Deal Dive: Why Campbell’s Spent $2.7 Billion to Buy Rao’s Maker

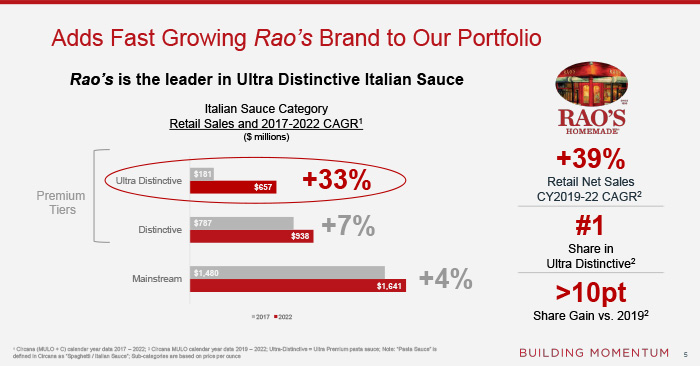

In a $2.7 billion deal, the Campbell Soup Company has picked up publicly traded Sovos Brands, makers of the Raos’ Michael Angelo’s and Noosa lines of products, in order to expand into the ultra premium sauce set and further strengthen its efforts outside of soup and snacks.

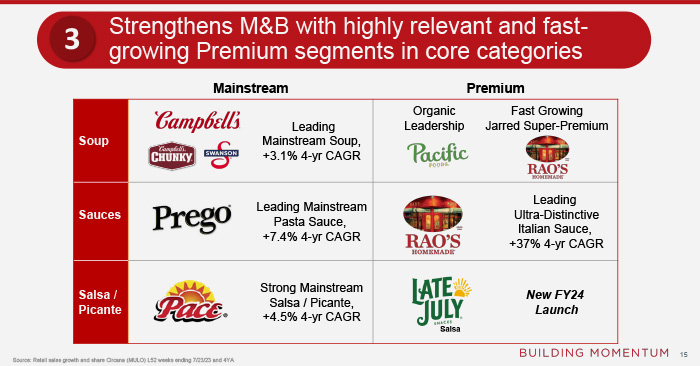

With this acquisition, part of an ongoing multi-year effort to broaden its product portfolio, Campbell’s said it can now offer consumers “mainstream” and premium offerings across its meals business, giving the company a means of encouraging shoppers to trade up from its Prego and Campbell’s Soup products. Campbell’s said it saw success with this strategy after acquiring Pacific Foods in 2017

“The single most important thing I want you to take away from this deal is that it accelerates the strategy that we have been successfully executing against for the last five years,” said Campbell’s CEO Mark Clouse. “It will not distract us nor will we depart from our focus, it simply will strengthen it.”

What are the Deal Details

Cambell’s purchased Sovos at $23 per share, a valuation of a multiple of 14.6x EBITDA, including run rate synergies and 19.8x excluding synergies. The company expects annualized cost synergies reaching roughly $50 million over the next two years and be accretive to adjusted diluted earnings per share by the second year, excluding one-time integration expenses and costs to achieve synergies.

In a press release today about its Q2 earnings, Sovos reported net sales of $217.6 million, a 10.2% increase year-over-year. The company had adjusted net sales of $837 for calendar year 2022.

Though Cambell’s is new to meals and frozen pizza, Clouse has experience with frozen products, having previously served as CEO of Pinnacle Foods. He told investors and analysts the company would move items through its existing Pepperidge Farm cold chain network.

What is Sovos Brands

Formed in 2017, Sovos includes two Italian food category leaders, Michael Angelo’s and Rao’s (acquired in 2017 and 2018, respectively) as well as yogurt brand Noosa. Until last year, the company also owned Birch Benders, but sold off the baking brand in order to focus more heavily on its sauce, soups and frozen meals businesses.

In Q2 Sovos reported net sales of $217.6 million, a 10.2% increase year-over-year, with net income of $5.4 million. In a press release today the company said its adjusted EBITDA was $35.2 million, up 36.9% year-over-year. However, Sovos is still dedicating significant resources towards its marketing efforts, with the release noting that marketing and R&D costs increased a combined 35.6% year over year.

It’s clear however, that of Sovo’s three brands, Rao’s is the crown jewel of the portfolio. For Q2 Rao’s sauce dollar consumption grew 31.5% year-over-year, and for fiscal year 2022 represented roughly 69% of Sovos’ adjusted net sales.

What’s the Opportunity?

Since its acquisition of Snyder’s Lance in 2017, a move that gave the company the Snyder’s Lance Pretzels, Kettle Brand, Cape Cod and Late July brands, much of Campbell’s focus has been on its snacks business. However, with its snacks portfolio on solid footing, Clouse said, now was the time to consider another acquisition.

“Sovos Brands brings a high growth portfolio with meaningful scale that reflects several of the most relevant consumer trends today: more premium restaurant quality experiences and quick delicious meal solutions,” Clouse said.

By streamlining sales, marketing, back office and supply chain efforts, Campbell’s said it believes it can achieve roughly $50 million in annualized cost savings. Two-thirds of that will come from “harmonizing” the combined corporate organizations and one-third from efficiency gains in sourcing and supply chain management.

Campbell’s sees easy wins in expanding Rao’s and Michael Angelo’s distribution as well as SKU counts per store. Executives told analysts that there is a 20 point difference in ACV between Rao’s top five SKUs (which have an 80% retail penetration) and its next five SKUs, despite still reporting strong velocities. When comparing Rao’s to other “key category players” Rao’s also has approximately ten items less per store.

While the Sovos team has been focused on expanding distribution, Clouse said, Campbells also plans to use its marketing muscle to increase household penetration of Rao’s products, which currently stands at 14%.

One area Campbell’s does not see a long-term future with is yogurt, telling analysts it was considering strategic alternatives for the Noosa brand. In the meantime, given its stability and performance, executives feel comfortable letting the existing team continue to execute against the business. The brand’s cheesecake bites and frozen yogurt were not mentioned.

“[Noosa is] a terrific business, really well run and we do not see it as a distraction,” Clouse said. “I’m not worried at all about the trajectory of the business, certainly we’re not assuming this is going to be the growth engine and the acquisition, but I also don’t see it as a high risk or heavy liability.”

![[Updated] Oats Overnights Secures $45M Investment From Astō](https://d2azl42aua8mom.cloudfront.net/wp-content/uploads/2026/01/29172259/2026-01-29-oats-overnights-secures-45m-in-growth-equity-from-square-150x150.jpg)