Honey Mama’s Closes Round As it Seeks “Mainstream” Adoption

Refrigerated chocolate bar brand Honey Mama’s announced this week it has closed a $5.8 million round of funding that will go towards supporting the brand’s expansion beyond the natural channel via sales, marketing and innovation efforts.

The round includes a $1.1 million convertible note closed last year from regional angel investors and Zachary D’Angelo of Rodeo CPG. Food and beverage focused venture firm Amberstone Ventures took the final $4.5 million, which was closed this week. The deal represents Honey Mama’s first institutional capital raise, having previously raised $100,000 in 2014 from friends and family and utilized a few “small” equipment loans.

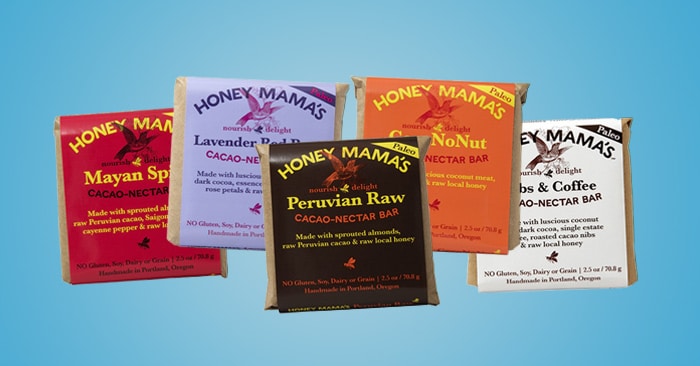

Founded in 2013 by Christy Goldsby, Honey Mama’s sells nine varieties of chilled chocolate bars that are sweetened with honey. The line is made with a limited ingredient list and is free-from soy, eggs, dairy, gluten, and grains. Each 2.5 oz bar retails for between $5 to $6. The brand is currently sold in over 2,000 doors including Natural Grocers, The Fresh Market, Fred Meyers, some regions of Whole Foods Market, Gelson’s and Central Market.

Because of its clean ingredient deck, Honey Mama’s bars straddle the line between wellness and indulgence, Goldsby said, a selling proposition that she thinks can broaden its appeal to conventional shoppers. Focusing first on the natural channel allowed the brand to grow thoughtfully and carefully though, CEO Jared Schwartz added.

“Our internal mission is to be part of the mainstream consideration for confectionery,” he said. “We’ve really realized the opportunity to bring this food to more than just the community it was in and that’s really the impetus behind wanting to raise money — just getting Honey Mama’s into more and more peoples’ lives.”

The brand’s performance in the natural channel also served as proof of concept, especially during the last few months. According to SPINS data cited by Schwartz, during the early months of the Covid-19 pandemic sales of wellness bars were down 45% and chocolate bars down 10%. Yet Honey Mama’s sales were flat or in some cases up 25%.

Amberstone chose to invest, in part, because of the results the brand has seen, even in limited retail.

“[We were] blown away by the reach and consumer resonance of the brand, and how it performs on shelf relative to the category,” Amberstone Managing Partner Alexander Bernstein said. “It is drawing people to the refrigerated bar set, and is driving sales not just in natural [retailers], but in conventional grocery as well.”

Expanding distribution requires a plan of attack, and that task has fallen to Schwartz. Goldsby asked him to take on the CEO role in 2018 and focus on operations, sales and supply chain.

“We brought Jared onto the company to bring an operational element to us that it was really needing,” Goldsby said. “I had outgrown my skill set and ability.”

To support the increased distribution, Schwartz said the company will invest in marketing based on “connecting with new communities” and “developing and fostering” new shoppers. The brand will also focus on its “capacity and efficiency,” which may in turn drive down price. Though Honey Mama’s is known for its hand-wrapped craft paper packaging, a reevaluation of branding is also on the table.

“We are investing in our brand to make it easier for consumers to understand our product and its benefits,” Schwartz said. “[That means that] we will explore optimizations within brand communications as well as product experience.”

Still, theres’ one large hurdle that can’t be solved by the company itself: where the product is merchandised. Most retailers place Honey Mama’s in the dairy case, grab and go case or chilled dessert case, which has led to consumer confusion over where to look.

In addition, sometimes placements may not work simply due to a lack of competition in a set. For example, the brand tested a smaller, lower-priced bar in Trader Joe’s last year. While it saw solid sales growth, being placed among deli items such as luncheon meat was not ideal, Schwartz said. The entrance of large strategics into the chilled snack set, such as Mondelez via its acquisition of Perfect Bar, may prove helpful in encouraging retailers to craft a dedicated set, he added. Though this would also mean more competition, Schwartz and Goldsby think they have a product that is differentiated enough to stand out.

“We’re really a category pioneer of being a wellness bar that tastes like a chocolate bar,” Schwartz said. “[We] offer a consumer an opportunity to be fully enrobed in indulgence but also have those health fixtures that empower their wellbeing.”