California Legislation To Impact Plastic Packaging Production

Nearly a year after it was passed into law, recycling-related legislation in California is poised to have a significant impact on bottle production in the country’s biggest economy. In late September 2020, California Governor Gavin Newson signed into law Assembly Bill 793, which mandates that all beverage containers sold in the state contain 15% post-consumer resin (PCR) by 2022. However, according to a recent report from the California Department of Resources Recycling and Recovery (CalRecycle) the vast majority of the state’s top bottlers — including names like Coca Cola and Whole Foods Market — have not met that minimum threshold.

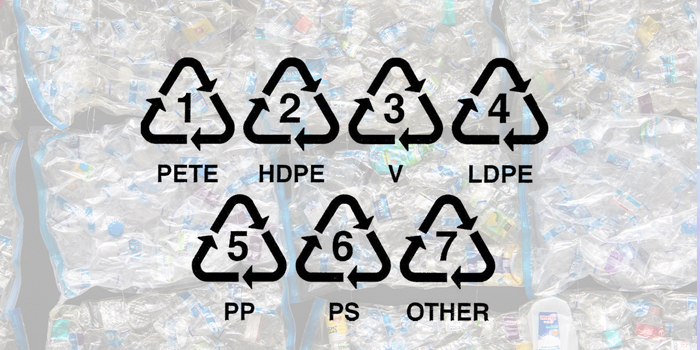

AB 793 marks the country’s first recycled content mandate for plastic beverage containers and, while Newson has recently signed a high volume of additional waste and recycling management legislation, another bill signed earlier this month — Senate Bill 343 — also stands out for the impact it could have on beverage manufacturing as it aims to redefine the “chasing arrows” system for food and beverage package recyclability.

Both bills were enacted to bring the state closer to its goal of a circular economy and set a standard for the rest of the country to transition away from fossil fuels and promote economies that reuse and repurpose materials. California has always been a leader in sustainability-focused regulations, Newson said when signing AB 793, and as the world’s fifth largest economy, this new legislation is likely to have an impact on how the rest of the country recycles.

What is AB 793?

Passed in late 2020, AB 793 mandates that all California Refund Value (CRV) plastic beverage containers are made with at least 15% PCR; in this case that material is rPET. The new legislation includes three short-term benchmarks with an end goal of achieving 50% PCR in all beverage containers by 2030. However, a recent CalRecycle report found that only seven of the state’s 69 bottlers have reached this first benchmark of 15% from the data provided on bottle production in 2020 and many bottlers had no data to report whatsoever.

According to Lance Klug, Information Officer for CalRecycle, the agency is in the process of developing regulations to implement the legislation, holds the power to conduct audits and investigations come the new year and noted that the penalties have already been established if manufacturers fail to comply.

“Beverage manufacturers that fail to achieve the requirements are subject to a 20-cent penalty for each pound they fall short of the mandated targets,” Klug said. “Beverage manufacturers who fail to meet the minimum content standard will be able to submit a corrective action plan detailing the reasons why they failed, or expect to fail, to meet the minimum recycled content standard and how they plan to meet the standard moving forward.”

What is SB 343?

In addition to regulating the amount of recycled plastic used to remake packaging, CalRecycle has been tasked with determining what products can be labeled as recyclable in the first place. As outlined in SB 343, this restricts the use of any recyclability claims — most commonly the “chasing arrows” designation which identifies the resin used to make the plastic — unless the material collected has been approved by CalRecycle, in a process that mandates that the material must already be collected by at least 60% of the state’s curbside programs and be processed in facilities that meet the international Basel Convention standards.

The legislation gives CalRecycle until 2024 to establish updated guidelines for designations using previous data and compile a list of commonly recyclable materials. According to plastics litigator Creighton Magid, a partner at law firm Dorsey & Whitney, the regulation could negatively impact the development of methods and technology to expand recycling programs.

“There are a large number of products that are only now beginning to be recycled, due to improvements in technology, rising prices for post-consumer resins, and more efficient markets for post-consumer materials,” Magid said. “The law imposes a huge new risk for anyone promoting new recycling technologies, developing new products or investing in recycling infrastructure or markets: if CalRecycle decides that the particular product in which you’ve invested can’t claim to be recyclable, you’ve lost your investment.”

What issues could arise?

In terms of AB 793, manufacturers could face difficulties in securing enough rPET to produce bottles, according to a report from S&P Global Platts. Currently, food and beverage containers represent the second largest use case for recycled PET as the majority of the material is funneled into other industries to make more profitable products such as carpets and clothing, according to the International Bottled Water Association.

According to Klug, there are 1,232 certified CRV beverage container recycling centers currently operating in California, along with five additional pilot projects; that breaks down to approximately one recycling center per 32,000 residents. Although the state operates a substantial curbside program, bottles recycled this way, opposed to being directly dropped at a redemption center, have an increased chance of getting sorted into bales of regular waste, making it even less likely for them to reenter the recycling stream.

Additionally, all materials must pass through a recycling center at some point to have a chance at being repurposed into usable rPET, a process further challenged by the recent closure of multiple recycling and redemption centers across the state. Klug explained that even though recycling centers are not required to report their reason for closing, many have cited challenges with rising costs, local zoning ordinances, pandemic-related health concerns as well as “the increased predominance of plastic beverage containers coupled with declining scrap prices – particularly the value of aluminum”

The cost of rPET is also on the rise — with the average price being $0.10 higher than virgin PET — due to the decreased availability of scrap material and supply chain disruptions, meaning obtaining suitable PET to recycle may be a difficult task for manufacturers. According to CalRecycle, 18 billion beverage containers were recycled in California last year, amounting to a 37% recovery rate which is not far from the 30% national recycling rate. Due to the new PCR content requirement, the uptick in demand will likely lead to a shortage of rPET.

Although SB 343 will not go into effect until 2024, this legislation may further inhibit the availability of PCR materials, according to Magid.

“Consumers may want products made with post-consumer content, but if SB343 discourages recycling of all but the most obviously recyclable products, where are manufacturers going to get the post-consumer feedstock?,” he said.

SB 343 was enacted to reduce consumer confusion around recyclability and is a part of a broader initiative to address “truth in labeling” claims about recycling. Maine and Oregon passed similar legislation earlier this year.

How are the major players performing?

For manufacturers in California, levels of concern over AB 793 are varied. Based on 2020 data, companies including Pepsi Cola Bottling Group, Nestlé Waters US, Niagara Bottling and CG Roxane have met the minimum threshold and will not incur any penalties come 2022. However, according to the report from CalRecycle, the vast majority of the state’s 69 other registered bottlers — including Coca Cola, which has achieved 10% PCR — are still far off the pace.

Coca Cola spokesperson Bailey Rogers said in an email statement that the company’s 13.2 oz bottles across Coca-Cola and its other sparkling brands and its 20 oz. Coca-Cola trademark, Diet Coke and DASANI bottles are made from 100% recycled material, specifically in California. Roger’s also said the manufacturer is working to meet its sustainability goals.

“We continue to invest in recycled PET in California and beyond to meet our goal announced in 2018 to use at least 50% recycled material in our packaging globally by 2030 as well as to comply with California’s recycled content law enacted in 2020.”

On the other side of the spectrum is CG Roxanne, the makers of Crystal Geyser which operates its own rPET bottle production plant in San Bernardino, California. The company has achieved 37% rPET bottles and is running “a decade ahead” of state requirements, according to Luke Genthe, rPET Facilities Project Manager at CG Roxane.

“Our commitment from the start was to reach a minimum of 50% rPET at West Coast plants,” Genthe said in a statement via email, noting the California legislation has set incremental goals to accomplish this same threshold by 2030. “CG Roxane’s San Bernardino rPET facility has the ability to recycle approximately 35 million pounds of plastic bottles per year. Reprocessing all of these recycled plastic bottles saves the equivalent of over 285 thousand gallons of crude oil in addition to approximately 210 million pounds of CO2 per year.”

Genthe said the majority of the PET entering the facility comes from the greater Los Angeles area where it begins in post-consumer PET flakes, is processed into pellets and then distributed to the company’s West Coast bottling plants. “At CG Roxane, we have a saying of “we make it, we take it back,” and we seek to honor that by sourcing the majority of PCR from the greater Los Angeles Area,” Genthe emphasized.

He also explained that the facility has mitigated supply chain disruptions due to its direct oversight from post-consumer flakes to bottle production allowing them to maintain a steady stream of rPET over the past year. Additionally, the company noted its plan to open an rPET plant in Tennessee by mid-2022 to increase the PCR content of bottles distributed on the east coast.

Highlights of other notable recycling-related legislation in California:

- AB 881: Exported plastic scraps are no longer counted toward the state’s recycling goals and the majority of future exports of materials are prohibited.

- AB 1201: Updated labeling requirements for compostable plastic packaging and bans the use of intentionally-added PFAS

- AB 962: Refillable beverage containers can now be returned and washed for reuse instead of being crushed for repurposing

- AB 1311: Certified redemption centers can change hours based on community need and accept container bag drops while paying customers electronically

- SB 54: This bill has been tabled, but is predicted to return in 2022. The main purpose is to require that all single-use disposable packaging to be recyclable or compostable by January 2032

![[Updated] Oats Overnights Secures $45M Investment From Astō](https://d2azl42aua8mom.cloudfront.net/wp-content/uploads/2026/01/29172259/2026-01-29-oats-overnights-secures-45m-in-growth-equity-from-square-150x150.jpg)