Plant-Based Food Market Valued at $7 Billion After “Breakout Year”

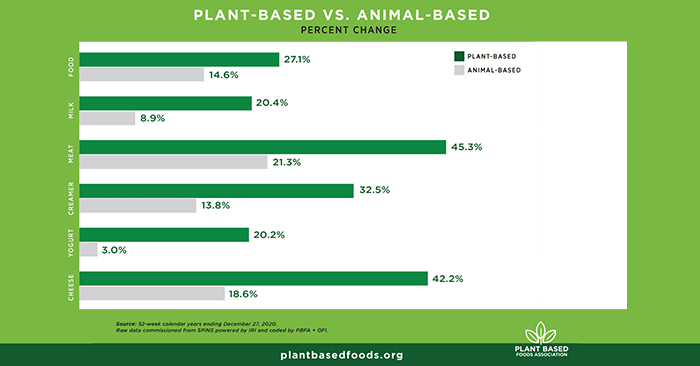

Plant-based foods are continuing to take a bite out of the U.S. retail food market, with sales up 27% to $7 billion in 2020, nearly double the growth of the total U.S. retail food market, according to a new report from the Plant Based Food Association and the Good Food Institute. Examining a significant year for the category, the report identifies leading segments like milk and meat alternatives gaining share in markets dominated by their animal-based counterparts, while also highlighting emerging segments rising in popularity such as yogurt, cheese and eggs.

The retail data, which was commissioned from SPINS, reflects a “fundamental shift” in consumer behavior as shoppers increasingly incorporate plant-based food into their diets, noted Julie Emmett, PBFA senior director of retail partnerships. In 2020, 57% of U.S. households, totaling over 71 million households, purchased plant-based foods, up from 53% in 2019. Growth in plant-based food purchasing was largely consistent across every U.S. census region.

Plant-Based Milk and Meat Lead Growth

Kyle Gaan, GFI research analyst, said 2020 was a “breakout year” for plant-based foods across categories, and for meat and milk alternatives in particular.

“The incredible growth we saw in plant-based foods overall, particularly plant-based meat, surpassed our expectations and is a clear sign of where consumer appetites are heading,” he said. “Almost 40% of households now have plant-based milk in their fridge, and at this rate, it won’t be long until we see just as many households purchasing plant-based meat.”

Plant-based milk was the largest plant-based food category in terms of sales, bringing in $2.5 billion last year, up 20.4% from 2019 and now accounting for 35% of the plant-based food market. Plant-based milk sales grew twice as fast as cow’s milk last year, and now make up 15% of the milk category. The segment has an even larger presence in natural retailers, where it accounts 45% of the milk category’s sales. Almond milk is the category leader, bringing in two-thirds of total sales, followed by oat milk and soy milk.

With $1.4 billion in sales last year, plant-based meat saw 45.3% growth in 2020, growing twice as fast as conventional meat, and now accounting for 2.7% of retail packaged meat sales. The report noted that 18% of U.S. households are now purchasing plant-based meat and 63% of shoppers are high-repeat customers.

Placement of plant-based meat alongside conventional meat in refrigerated aisles at retailers has significantly contributed to the segment’s growth, the report noted. Refrigerated meat sales grew 75% in 2020, compared to frozen sales, which had a 30% increase.

Plant-based seafood is also a notable emerging segment, with brands like Good Catch garnering notable investment and distribution in 2020. The segment grew 23% in 2020, bringing in $12 million in sales.

Other Plant-Based Categories Gain Traction

Beyond meat and milk, several other plant-based categories gained momentum in 2020. As brands like Nutpods grew their portfolio and distribution, plant-based creamer sales were up 33%, now accounting for 6% of the creamer category. Yogurt sales increased 20%, significantly outpacing dairy yogurt, whose sales saw just a 3% uptick last year. Plant-based cheese brought in $270 million in sales in 2020, up 42.5%, and grew over twice as fast as animal-based cheese last year as plant-based cheese makers such as Daiya and Miyoko’s continue to gain traction.

As JUST Egg expanded distribution to 20,000 retailers last year, plant-based eggs saw 168% growth, the largest growth percentage of all plant-based categories, with $27 million in sales.

Plant-based frozen meals are now a $520 million segment, and its 29% sales growth outpaced total frozen food growth by 8%. Sales of plant-based ice cream and frozen novelties were up 20%, to $435 million, while spreads, dips and sauces saw an 83.4% sales increase.

Driving Future Growth

The onset of the COVID-19 pandemic gave the plant-based category a significant boost, but the trend toward plant-based shopping was already seeing a surge before the pandemic, the report noted, with consumer interest in health, sustainability and the improvement of animal welfare already high.

While retailers may have previously considered the plant-based shopper to be a smaller percentage of its demographic, SPINS head of retail Dawn Valandingham said the category has “evolved to the point that retailers can’t limit who they consider the plant-based shopper” and retailers should market these products more broadly.

“They should now assume everyone is a potential plant-based buyer and educate them enough to see the possibilities,” she said. “Between the innovation in plant-based products and the gradual return to less restrictive shopping measures, 2021 offers many opportunities for retailers to appeal to more customers and expand their plant-based offerings.”