FMI: Omnichannel Shoppers Force Shift In Retail Layouts, Drive Clamor For In-Store Tech

Consumers are increasingly seeking out fresh and convenient options, leading retailers to reconsider store layouts and invest in technology to improve their efficiency and omnichannel capabilities. According to the Food Industry Association’s (FMI) latest report, The Food Retailing Industry Speaks, demand for fresh and perimeter store departments has changed in-store dynamics and led to a heightened interest in technology designed to streamline omnichannel processes.

“As a result of shifting consumer behavior during the pandemic, 91% of all retailers now offer online sales, and almost half of those retailers saw online increases in 2021 and about 20% of those same retailers expect their online sales to increase again this year,” said Mark Baum, SVP of Industry Relations and chief collaboration officer at FMI, during a virtual briefing on the report.

While e-commerce has not maintained the “dramatic increases” seen during “the throes of the pandemic,” said Baum, retailers surveyed for the report expect, on average, to see the total share of online sales increase from 5.7% in 2020 to 6.5% in 2022. In 2019, online’s total share was 2.5% on average, and the steady rise of online grocery is expected to continue.

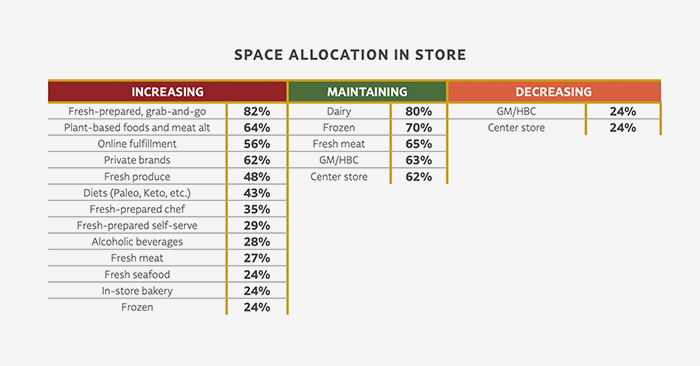

More than half of retailers (56%) are actively adding in-store space for online fulfillment capabilities, but the majority (56%) continue to use third-party platforms to execute those orders due to labor shortages.

Alongside the rise of omnichannel shopping habits, fresh and perimeter departments have garnered increased space in-store. Retailers surveyed noted growing consumer demand for produce, meat, deli, in-store bakery, seafood, as well as foodservice and grab-and-go style sets. Fresh and perimeter departments account for about 44% of total online retail sales, the report states, while “everything else”– actually the majority of sales, at 66% – comes from center store and general merchandise (GM) products.

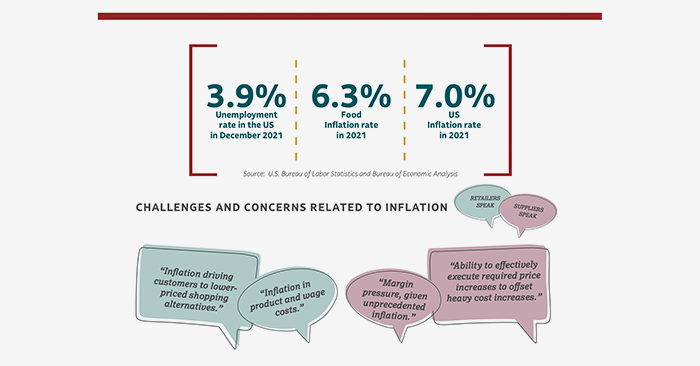

While they may be consciously driving traffic toward online platforms, retailers and suppliers are facing new challenges when it comes to profitability. As inflation continues to rise, suppliers said they are passing the higher cost of raw materials on to retailers. However, retailers are facing pricing pressures of their own with the increased use of credit cards and mobile payment systems from online transactions.

“A key issue impacting omnichannel profitability is high credit card interchange fees,” said Baum. “85% of all online purchases are made via credit card or debit card, and card users drew in more than 75% of all sales in 2021, up from 68% back in 2017. [However,] credit card fees average about 1% of a retailer’s total sales and even higher (1.4%) for small retailers with 10 stores or fewer. These fees come directly off the bottom line and make it really challenging to keep consumer costs low, especially if you consider rising inflation.”

The vast majority of retailers and food suppliers (85% and 86%, respectively) said they expect inflation to continue impacting their margins over the next year. In order to combat that effect, retailers are increasing their focus on private brands.

Last year, retailers invested an average of $1.5 billion into new technology, but less than half (39%) said they’ve seen these investments have a positive impact on their bottom line. Despite that low confidence in ROI, 83% said they expect their technology investments to increase again this year. Primarily, retailers have used tech to automate pricing programs and reduce friction for consumers shopping in-store.

The report claims suppliers are ahead of the curve compared to retailers when it comes to tech. Many food suppliers are increasingly adopting AI and machine learning programs that are applicable to retail and make operations more efficient, plan assortments, optimize pricing strategies and manage supply chain logistics.

“Rapid adoption of technology was and is a key component in helping food retailers and their suppliers overcome many of the challenges posed by COVID-19,” said Baum. “We are seeing a big technology makeover, including [areas like] tech to personalize shoppers’ experiences, to enhance foodservice ordering and delivery and to allow for dynamic pricing, product traceability and, especially around mobile checkout systems to make the process faster and more frictionless.”