The Pandemic Boosted E-Commerce, What Happens Now?

Last Tuesday, Shopify announced that it was laying off 10% of its workforce – about 1,000 employees from mostly recruiting, support and sales divisions. In March, unicorn grocery delivery company Instacart revised its valuation down 40% from $39 billion to $24 billion. This all comes after a wave of grocery delivery tech companies have reduced or abandoned operations in many cities as consumers returned to pre-pandemic shopping habits.

After being hailed as the future of the industry (way back in 2020), a confluence of factors sees e-commerce in a very different space now. Record inflation has ballooned prices for goods and services across the CPG industry, fear of an oncoming recession has pulled back consumer spending and an uptick in traditional retail shopping has left many digital shopping platforms reckoning with their exponential pace of growth. For D2C-first food and beverage companies, the change could have long-term reverberations on how they strategize and reach consumers online.

Is this the tipping point for e-commerce platforms?

Recent events might suggest so, but the outlook is far from clear. Most e-commerce industry experts agree that the general downturn for the space is a result of service platform companies like Shopify – along with delivery competitors like Instacart, Getir and Gorillas – growing too fast.

“Shopify is dealing with self-inflicted wounds,” industry consultant Brittain Ladd told BevNET. “They hired too many people, they invested in certain areas of the company that they shouldn’t. And so really what’s going on at Shopify is they’re basically rebalancing the company to be more in line with what’s the actual behavior of the customer.”

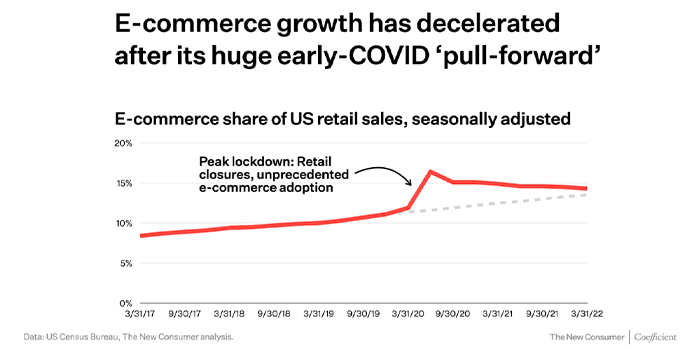

While those platforms have kept scaling, consumer buying trends haven’t changed dramatically, but they’ve slowed relative to the exponential growth from the early days of the pandemic.

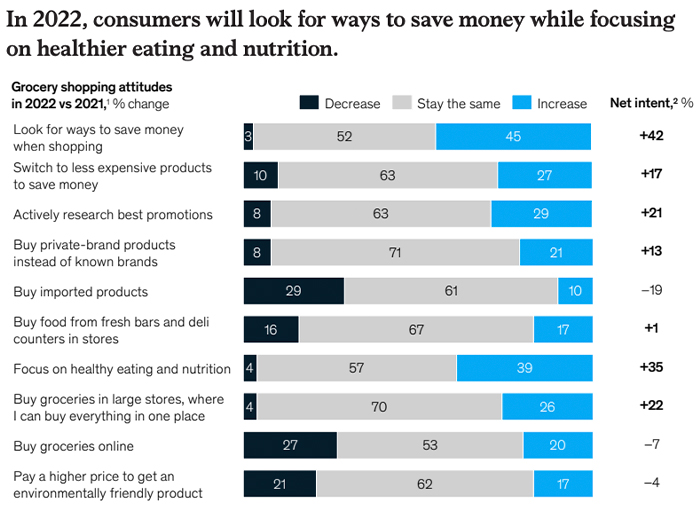

According to a McKinsey & Co. report, safety and convenience is less important to online shoppers than during the height of the pandemic, with comparisons, assortment and personalized promotions now taking precedence. Record inflation in the first half of 2022 has also forced e-commerce platforms to offer more competitive prices to attract new customers.

Meanwhile, the digital marketplace has grown and larger retailers have expanded their online presence. That means digital native brands have been forced to reevaluate the best course of action for getting products to customers.

Ladd has one piece of advice for his clients in the food and beverage sector: “Sell everywhere. Deliver anywhere.”

Micro-fulfillment companies like Davinci or Ware2Go (a UPS company) help D2C brands get products to consumers in a more timely and cost-effective manner than traditional mail. Although many start with a D2C-first strategy, a brand’s ability to diversify across retail and e-commerce channels is one of the most important qualities that a small, up-and-coming CPG business can have, Ladd said.

This is not always an easy prospect – especially for beverage brands. For RTD latte company Taika, diversifying from its roots as a D2C-led company was a process but has opened up opportunities for repeat business.

“We’re scaling through retail because scaling through D2C as a beverage brand in some cases doesn’t make sense. D2C is not something that we can rely on exclusively to grow,” said Taika founder Michael Sharon. The big shift was to lean into Taika’s wholesale business and make sure that people could pick up its product in whichever way they needed.

For many small food and beverage brands, D2C can only move the needle so far. It is a great way to introduce consumers to a product but it is hard to reach a broader customer base with solely a D2C strategy.

According to a survey by Coefficient Capital, e-commerce sales spiked in the middle of 2020 to over 15% of retail sales and have been steadily decelerating back to the pre-pandemic trajectory ever since.

Social media has opened smaller CPG brands to targeted marketing but TikTok cannot be the only way to drive trial. In-store sampling has always been a way to gain visibility and brands are returning to old tactics as consumers return to stores.

But convenience and economics are really some of the main drivers of the shift in the e-commerce space, said Chelsea Jones, co-CEO of digital marketing consultancy company Chelsea and Rachel Co.

“It’s more back to the buying behavior,” she said. “It is more like, what’s convenient for me, what do I really need, what do I not want?”

As inflation and fear of a recession pull back disposable income, consumers find ways to get the products they want in less cost-prohibitive ways.

“Discretionary income is the threshold of having food delivered or the convenience of grocery delivery,” said Jones’ business partner Rachel Saul.

The Economics of D2C Brands Has Changed

Consumers have become more discerning not just about price, but about how and when they receive the products they buy. But companies are facing similar decisions. Thanks in part to spiraling freight and fulfillment costs, brands are pulling back on their D2C business because the “cost to serve” both internally and through third-party distributors online has become more expensive, said Betsy McGinn, founder of e-commerce consulting company McGinn eComm.

Conversion rates for food and beverage brands have not changed dramatically during the pandemic, at about 2.5% to 3%, according to McGinn. “That means that you have to invest a lot of money on paid media and other tactics to get people to the store on your website and then convert them.”

Both from a growth standpoint and a cost standpoint, CPG food and beverage brands are struggling to make D2C the most profitable part of their business. Customer acquisition has become more expensive as more players coming into the space means more competition for views and conversion rates.

E-commerce has become so complicated and competitive that the need to outsource parts of a CPG company’s operations – to specialists on everything from digital advertising to growth optimization geared toward different platforms – has become necessary but expensive.

These outside expenses might be cost prohibitive and small scrappy brands are finding ways to do this work themselves, McGinn said.

But even those scrappy brands are facing increases in costs for do-it-yourself services, thanks to both demand and inflation. Brand consultant and investor Nik Sharma said that he has seen the costs of management software, like email and SMS marketing platform Klaviyo, go up as well.

“Klaviyo is sometimes the most expensive cost in somebody’s entire direct-to-consumer stack, which is insane,” he said.

These costs impact how a brand markets its product, making it more cost-effective to diversify distribution to more ingrained channels like Amazon. Sharma remembers that a couple years ago, some D2C brands avoided going to Amazon because there was less access to consumer data – “but now, you can really unlock a great revenue stream if you can play the Amazon game right,” he noted.

In the short term, if they play the Amazon game, and others, to win, most D2C food and beverage brands will not be impacted too much by the contraction in e-commerce platforms. Some Shopify users might see slightly less support from the back end of the platform, but most industry experts think that the impact will be minimal for food and beverage brands.

If anything, it could put more emphasis on how a D2C company communicates with its customers and what kinds of promotions it offers to keep engaged with its consumer base.

“It’s so important for CPG brands to actually recognize what tools they have and to do a bit of an audit of their D2C component,” Chelsea Jones said. “I almost challenge food and beverage in particular, on how they can simplify and how they can get back to the basics of really engaging with their customers more on that D2C level.”