Arms Race: Cultivated Meat Companies Battle To Grow Production Space

In November, cell-cultivated meat company Upside Foods (formerly Memphis Meats) announced that it had passed Food and Drug Administration (FDA) regulatory approval for its animal-free chicken. The company is one of hundreds of food technology startups aiming to unlock a potentially game-changing innovation for both the environment and consumers: using cell cultures to grow real meat, poultry or seafood without the need to raise and slaughter livestock.

Although lauded by the cellular agriculture community as a huge step towards bringing the food tech industry closer to offering commercially viable products, the FDA’s decision also puts pressure on the industry to move beyond impact projection-laden press releases, closed door tastings and proof of concept production models.

Yet even at this early stage, cell-cultivated protein companies appear to be locked in a friendly arms race to build commercial-scale production plants in anticipation of growing demand. The desire to start building now reflects the long and complex road ahead towards widespread commercialization and price-parity with conventional meat and seafood – as well as investors’ belief that future returns will be worth the effort.

The race to the top by some of the most-well funded cell-cultivated startups when none of them have received full regulatory approval from both the FDA and the U.S. Department of Agriculture (USDA) might seem perfunctory. Yet against the backdrop of declining sales of plant-based meats, the industry’s urgency to be proactive is partially an attempt to learn from previous mistakes.

Where the Cultivated Sausage Gets Made

The FDA’s greenlight of Upside Foods’ cultivated chicken product came just months after the company had announced the closing of a $400 million Series C funding round aimed at funding the construction of a commercial-scale production facility that is expected to produce tens of millions of pounds of product annually.

News of Upside’s new production plans came less than a year after it had opened its pilot facility in Emeryville, California in November 2021. The 53,000-square-foot Engineering, Production and Innovation Center (EPIC) has the capacity to produce 50,000 pounds per year, with plans to expand to upwards of 400,000 lbs annually. EPIC was primarily funded by a $186 million Series B round that closed in January 2020.

Along with Upside Foods, at least three other cell-cultivated protein companies have either announced plans for or have already begun construction on commercial production plants in the U.S.

GOOD Meat, the Alameda, California-based division of alt-meat company Eat Just, announced in May that it was planning a “large-scale cultivated meat facility” to bring its cultivated beef and chicken to the U.S. GOOD would not disclose any other details about the expanded food manufacturing facility except that it will house ten 250,000-liter bioreactors capable of producing up to 30 million pounds of meat when fully operational.

The food tech company currently operates domestically out of a 100,000 sq. ft. demonstration facility that operates a 3,500-liter bioreactor, in addition to smaller vessels and supporting infrastructure. Internationally, GOOD produces and sells a limited amount of cell-cultured meat in Singapore making it the sole cultivated meat business producing a commercially available product. In May, the company reported it had started construction on its Singapore production plant that will operate “the single-largest bioreactor in the cultivated meat industry to date” capable of producing tens of thousands of pounds of meat from cells. The facility is expected to open in Q1 2023.

The brand expects to follow a similar launch strategy to its work in Singapore, using fine dining and foodservice to acclimate consumers to the novel product, said Andrew Noyes, GOOD Meat VP of global communications and public affairs. “Retail production and sales will be further down the road when cultivated meat can be produced more efficiently and affordably and at a much larger scale.”

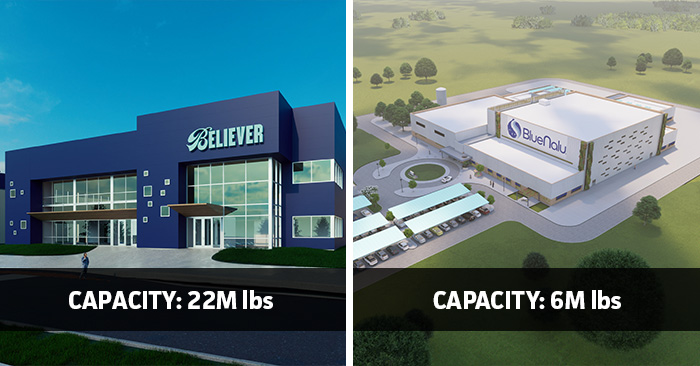

Cultivated seafood maker BlueNalu is also joining the building boom. The San Diego maker of cell-cultured bluefin tuna expects it will be able to grow about six million pounds of seafood products annually utilizing eight 100,000-liter bioreactors. The company would not disclose the location of the plant but expects to start production in the 140,000 sq. ft plant by 2027. So far, BlueNalu has raised $84.6 million to-date.

In December, Israeli cell-cultivated company Believer Meats (formerly Future Meat Technologies) broke ground on its 200,000 square foot production plant in Wilson County, North Carolina. The $123.35 million project is expected to produce at least 22 million pounds of product.

All of these come as another player in the space, New Age Eats (rebranded from New Age Meats), abruptly announced on LinkedIn last month that it was selling its 20,000 sq. ft. pilot manufacturing facility in Alameda, California. As recent as October 2021, the company had secured $25 million to fuel its growth strategy.

What It Takes To Build A Commercial Cultivated Meat Plant

Funding custom-built food manufacturing facilities does not come cheap. Most cultivated meat companies have been tapping venture capital firms and sustainability-minded investor groups for years: According to alt-protein nonprofit organization the Good Food Institute, between 2016 and 2021, cultivated meat and seafood startups raised a total of $1.93 billion, with $1.38 billion coming in 2021 alone.

“Future demand for cultivated meat over the next two years is unpredictable and the initial production will be limited in pilot plants,” GFI’s senior scientist for bioprocessing Faraz Harsini told NOSH. “The industry is still in its early stages and various elements, such as government regulations, consumer understanding and acceptance, and technological advancements, may affect its growth.”

For the larger cultivated protein companies, starting early on building large-scale commercial facilities is necessary because supply chains are still stretched for basic materials like the steel used to make custom-built bioreactors.

Additionally, Industrial-scale production using larger bioreactors will incur massive energy costs. In a 2021 life cycle assessment, GFI Europe highlighted the importance of finding reusable and sustainable sources of electricity to keep costs down and ensure cultivated meat products stay on message as an environmentally friendly alternative to conventional meat.

“You can’t turn on a switch and suddenly be producing tens of millions of pounds [of cultivated meat],” said Yossi Quint, founder and CEO of bioreactor manufacturer Ark Biotech.

Quint’s company is one of the few bioreactor manufacturers focused on building solely for the cultivated meat space. Most cell-cultivated companies have thus far almost exclusively deployed smaller 1,000 to 25,000 liter bioreactors used in the pharmaceutical industry.

The construction lead time for an industrial-scale, custom bioreactor can take anywhere from six to 18 months, not accounting for the other factors – site location, building permits, infrastructure construction – that go into building a food manufacturing facility.

Yet a million-liter bioreactor is likely 90% cheaper than a 25,000 liter bioreactor due to the fixed cost of goods, Quint claimed.: “When you think about the depreciation and entering the cost of goods sold, having a bigger bioreactor is a cost advantage, if you are really trying to compete with commodity meat,” he said.t.”

On the other side, investors may be hesitant to expend capital before having more information on the regulatory process, he added. Wildtype, a San Francisco-based cultivated seafood company specializing in cell-cultured salmon, is currently building a 13,000 sq. ft. space in San Francisco, but it is not planning to move into a large commercial plant until it has “work out all of the kinks in production” in order to “inform the design of a larger facility,” CEO Justin Kolbeck said.

Building production capacity will help fledgling brands address one of the key challenges to category-wide growth in cell-cultivated meats: directly competing with conventional meat in terms of price and scale.

“This is large scale food manufacturing, much more analogous to a Mondelez Oreo factory than to a lab at MIT,” said Steven Finn, co-founder and co-managing partner at Siddhi Capital, an investor in cultivated companies like BlueNalu, SciFi Foods and New Age Meats. “Lab grown meat is a science experiment [whereas] the cultivated meat of the future is a manufacturing problem.”

According to Finn, cultivated meat needs to move production into larger facilities in order to message to consumers that these products are not a whole lot different than the animal-based meat and seafood they are used to.

Taking Cues From Other Alt-Proteins

Cultivated meat companies may be fearful that once regulatory approval is cleared – considered a question of “when” not “if” by nearly all companies involved – demand will quickly ramp up.

The rush to build out capacity might stem in part from watching the challenges in plant-based meat.

One lesson is that there might be opportunities for companies with scale to become co-manufacturers for other brands. Motif Foodworks, the food tech ingredient maker spun off from Ginkgo Bioworks, announced last week that it would be offering its bioprocessing services to alt protein companies looking to scale -up as a result of Motif opening the doors to its second production facility.

The “technology agnostic, substrate agnostic” company (meaning it works across the novel protein production processes from plant-based to microbial fermentation to cell-cultivated) will use its new 65,000 sq. ft. to collaborate with emerging brands in the space and help them scale.

Motif CEO Michael Leonard sees the urgency of some cultivated meat companies to scale quickly as a response to the conversations around unit economics.

Three to five years ago, he argued, a novel product that people would pay higher prices for was considered less risky. Because cell-cultivated meat is more capital intensive, and now that investment dollars are becoming harder to come by, tech-heavy alt meat companies are trying to show what price structures are possible earlier in the process.

Mycelium-based plant meat brand Meati is one plant-based brand that took its time building a base of consumers online through small-batch releases of its products. Last month, it took a big step into commercially scaling operations with the opening of its 100,000 sq. ft. “Mega Ranch” production facility in Thornton, Colorado. Meati netted $150 million last summer bringing its total funding to about $277 million to help fund the project.

In December, precision fermentation startup Liberation Labs closed a $20 million seed round, led by Siddhi Capital and serial alt meat investor group Agronomics, to construct the “first purpose-built commercial-scale precision fermentation plant in the United States. The company is projecting its Richmond, Indiana facility to be 30% to 50% more cost-effective than current precision fermentation ingredient producers when it goes online by the end of 2024. It will have a 600,000 liter capacity used to service alt dairy and protein companies.

Even considering the company’s ambitions, Finn noted that Liberation Labs’ co-manufacturing model is what drew him to investing and could be a relevant example for startups to protect themselves as they step forward into this new market.

“In my opinion, I wouldn’t put a whole bunch of equity dollars behind tech that was not de-risked,” Finn said. “I think it’s in a [cultivated] company’s best interest to direct the science elsewhere with partners, and then maybe build a facility or maybe not.”