Little Secrets Founder/CEO Departs as Company Announces Low-Sugar Line

Chocolate company Little Secrets has announced that its founder and CEO Chris Mears will depart the brand, with president and COO Jeremy Vandervoet taking on the role. The company also said it plans to launch a low sugar line as it evolves beyond its core focus on indulgent products.

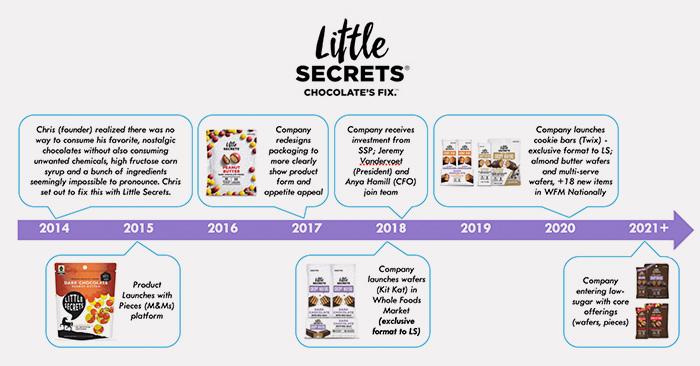

Mears founded the company roughly six years ago after serving as an early employee at both Bear Naked and Evol frozen foods. In 2018 investment group Sunrise Strategic acquired the majority of the company and Vandervoet came aboard, alongside CFO Anya Hamil. Since then, Mears has focused on sales and business development, while Vandervoet has taken responsibility for operations and marketing.

In the near term, Mears will remain as an advisor to the company, especially as it looks to bring on new sales talent. He continues to personally be a minority shareholder, in addition to venture firm Revelry Brands. Mears told NOSH that he felt it was simply time to move onto a new role, noting that Little Secrets represents his longest tenure at any one company.

“I’m probably that guy that comes in with the white sheet of paper and gets it to national distribution and helps build out the team and then I start getting hungry for something else,” Mears said. “I’m not sure what I want to do. I feel like I’m jumping off a cliff and we’ll see where I land… I came to the realization that you can love a business, and you can love a team and you can still want to do other things.”

Under Mears’ tenure, the company has evolved in terms of its packaging and products. Launching with a line of candy covered chocolate pieces sold in natural and conventional retailers, the company found greater success over the last year when it launched new products of Wafers and Cookie Bars and reduced its focus to the natural channel. In a December interview, Mears said the new products reinforced the brand’s promise of “better takes of classic favorites,” such as Kit Kats, Twix and M&M’s.

The plan paid off, with Whole Foods now representing the company’s largest customer — though Sprouts, Natural Grocers and The Fresh Market are also seeing traction — and the brand becoming the 12th highest grossing confection brand in the retailer. For the 52 weeks ending March 15, 2020, the brand had $3.3 million in sales at Whole Foods alone. During the Covid-19 pandemic, which has negatively impacted the sales of impulse or single serve items, Little Secrets sales have remained above the category average, with 30-65% growth, depending on the retailer.

However, there’s more room to run, Vandervoet said, and so the company plans to launch a new lower sugar line in the coming months. Though details are still being finalized, the sub-brand will tentatively be called Little Secrets Little Sugar and consist of dark chocolate pieces and wafers.

Each serving will have roughly 3 grams of sugar — current products can have up to 26 grams of sugar per serving — achieved by using a combination of stevia, erythritol and fibers, depending on the product. Although Allulose remains a buzzy new ingredient in the gummy and hard candy side of confection, the sweetener does not work well in chocolate and is currently banned by Whole Foods, Vandervoet said.

The move into lower sugar could be seen as a departure, in some ways, for a brand that has focused on indulgence. But Vandervoet noted that the emphasis on taste has remained, with no compromise in the new product line.

“This is a taste oriented category. Products that don’t taste good will not last for a long time,” Vandervoet said “Our mission is to create the best tasting version of the classics that we can, and now I’m saying if we can do that for two different consumer segments, I think that’s a winning strategy.”

The company will not become one focused on “diet” items — the new chocolates will not, for example, fit keto guidelines — because diets come and go, Vandervoet said. The brand will try not to be thrown into the “better-for-you” space, because that connotes lack of taste, he added:. instead, it’s about offering a “better take”.

“We aren’t changing our strategy as a brand. We are adapting and being nimble in the marketplace with our tactics,” Vandervoet said. “We have a winning hand with our fully indulgent line… we’re not walking away from that strategy, we’re saying in order to be even more relevant to more consumers, can we create new tactics and products but still have the strategy of taste.”