because you’re not fighting for three shelves with Italian, Mexican, Spanish or any other [national] food,” Lu said. “Their food is right alongside all the other options out there.”

All At Once: Community Over Competition

For those who have been paying attention, the emergence of so many innovative and disruptive Asian food and beverage brands should come as no surprise. As many of the founders are quick to note, Asian Americans have been experiencing long overdue recognition in mainstream popular culture – be it through movies, music, sports and even politics. AAPI-led films have dominated the box office and collected awards, most recently with the Michelle Yeoh-led Everything Everywhere All At Once which leads this year’s Oscar ballot with 11 nominations. In music, K-pop bands like BTS have created dedicated fanbases among American teenagers and TV series such as Squid Game and Bling Empire are reaching mass audiences through streaming platforms.

Building on this rising interest, retailers have also devoted marketing dollars and shelf space to Asian-owned food and beverage brands. For AAPI month last May, Target launched an “AAPI owned” badge for brands on its website as well as debuted extensive online marketing campaigns.

Kevin Lee, co-founder of plant-based ramen brand immi, said the recognition only increased during the pandemic and credited streaming services like Netflix, which has curated a substantial library of Asian TV shows, with driving interest to these new brands. During market research, Lee met one consumer – a middle-aged teacher from the Midwest – who said she discovered the brand online mid-2020 after binge watching a Korean drama called Crash Landing on You and saw the cast eat large amounts of instant noodles, inspiring her to google healthier ramen brands.

“What’s happening on TV and culture is affecting people’s palates and the cuisines that they’re driven towards,” Lee said.

Another hallmark of this new wave of founders is a sense of camaraderie as community supersedes competition, even when brands may be fighting for the same shelf space. A number of founders of these next gen Asian brands said they talk regularly in group chats, and, generally speaking, are always looking out for one another. Talking about this collaborative approach often brings to mind an old cliche about “rising tides,” but Kevin Lee said he likes to look at it more like a basketball team: “When we win, we all ride the same train uptown.”

Lee noted that in text threads founders will tell each other which grocery buyers are more receptive to upstart AAPI owned brands (and which aren’t) and will introduce each to potential partners, including investors, brokers and PR firms. Many of the founders are even personally invested in one anothers brands; Lee said he and Fly By Jing founder and CEO Jing Gao are both invested in each others’ companies.

“It’s very much been self-motivated and us doing all of this grassroots,” Lee said. “We try to support each other the best we can and then hopefully we’ll find more resources as this ecosystem keeps growing.”

Brands will also frequently collaborate on marketing campaigns to promote one another with their consumer bases. For example, 13 companies contributed to a holiday giveaway in December, including Omsom, Nguyen, Sanzo, immi and Fly By Jing, alongside brands like Lunar hard seltzer and noodle maker Nona Lim.

At Natural Products Expo West 2023 this upcoming March, Nguyen said several of the brands are also planning a happy hour during the show at Fly By Jing’s booth, which will be promoted closer to the event.

However, Lu was cautious to note that this cultural moment for Asian Americans has been far from perfect. While the pandemic lockdowns may have led more Americans to embrace Asian media and try new foods, inflammatory political rhetoric labeling COVID as the “China Virus” and other xenophobic messaging has created a spike in hate crimes. That has also hurt many Asian American owned businesses – journal Nature Human Behavior published a study last week reporting that Chinese restaurants lost $7.4 billion in revenue in 2020, with foot traffic down 18.4% below other restaurants, in part because of anti-Chinese bigotry.

“When we’re seeing videos of people that look like our grandparents getting knocked to the ground, or stabbed … it’s a lot. It’s a lot,” he said. “And these founders, they’ve all had to suffer and experience this while they’re trying to build their companies. And it’s scary. So I do want to acknowledge what these folks have gone through while they’re building these brands, and that’s not easy.”

But despite the challenges, the sense that these brands are a part of a wave has been meaningful on both business and personal levels. Nguyen noted that in accounts such as Whole Foods, strong performance for some of the earlier brands to emerge, like Sanzo, has generated interest from buyers to take on other products and allot more space to them. But perhaps the most important thing, she said, is the sense that they’re building something bigger than just singular brands.

“We want each other to win, because we know that it’s not about individual businesses,” Nguyen said. “Like it is [about individual businesses], but it’s also about this larger cultural moment that we’re building and this larger movement in this culture shift that we’re all pushing together through our respective lanes.”