IRI and Forrester Find the Future of Online Grocery Remains Uncertain

One of the most notable behavior shifts that has emerged amid the Covid-19 pandemic is consumers’ move from in-store to ecommerce grocery shopping. In 2020, for example, online grocery sales grew by 48% while brick-and-mortar sales rose by just 6% in North America. But will this shift be permanent?

A recent report from market research firm Forrester, authored by principal analyst Sucharita Kodali, looks to answer this question. Using IRI data to examine how the pandemic shaped online grocery shopping, the report forecasts consumer shopping habits in 2021 and lays out the best course of action for brands and retailers as they balance ecommerce and retail sales.

Pandemic Spurs Ecommerce Grocery Growth

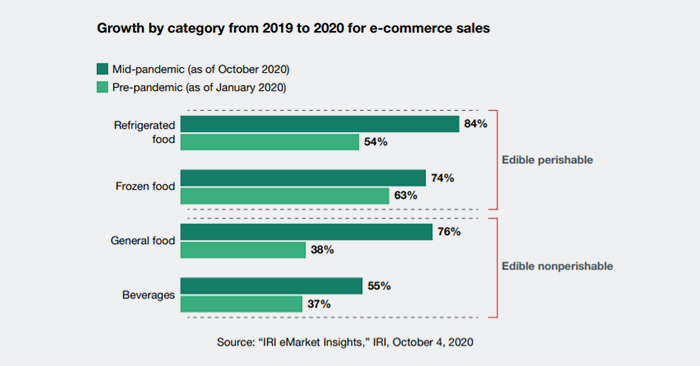

While some were more popular than others, all major grocery subcategories including refrigerated items, frozen items, general food and beverages experienced online growth last year, according to Forrester and IRI. The fastest growing category was the refrigerated food category, with 84% growth, though this category had the lowest penetration overall in online grocery sales at just 6%.

Nonperishable, nonfood items (beauty, health and homecare) continued to dominate ecommerce grocery sales and see the highest penetration, accounting for 71% of ecommerce sales. Nonperishable food items such as general food and beverage comprised 20% of sales, and frozen and refrigerated were 9% of online grocery sales.

Online grocery purchases through Amazon and Walmart have grown since the onset of the pandemic, the report added, still the two channels see different purchasing habits. While Amazon grocery buyers focused largely on nonedible items, online shoppers at Walmart.com, which saw 79% growth in ecommerce during Q3 2020, purchased more food and beverages items, with orders comprising one-third of edible nonperishable purchases and 40% of edible perishable products purchased online.

The report also noted that online sales were disproportionately composed of super premium items such as Rao’s pasta sauce, making up 38% of ecommerce sales, whereas these items made up 17% of sales in brick-and-mortar stores. This could be attributed to consumers seeking to replicate restaurant eating experiences at-home, Kodali said.

The Uncertain Future of Online Grocery

Despite the quick adoption of online grocery shopping, growth in this channel will likely not continue at this pace due to several factors, Kodali predicted.

“While consumer demand is important, supply is even more so, especially in grocery, where merchants are unable to eke out a profit on online sales, much less anything comparable to their current store margins,” Kodali said.

As vaccinations increase and limitations on restaurant capacities are lifted, the restaurant sector (down 19% in October 2020), will likely rebound. This recovery, Kodali believes, will cause grocery sales both online and in brick-and-mortar stores to decline.

Part of the reason for this slowdown may be because consumers report that their shift from retail to online shopping has not been seamless, with many feeling unsatisfied with their ecommerce experience. Out of stocks, long shipping times, late deliveries and high prices were all issues that increased mid-pandemic compared to pre-pandemic. Kodali predicted that these issues will ultimately lead consumers back to retail stores post-pandemic.

Some shoppers who switched to ecommerce shopping at the start of the pandemic have already begun to resume their previous in-store shopping habits. Because of this, ecommerce growth has already begun to decelerate, a trend grocery giant Ahold Delhaize reported in Q3 of 2020. This behavior is consistent with the findings of a Forrester survey in April 2020, which revealed that 45% of consumers hoped to “resume usual shopping habits soon.”

“Once a vaccine is prevalent, we expect people to resume their old behaviors, including going to stores, for the mere reason that that is the behavior they know and like,” Kodali said.

Recommendations for Brands and Grocers

Considering these trends, the report notes that brands and grocers should not prioritize ecommerce business over profit.

“Keep in mind there are many important lessons to learn about e-commerce from the pandemic, but blindly embracing online grocery retail at the expense of all else is not prudent,” Kodali said.

Grocers should remain focused on in-store shopping, as this is where the majority of sales will continue to occur, and should instead invest in further implementing sanitation protocols and streamlined checkouts. Kodali added that retailers should also avoid delivery unless it is executed through services like Instacart, and instead consider serving as a pickup location for brands sold through ecommerce. The report also recommends partnering with microfulfillment centers as well as CPG giants like Frito Lay who are looking to experiment with ecommerce sales to reduce online grocery fulfillment costs.

However, the report also warned brands and grocers to also be wary of companies like Instacart and DoorDash which subsidize delivery costs, recommending they keep “meticulous track” of costs in order to determine if they should raise prices on these ecommerce transactions.

“If these costs are too expensive for you, focus on where you can differentiate: in-store selection and a pleasant store experience,” Kodali said.