How Rev Energy Gum Is Eating Up Ground In Functional Gum

Austin, Texas-based Rev Energy Gum believes the fuel that drove the brand to over 20,000 retail locations in under five years was a perfectly timed combination of product-market fit and a format that flexes for a range of consumer need states.

Founded in 2018 by CEO Blake Settle, alongside Sam Ehlinger, now a quarterback for the Indianapolis Colts, and Reed Burch, COO, the concept for Rev was born when Settle was once a chemistry major at the University of Texas. He had recently been diagnosed with Type-1 Diabetes and struggled to find low-sugar, energy products available for late-night studying.

“I ended up just buying a pack of sugar free gum out of the vending machine and was chewing like seven pieces at a time,” Settle said. “[I thought] as I was chewing them [there had to be] a way to take the caffeine from these energy drinks and coffee and put it into the gum to make a more portable energy solution.”

The brand has been on an upward, explosive growth trajectory since, and according to Settle, Rev’s revenue has grown by nearly 250% on an annual basis since its launch.

Settle and his co-founders started by selling to stores around campus while still in school and eventually got the product into regional c-store chain Buc-ee’s in Texas. This past April it expanded to 4,000 Walmart stores, building on its existing retail partnerships which include Target, Dollar General, 7-Eleven, and Circle K, among others.

Following the Walmart launch, Rev also brought on former Ferrera Group GM of China operations, Matt Herrmann, as the company’s President.

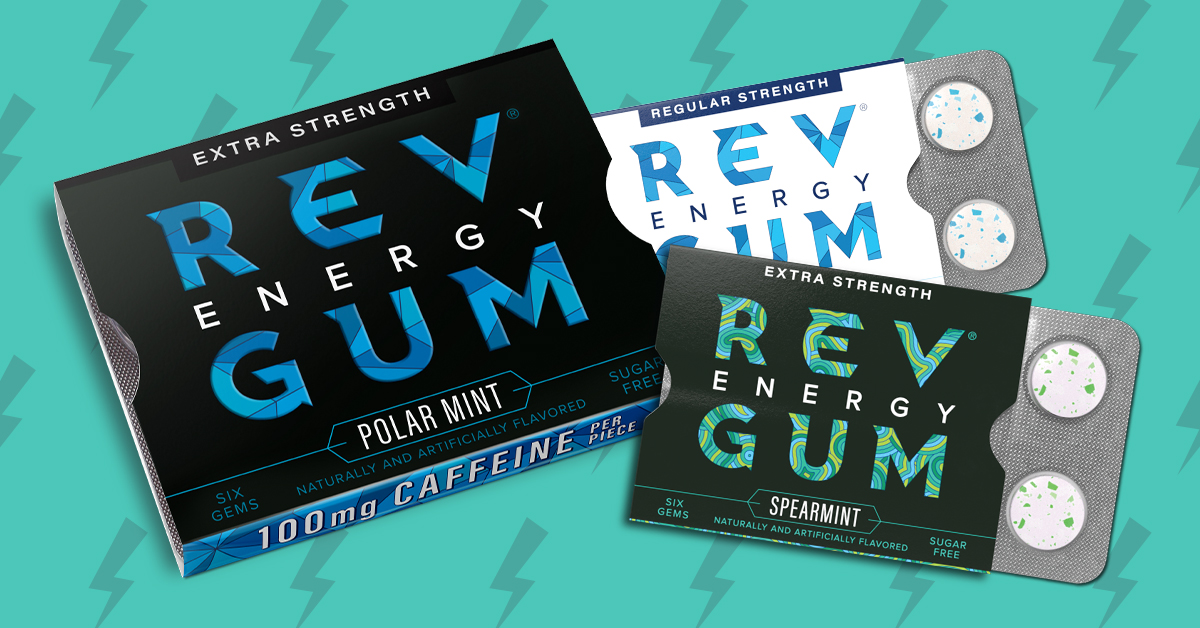

Rev Energy Gum makes two lines – a regular strength (60 mg of caffeine) and an extra strength (100 mg caffeine) – with both available in Spearmint and Polar Mint flavors. The regular strength retails for $2.94 per pack while the Extra Strength costs $3.12 per six-piece pack. The sugar-free gums are produced at its Austin production lab as well as through a network of co-manufacturers.

“For over the past couple of years, it’s been nothing but non-stop production, and that has been a lot of our focus,” said Settle. “But this year, as we use some of the capital to invest in machinery and better processes we’ve gotten ahead of the inventory curve, which has been incredible.”

Rev announced the closing of a $6 million investment round in September, led by YETI Capital; the founders of Drunk Elephant; former co-CEO of Whole Foods, Walter Robb; and award-winning athlete, Lance Armstrong. Settle said each of these investors bring a strategic outlook to the business.

“They’ve all really been on the ground and seen brands being built and have an understanding of what it takes to be a great supplement in the athlete’s world,” said Settle. “A big focus for us was – how do we bring in these characters so they can really contribute and give us a point of view that we don’t have internally, more than a traditional investor that is just writing checks.”

While the product contains small amounts of artificial sweetener aspartame, which came under fire after a new report from the World Health Organization labeled it a “possible carcinogen” earlier this year, Settle said the presence of the ingredient in this product has not caused notable concern among consumers. He noted the volume of aspartame used in a single piece of gum is significantly less than what is found in low sugar beverages like Diet Coke.

“For us, it’s about the balance between the [sugar] alternatives and what [actual sugar] does to your teeth, especially when you think about it in a chewing gum application versus a beverage,” Settle said.

As the company looks to future growth, he said Rev will “stay in its lane” but has its sights set on going deep in the functional gum category. As the team thinks about future innovation it seeks to build a functional product space that lives “outside the cooler” and “outside of liquids.”

He noted that the on-the-go product format has resonated with a broader swath of consumers compared to the male-centric energy drink and shots set, Rev’s consumer base is evenly split between male and female customers.

“We see truck drivers [buying it], not wanting to consume liquids to have to go to the restroom and just depending on what retailer we’re playing in, you see so many different consumers,” he said. “It’s every one from a mom that has to stay up late at night, to a college student that has a night out on the town, to an athlete getting up and going to the gym.”

The global energy gum market was valued at nearly $90 million in 2021 and is expected to grow 8.2% to $192.1 million by 2031. While plenty of other caffeinated gum products already exist, including products from Simply, Alert and Military Energy Gum (MEG), Rev remains one of the only sugar-free offerings available.

Brands like Simply use only natural ingredients including cane sugar and matcha while MEG uses a combination of ingredients including sugar, dextrose, aspartame, corn syrup and artificial colors.

Neuro, a brand that was also started by a group of college students in 2015, is Rev’s closest competitor with zero grams of sugar and distribution in over 10,000 retail doors nationwide. Neuro products also contain L-theanine and B vitamins; the brand has since expanded beyond gum into mints while maintaining its low sugar, functional position.