Zero Egg Raises $5M For Jump to U.S.

Just a month after Israeli food technology company ZeroEgg made its U.S. debut, the company announced it has closed a $5 million round of funding to help accelerate its growth.

Zero Egg so far has launched two plant-based egg alternatives in foodservice and as an ingredient for CPG producers.

The round was led by Powerplant Ventures, and also included investment by previous investor Unovis Asset Management’s New Crop Capital and The Kitchen Hub, the incubator and accelerator run by food producer The Strauss Group. So far, the two-year-old company has raised $8 million in total.

Powerplant Ventures co-founder and partner T.K. Pillan will join the company’s board of directors. Also the co-founder of restaurant chain Veggie Grill, Pillan is well versed in the foodservice channel and how brands can optimize their marketing and sales strategies to target restaurants.

“I’ve been on a mission to offer practical plant-based options for consumers at both the retail and restaurant level for many years. What has been missing until now is a complete, affordable plant-based alternative for eggs,” Pillan said. “Zero Egg is a game-changer for the industry.”

Zero Egg currently has two products in market: Egg Basics (which can replace eggs in traditional egg entrees and breakfast dishes) and Bake Basics (which can be used for baking, pasta, or other dishes that use egg as an ingredient). Both are powders made from a variety of plant-protein sources, including potatoes, chickpeas, peas and soy. Zero Egg’s unique functionality, CEO and co-founder Liron Nimrodi said, comes from how these ingredients are combined and not from a new and novel ingredient.

Nimrodi joined Zero Egg in 2018 after her co-founders already had a minimum viable product that had been tested in the Israeli market. The Kitchen, which had identified the product as a future investment, brought on Nimrodi, formerly of Sodastream and Osem Nestle, to craft a business plan using the technology and bring the company to market.

The company launched into the food service channel in Israel in 2019 and is already used by a restaurant chain for their breakfast options as well as by a large coffee chain in their baked goods. Now, with the U.S. in its sights, Zero Egg has also added Whole Foods veteran Isabelle Francois as General Manager Zero Egg North America, joining a team of 12 globally.

Zero Egg plans to spend 2020 and 2021 focusing solely on restaurants and partnering with co-packers and CPG manufacturers. With a goal of having menu and front of pack callouts for the ingredient, the hope is to be cash efficient, establishing equity and loyalty among consumers to prepare for a 2022 entrance into grocery stores with a branded Zero Egg product.

“Thirty billion eggs are consumed in the food service manufacturing industry in the U.S., and then eggs are on 72% of menus, so we see the potential to reach out to more consumers where the egg category is in its infant stage in retail and foodservice,” Francois said. “Retail is marketing intensive.”

Though a pandemic might seem to be a strange time to target foodservice, Francois and Nimrodi say they have found that many restaurants and brands are welcoming innovation and looking for new reasons to drive consumers to their menus or products. Furthermore, with a lack of trade shows and travel, there’s more time to invest in R&D.

2021 will also see the introduction of new product types. Zero Egg already has an allergen-free product developed, Nimrodi said. Other launches will span the spectrum from “creativity to convenience” Francois added, with some brands seeking more ingredient offerings while others wanting a more finished product that can easily be incorporated.

Nimrodi said that the company is particularly interested in being an ingredient provider, and that the company has tried to remove many of the barriers that would prevent a brand or restaurant (many of which already use powdered egg products) from switching to Zero Egg.

Price isn’t one of those barriers, Francois said. Currently Zero Egg breaks down to roughly 12 to 20 cents per egg equivalent, while cage-free eggs in the commodity market currently cost roughly 12 cents. Because the company has achieved price parity, there’s no increased spend, Francois said, adding that Zero Egg could even be a more cost efficient option because there’s no fluctuation in pricing depending on the market.

“[Your product or menu item] becomes universal,” Francois said. “And from a consumer standpoint, there’s no difference — the same taste, the same texture.”

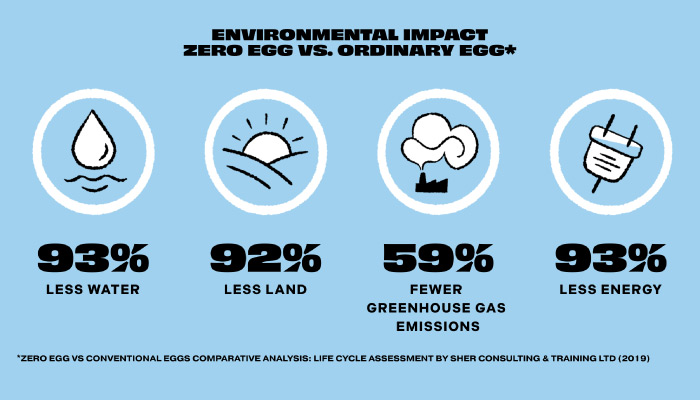

Meanwhile, Zero Egg also has a sustainability and health halo it can offer brands. Compared to a conventional egg, Zero Egg uses over 90% less land, water and energy to create and has zero cholesterol.

“The demand for plant-based egg from the industry and food service is huge. It’s not only because consumers are demanding products, but there are also real problems with eggs: allergens, pathogens, supply chain issues, pricing problems,” Nimrodi said. “The market is hungry for a solution.”