HowGood Raises $6M to Grow Sustainable Ingredient Data Platform

Sustainable ingredient data platform HowGood announced this week the close of a $6 million funding round. The company will use the capital to further invest in its proprietary database, which helps members of the food industry and consumers make choices around purchases, formulation, investment or marketing claims.

The funding round was led by Contour Venture Partners, with participation from FirstMark Capital and Trailhead Capital. Danone also invested through its Danone Manifesto Ventures arm after partnering with HowGood across its North America portfolio. The recent round brings the company’s total funding to date to $15.6 million.

“HowGood has spent years building and productizing a research database that is unparalleled in the sustainability intelligence industry,” said Matt Gorin, managing director and co-founder of Contour Venture Partners, said in a press release. “This has now become table stakes for food brands in order to meet the demands from the consumer around food ingredient transparency across a number of variables that are important to them.”

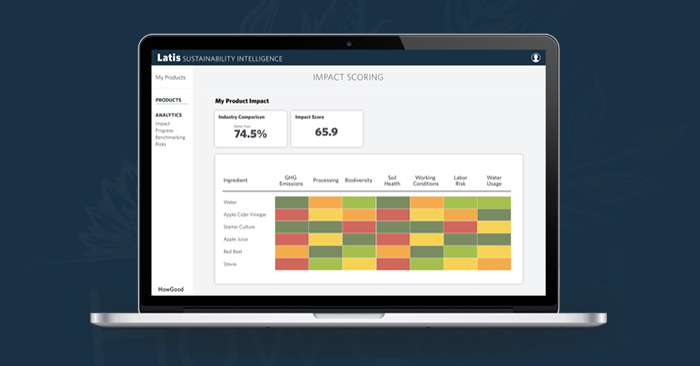

Founded in 2007, HowGood’s early years were spent working with experts and universities to build out its intelligence platform, called Latis. The resulting database now features over 33,000 ingredients, each with metrics for greenhouse gas emissions, biodiversity, labor risk, animal welfare and health and toxicity. The database can support members throughout the industry for purposes such as aiding brands in selecting sustainable ingredients, helping sustainability-minded investors determine companies to invest in and allowing retailers to communicate products’ sustainability attributes to consumers, CEO and founder Alexander Gillett said.

“We were passionate about sustainability issues and social justice issues and some of the largest impacts that happen in the world within those issues happened within the food realm,” he said. “We have passion and understanding around data and data aggregation and the knowledge that you can’t actually be an expert in all the impacts.”

The new funding will allow HowGood to onboard new clients more quickly, add new metrics that companies have requested, such as deeper greenhouse gas standards, and increase its work with sustainable ingredient suppliers, Gillet said. The company will also add more team members in sales, marketing, R&D and operations, and expand into different CPG categories such as apparel, cosmetics and cleaning supplies.

Though the founding team had multiple ideas for the platform, at launch HowGood originally focused on consumers, creating an app that allows users to scan barcodes of their favorite products and see sustainability data. But about six years ago investors began showing interest in using the data for their needs, and retailers followed suit, using its simplified consumer-facing rating system to identify sustainable products in-store. Since then, Gillett said, HowGood has seen a significant uptick in demand from CPG food and beverage companies, and in turn, invested more attention into these segments, and CPG brands currently make up the majority of the company’s client list. Now, the company’s clients include major CPG companies like Danone, retailers like Giant, Stop & Shop and Walmart and even restaurants like Chipotle.

“We realized it’s great to have the market drivers,” he said. “What we’re learning was that companies already wanted to make these changes, and the idea is to be able to support them and continue to offer more and more detailed understanding and nuance.”

A typical CPG company has their marketing, sustainability or innovation teams use the HowGood database to find new ingredients that meet both their sustainability standards and align with consumers’ values. Though companies could do this research on their own, this process can be very complex and time consuming, so HowGood helps streamline both R&D and marketing efforts towards the same goal. HowGood charges companies by the number of ingredients for which they access data, so it can also be accessible and affordable for smaller food startups who produce fewer products and require less data.

“We bring together hundreds of experts to interpret these different growing practices, so someone who’s working on formulation, they just can’t be an expert in all those things,” he said. “They’re reformulating a cereal brand, they can’t understand all the different ingredients, and all the different environmental and social impacts. So we simplify that for them.”

It’s not just about the ingredient itself. HowGood also offers companies alternative options, for example comparing a specific crop of an ingredient to others grown across the world in different climates and regions. This way, companies can see a more “holistic view” of the different outcomes that result from shifting from one ingredient to another, Gillett said.

After 14 years, the database is still far from static, Gillett noted, and HowGood will continue to add hundreds of ingredients monthly as new and innovative ingredients enter the market and consumers indicate new metrics they’d like to have at their disposal. Furthermore, the company is “never done” evaluating ingredients already on its database, Gillett said. As new practices and studies emerge and environmental factors and standards change, HowGood aims to establish an up-to-date platform that helps shape the choices of brands, retailers, investors and consumers.

“We want to help people start to be able to make a more data-centric decision making policy around this,” he said. “So that it’s not just good intentions, but best practices.”