GFI: Alt-Protein Fermentation Tech Ramps Up With Sights Set On Eggs and Seafood

Fermentation has become a buzzword within food, especially in the crowded alternative protein space as dozens of new companies enter the space, rapidly scale production capabilities and bring a range of new categories into the fold.

During The Good Food Institute’s State of the Industry presentation on fermentation-enabled meat, seafood, eggs, and dairy yesterday, panelists broke down multiple areas of interest including investments, tech innovations and regulatory progress while highlighting its potential to create viable climate solutions over the long term.

What is alt-protein fermentation?

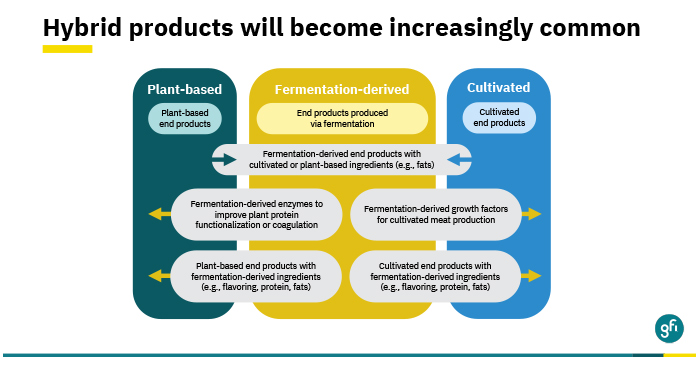

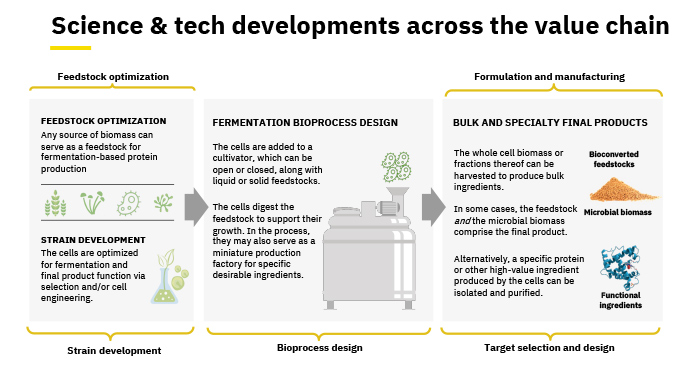

Fermentation isn’t a new concept, but applying the process of cell reproduction to animal proteins, or to replicate those proteins with plant structures, is the primary approach used by food tech startups looking for industrial agriculture alternatives. The two main methods that have emerged within the industry are precision fermentation, which is mainly used by dairy-replicating companies, and biomass fermentation, primarily used by animal-free meat companies.

The technology is being used to create everything from bee-free honey (MeliBio) to animal-free salmon and scallops (Cultured Decadence, now Upside Foods). According to GFI, over the past year egg alternatives and seafood have led growth within the segment.

While seafood and eggs emerge, animal-free meat continues to lead with companies like Myco tech and The EVERY Company at the forefront of both investments and innovations. Late last year The EVERY Company, which also produces animal free protein ingredients, debuted the first animal-free egg white product in a co-branded protein smoothie with juice maker Pressed. The launch was especially novel due to the company’s ability to not only replicate “key functionality requirements” but also the dozens of different kinds of proteins naturally found in eggs, according to GFI.

Creating a sustainable food system has emerged as the common mission between these companies and processes like upcycling to enable a deeper climate impact. For example, Anehuser Busch INBev activated a partnership with ingredient supplier EverGrain to turn spent barely into protein sources.

What’s next?

Fermentation companies have made headlines over the past year for high value capital raises totaling upwards of $11 billion industry wide. According to GFI, protein fermentation accounted for over one third of total investments in the alternative protein space last year, comparatively, it represented 20% of deals in 2020.

“This recognition of alternative proteins as climate tech and the growth we’ve seen in fermentation investments and in alternative protein investments broadly, is impressive.” said Sharyn Murray, GFI’s senior investment engagement specialist. “It’s worth noting that investments and alternative proteins remain really a minuscule fraction of the trillions of dollars that we’ve been investing globally in climate tech companies.”

Murray noted the expenses of creating fermented proteins are significantly higher than other plant-based protein production, however she also cited the uptick in deals as proof that both startups and industry stakeholders see opportunity within the space.

However, alt-protein fermenters first need to overcome the regulatory barriers that currently restrict widespread commercialization of these products.

The FDA is in charge of regulating production of fermented animal-protein alternatives and companies can gain approval by either submitting a food additive petition or by applying for GRAS certification. The latter method has been used by companies like Impossible Foods and Motif Foodworks for heme proteins; however, the process itself is still fairly complicated.

“FDA doesn’t generally approve or deny products but rather responds either that there’s not enough information available yet to determine that the product is GRAS, or it issues what’s called a no questions letter, saying the FDA doesn’t question the company’s conclusion that the product is GRAS,” explained regulatory attorney Madeline Cohen. “Although that’s not a formal approval from FDA, it’s usually an indication that the product can move forward.”

Currently there is no regulation on labeling, but the FDA and USDA decided in 2020 they would draft joint guidance for the industry. While a draft is expected for alternative dairy products this year, guidance for meat and other products is not yet in the works. But, according to GFI, companies within the space have reached an unofficial consensus to use the term animal-free.