Real Good Foods Announces IPO

This week, frozen food brands Real Good Foods filed with the Securities and Exchange Commission (SEC) SEC to undergo an initial public offering. The company is seeking to raise $86.25 million in order to expand its distribution and capacity at a new manufacturing facility.

What Does Real Good Foods Make?

Founded in 2016, Real Good Food produces frozen entrees, sandwiches, appetizers and desserts that cater to consumers looking for convenient, better-for-you comfort foods. Positioned to serve consumer interest in low-carbohydrate, high-protein options, the company’s offerings are gluten-free and grain-free, swapping traditional ingredients for either a base of chicken and parmesan cheese or plant-based proteins and fibers. As a result, some of its offerings have four times less carbohydrates than the competition with twice as much protein.

There’s a real consumer need, the company said in its prospectus, to develop these better-for-you options, noting that 13% and 42% of the U.S. adult population suffers from diabetes and obesity, respectively.

“The purpose of our company is to fulfill our mission of making craveable, nutritious [health and wellness] foods accessible to consumers while taking an uncompromising approach to the creation of products that are delicious, convenient, and have broad appeal,” the filing states. “We hope to create products that allow consumers to enjoy more of their favorite foods and, by doing so, Iive better lives as part of a healthier lifestyle.”

There’s also a financial incentive. According to Real Good Food, the U.S. health and wellness industry is valued at $170 billion. Meanwhile, in the frozen aisle, Real Good Foods’ two core, strategic growth subcategories are frozen entrée and breakfast — which, according to SPINS data in the prospectus, comprised 48% of the approximately $58 billion U.S. frozen food category (excluding frozen and refrigerated meat) during the year ended December 2020.

What Does the Company’s Business Look Like?

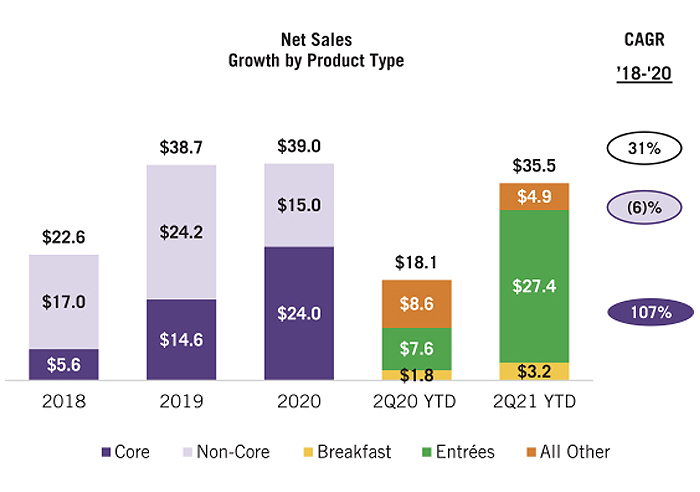

During the six months ending June 30, 2020 and 2021, the company had net sales of $18.1 million and $35.5 million, respectively.

Historically, the SEC filing notes, the company has sold the majority of its products under the Realgood Foods Co brand, with a few “select” private label products as well. For the 12weeks period ending June 13, the company’s branded products had an average of approximately 170,000 “total distribution points” across the United States — with distribution points defined at the sum of the number of stores selling each SKU. Comparatively, the company noted, other leading health and wellness brands within the frozen food category had total distribution points over 930,000 during the same period.

The brand’s products are sold primarily in natural and conventional grocery, drug, club, and mass merchandise stores, with an average all-commodity volume (ACV) of approximately 20%, as of June 13. The company’s largest retail clients are Walmart, Kroger and Costco — in 2020 these three retailers accounted for 28%, 17% and 12%, respectively, of net sales for a total of 57% of the company’s net sales (a drop of 9% from 2019).

Still, despite the company’s efforts, the filing notes it has experienced net losses every period since its inception. In 2019 the company had net losses of $14.2 million and in 2020 net losses of $15.6 million.

The Covid-19 pandemic has been part of the reason for these losses. On the product front, while a key driver of sales was previously the company’s line of frozen pizzas, the better-for-you pizza subcategory saw a drop in sales during the pandemic. Sales issues were compounded by financial difficulties by one of the company’s co-packers, “which negatively impacted our ability to produce enough products to meet demand and resulted in lower net sales.”

Additionally, many retailers cancelled or delayed category resets and reviews during the pandemic, resulting in slower sales growth.

In response to these issues, in March 2020 the company “temporarily reduced” its overall headcount in marketing, accounting and operations by ten employees. While these efforts allowed the company to preserve capital, the cuts in operations, the filing notes, also “had a negative impact on our ability to grow our net sales.”

What’s Unique About its Marketing?

Real Good Foods claims it has the largest social media following of any brand within the frozen food category today, with roughly 365,000 Instagram followers alone as of the end of June. For comparison, the company notes, that’s more Instagram followers than the top seven selling health and wellness frozen food brands (Amy’s Kitchen, Applegate Farms, California Pizza Kitchen, InnovAsian Cuisine, Aidells, Michael Angelos, and Perdue) combined. But it goes beyond sheer volume: with the filing also noting the company has higher engagement on each post.

A strong social media presence has benefitted the brand by allowing the company to decrease costs associated with traditional media and advertising spend. Instead, the filing notes, the company has “direct, authentic conversations” with its consumers via social media, SMS text, email and through social media influencers.

“Through this approach to community engagement, we are able to build brand trust and, in turn, loyalty, which efficiently draws new consumers to our brand, provides a forum for real-time feedback, and allows us to understand our diverse population of consumers more deeply,” the filing notes. “We also believe our extensive community engagement resonates with our retail customers, leading to additional shelf space and distribution points for our products.

What Does R&D and Production Look Like?

Real Good Foods develops most of its products in fewer than six months, with product concepts first conceived by the company’s marketing team and then tested via what the company calls its RDF Labs — a select, diverse group of customers that have opted to try new items. This process not only allows the company to iterate quicker than using traditional research methods but also, it states in the filing, gather “more helpful” information and ultimately “introduce new products with higher confidence of market acceptance.” Most products are also first released on the brand’s website, before the company invests in pursuing retail distribution.

“This process provides us another opportunity to marry our products to our consumers’ preferences, as our most avid consumers engage with our products through this channel and provide additional feedback,” the filing notes. “This disciplined approach to product development has resulted in a market acceptance rate higher than industry standard by the time our new products arrive in retail channels. As a result, we believe our concept-to-shelf product innovation is often more efficient and successful compared to conventional brands within our category.

In March, the company also acquired the manufacturing facility of its former copakcer, shifting more of its production (which the company says requires specialized process and equipment) in-house. As of June, the company was producing more than 70% of its products at its California plant.

What’s the Future Hold?

First up, the company noted, it will focus on increasing its total distribution points and its velocities with existing customers as well as continuing to grow brand awareness. In terms of product innovation, the company will seek to expand into “multiple adjacent food categories within and outside of frozen,” via innovation or acquisitions.

The move to more self-manufacturing will also benefit the company long term, it believes, by improving gross margins and quality control. Future investment into the production equipment and automation will only “increase efficiencies and reduce labor costs.”

Though the company notes it certainly has room to expand its distribution and ACV, executives believe that growing consumer interest in eating healthy will only increase the number of retailers willing to add Real Good Food products to their shelves.

“Retailers tend to favor brands that bring new consumers to categories, and we believe our ability to attract new H&W consumers to our customers’ stores and online marketplaces presents a compelling opportunity for our customers to expand our existing shelf space,” the filing notes. “Further, as we continue to develop innovative products and build brand equity, we believe we can grow our distribution points and achieve penetration levels that rival those of leading [health and wellness] brands in the frozen food category.”