SPAC Meets Snacks: Stryve Goes Public, Seeks to Build Snacking Platform

Biltong brand Stryve Foods announced plans to go public on the NASDAQ through a business combination with Andina Acquisition Corp III, a publicly-traded special purpose acquisition company (SPAC). The new company is valued at $170 million, and will be listed on the NASDAQ under the ticker symbol SNAX. Stryve’s goal, the company said, is to become a snacking platform that can exist across categories.

The deal is expected to close by the second quarter of this year. Stryve’s expected net revenue for 2021 is $46 million, the company said, and claims that profitability is “in reach” by mid-2021. The company expects its 2022 net revenue will hit $92 million.

Strvye had previously raised $26.5 million over two rounds of capital from investors including Meaningful Partners, Pendyne Capital and Murano Group. The company was trying to raise its next round when the Covid-19 pandemic hit, according to Co-CEO and CMO Jaxie Alt. An investor introduced Stryve to Andina, which has had two other SPACs: one with LazyDays R.V. Center in 2017 and another with Colombian glass and window producer Tecnoglass, Inc. in 2013.

“It became very clear to us that a SPAC IPO was really the perfect way for us to get access to the capital we needed in order to really fund our exponential growth plan,” Alt said. “And do it a lot faster than a traditional IPO or acquisition or large investment from private equity.”

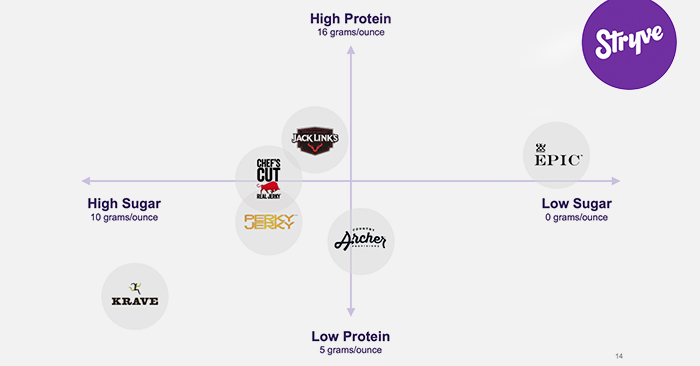

Founded in 2013, Stryve produces sliced biltong, a low sugar, high protein alternative to traditional jerky, along with whole biltong slabs and meat sticks under its flagship brand. Stryve is available in 17,000 retailers across the U.S. and Canada, such as Kroger, Natural Grocers, Walmart, Sprouts, Wegmans, Meijer and Hannaford and will be expanding to select Target locations and Thrive Market in 2021. The brand has also expanded its ecommerce presence, launching Stryve.com in April of last year, increasing its direct-to-consumer revenues from $19,000 in 2019 to $3.6 million in 2020, and seeing a 33% volume growth on Amazon in 2020 with $2 million in sales.

The company has invested not only in building out its brand and product line, but also in its manufacturing capabilities. The company previously acquired the only two USDA certified plants able to produce biltong, and then subsequently shuttered both, retaining some of the plants’ staff and the intellectual property. In 2019, Stryve opened a new 52,000 square foot plant in Madill, Oklahoma, which the company claims is the largest USDA approved facility, adding that the only other biltong facility in the U.S. is 1/3 the size of Stryve’s.

There’s a high barrier to entry for biltong in the U.S., according to Stryve COO Alex Hawkins. The USDA has been restrictive in approving biltong manufacturing facilities in the U.S., and processed meat cannot be imported, limiting international competition.

The facility also produces private label items, Alt said, but no longer offers co-packing for outside brands.

With manufacturing shored up, the goal is to create a platform of air-dried beef options, a subsegment of the jerky category that Alt feels will eventually become the dominant form factor for meat snacks, comparing it to how Chobani has helped Greek yogurt surpass traditional style yogurts. Stryve has already begun to execute toward this goal, acquiring and launching new air dried beef brands.

Acquisitions include the 2018 acquisition of Braaitime, which is sold online only and caters largely to South African consumers in the U.S. That deal gave Stryve one of its original two biltong production plants and founder Warren Pala came aboard as Stryve’’s chief manufacturing officer.

The company also disclosed today it had acquired Kalahari Snacks in December, a brand it previously co-packed for and that has strong traction in the natural channel, Alt said. Kalahari Snacks had previously raised more than $3 million in funding with investment from AF Ventures. The brand had 2020 gross revenue of $3.6 million.

Stryve was unable to disclose what roles Kalahari co-founders Tyler Noyes and Brett Johnston hold moving forward, or if Kalahari would be run as an independent business from its previous headquarters in Massachusetts. Former CEO Chris Hickey began a new role earlier this month.

Kalahari declined to comment for this story.

Finally, Stryve has also recently launched Vacadillos, a new brand that Alt said is targeting the Hispanic consumer with a Latin American version of biltong called Carne Seca. She noted that there are 60 million Hispanic consumers in the United States, and yet the demographic under indexes for jerky because, she said, “There’s no brand really fulfilling their needs.” Marketing Stryve to Hispanic shoppers, she said, would be ill advised because the name was too unusual and the term biltong simply didn’t resonate. Vacadillos, she added, uses more Latin and Central American flavors such as chili lime.

Still, beyond meat snacks, there’s a broader play at hand. The transaction will support the company’s larger growth strategy of becoming a vertically integrated, healthy snack platform that expands beyond meat snacks to crackers, chips, bars and cookies, Alt said. The plan for the next three years is to internally develop these new items, but there’s the potential for future acquisitions.

“While I love our current business, we consider ourselves a platform, eager to expand beyond the meat category,” she said. “Our vision is to help America snack better. And what does America snack on: chips and crackers. These are really massive categories that we think there’s a lot of white space for health driving innovation to really drive our mission. We want the name Stryve to be synonymous with healthy snacking.”