The Checkout: FDA Petitioned For Front-of-Pack Nutrition Labeling; Stryve Reports Record High Revenues Despite “Execution Challenges”

Welcome to The Checkout: an express lane for the weekly news you need to know, always 10 items or less.

FDA Pressure For Health-related Food Labels Heats Up

The Center for Science for the Public Interest (CSPI) filed a regulatory petition with the Food and Drug Administration (FDA) earlier this month urging the agency to establish mandatory front-of-pack nutrient-related labels. The move comes after the FDA announced in March it had taken preliminary steps toward drafting guidance to define claims like “healthy” and “natural” on food packaging.

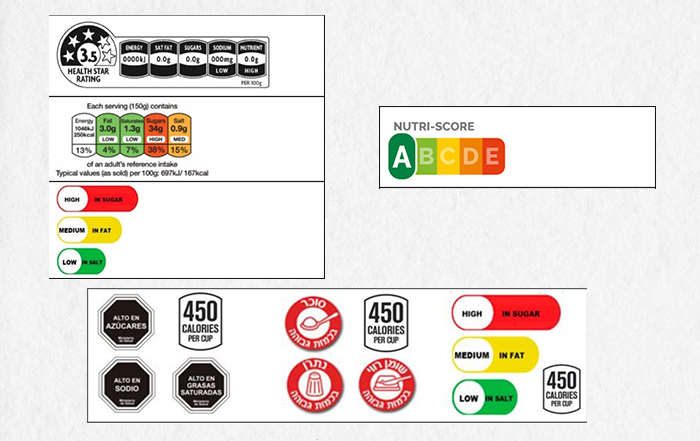

According to the petition, CSPI believes the FDA needs to establish a mandatory, easy-to-understand, standardized and nutrient-specific system that includes calorie information, levels of added sugars, sodium and saturated fat per serving on the front of all food packages. The group cited various similar systems that have been enacted internationally including the nutri-score system in the European Union and the stoplight system in Ecuador.

“There is a pressing need for novel interventions to improve diet quality of the U.S. population. FDA has the authority to implement mandatory, interpretive, nutrient-specific [front-of-pack nutrient labels]. Evidence shows that such a system could improve diets and promote equitable access to nutrition information,” the petition reads. “Although both nutrient warnings and traffic light labels meet these criteria, we emphasize again that nutrient warnings appear to have superior efficacy at improving diets and are therefore more likely to improve population health.”

CSPI also stated that it found the Nutrition Facts panel has low consumer utilization and the current voluntary “Food Up Front” program has not led to “adequate” information or influence over consumer behavior. The center emphasized that the FDA should consider the systems that have been effective internationally as it looks to develop a system for the U.S. consumer.

Stryve Reports Record High Revenues Despite “Execution Challenges”

Snack platform Stryve reported gross revenues of $14.8 million, nearly double compared to the same period last year, but negative gross profit margins of $4.4 million contributed to less than favorable results overall during Q2. The company’s new CEO Chris Boever said the decline is largely due to short term challenges including supply chain issues and rising input costs as well as unfavorable price/mix across its larger retailer accounts.

Boever, who took the helm about two months ago, announced during a call with investors this week that the company will be restructured to simplify the organization and product portfolio as well as introduce an initiative to target cost discipline and project management. He said this plan is already underway, with roles and responsibilities being clarified to create “a culture of accountability” that drives productivity.

“We believe that our path to profitability, in conjunction with the restructuring plan, is expected to dramatically change the trajectory, with the goal of reaching profitability during the first half of 2023,” affirmed CFO Alex Hawkins on a call with investors. “We understand that the second quarter financial results and execution challenges were painful; however, the experience did provide us with fantastic household penetration with our target consumers and their response gives us great confidence in the broad appeal and consumer attractiveness of our [portfolio].

Stryve has also decreased its full year guidance from $35 million to $37 million to “ensure sustainable, quality sales and margins.” Additionally, Hawkins announced the company is under a letter of intent to secure $20 million of non-dilutive funding to support its momentum toward healthier margins and increased productivity as it aims to achieve profitability by next year.

Fermented Food Holdings Acquires Great Lakes Kraut Foods Sauerkraut Business

Fermented Food Holdings (FFH), a holding company for brands including wildbrine and Bubbies, has added another distilled business to its roster, announcing the acquisition of Great Lakes Kraut (GLK) Foods earlier this week.

The deal will join GLK’s sauerkraut brands and supply chain capabilities, including procurement, packaging solutions, and distribution, with FFH’s premium fermented foods portfolio. GLK serves as the parent company to four sauerkraut brands: Silver Floss Kraut, Flanagan, Cortland Valley Kraut and Saverne Kraut. The company also makes a pickled veggie line known as Oh Snap!

“We are encouraged by the results from the other brands in our portfolio, Bubbies and wildbrine, after integrating our traditional CPG discipline with the entrepreneurial teams in those great businesses,” said Oliver Joost, FFH co-president, in a press release. “We believe that the acquisition of GLK’s sauerkraut business will add critical supply chain capabilities and distribution reach to unlock our next chapter of growth.”

“FFH has a vibrant portfolio of brands to add to those of the GLK sauerkraut business and offers a business approach that will be an excellent fit for a business that has been family-owned for four generations,” added GLK president Ryan Downs, in the release.

USDA: Demand for Honey Reaches “All Time High”

A recent Sugar and Sweeteners Outlook report, published by the United States Department of Agriculture (USDA) earlier this week revealed that honey and made-with-honey products consumption totaled 618 million pounds last year. Previously, the highest recorded consumption was 596 million pounds in 2017.

“We are thrilled to see the results of this study,” said Margaret Lombard, CEO of the National Honey Board, in a press release. “It means that consumers are beginning to understand when you choose honey you are not only getting a perfect all-natural sweetener, but you are supporting honey bees and beekeepers who help to feed the world.”

According to the USDA, the increased rate of consumption comes as demand for “healthy sweeteners” continues to rise, combined with growing consumer perception of honey as a superfood.