Expo East: Vision 2030 Reflects on State of Natural

At the final Natural Products Expo East, even the annual State of Natural keynote presentation came with an update.

Dubbed “Vision 2030”, Carlotta Mast, SVP and market leader at New Hope Network, kicked off the annual address by sharing details around Expo’s soon-to-be replacement, Newtopia Now. The Savannah, Georgia-based gathering next August will host a variety of themed “neighborhoods” Mast said, including sections surrounding Regeneration and Representation.

“We’re trying some new things,” Mast said. “There’s a lot of new things I hope you see at this Expo East which plant the seeds for the new event experience that we’re creating.”

But there are a few concepts that are core to all natural product categories, and never quite change – like data, investment, inclusivity and ever-emerging innovation.

During the presentation, industry experts spearheaded these conversations over a 90-minute session that included Kathryn Peters, chief of staff at SPINS; Nick McCoy, managing director and co-founder at Whipstitch Capital; Tina Owens, Sr. fellow of regenerative agriculture at Soil & Climate Alliance (Green America); Vanessa Pham CEO and co-founder of Omsom; Michiel Bakker, VP of global workplace programs at Google; and Jennifer Stojkovic, general partner of Joyful VC and founder of the Vegan Women Summit.

The Natural Products Industry: Year in Review

While natural product sales have slowed year over year, the industry is still notching mid-single digit growth and is set to surpass $300 billion in sales this year – nearly doubling over the course of the past decade.

Natural, organic and functional food and beverage sales increased 8.6% in 2022 to $202 billion, while natural supplement sales decelerated and have been challenged to find new growth opportunities post-pandemic. From a sales channel perspective, ecommerce slowed the most in 2022 while mass market retailers saw a 7.7% uptick in sales, and captured the largest share of natural and organic purchases.

That swap marked the first time in a decade that ecommerce growth was lower than mass market.

Peters said the primary reason why sales growth slowed for natural and specialty retailers was due to lower inflationary pressures in the channel: “I think it really demonstrates the commitment that our retailers and many of our natural products brands have to having keeping prices as affordable as they could,” she stated.

In terms of product, clean label claims are helping items index higher than all other attributes.

“It’s not how many ingredients are in the food, it’s ‘what are those ingredients and do people understand them,” said McCoy.

As brand’s work to build their businesses, profitability will be key for anyone looking for an exit over the next decade. The past two decades saw the emergence of venture capital in the food industry, but now, priorities for large strategics are shifting and McCoy believes CPG conglomerates no longer have an interest in buying into the next big idea unless it comes with a well-balanced balance sheet

“Big strategics are buying companies at larger amounts [in recent years], they can’t scale them 10x in revenue to get them profitable,” McCoy stated.

Although capital is still harder to come by in the current climate, the willingness of PE firms and larger funds to finance mid-market businesses has become an integral piece of the industry in the last decade, McCoy claims, and may be the key to achieving profitability for some looking forward.

The Path Forward?

Vision 2030 also outlined a potential future for the industry that sees plenty of plant-based protein, regenerative ag momentum and a continued push for equitable representation.

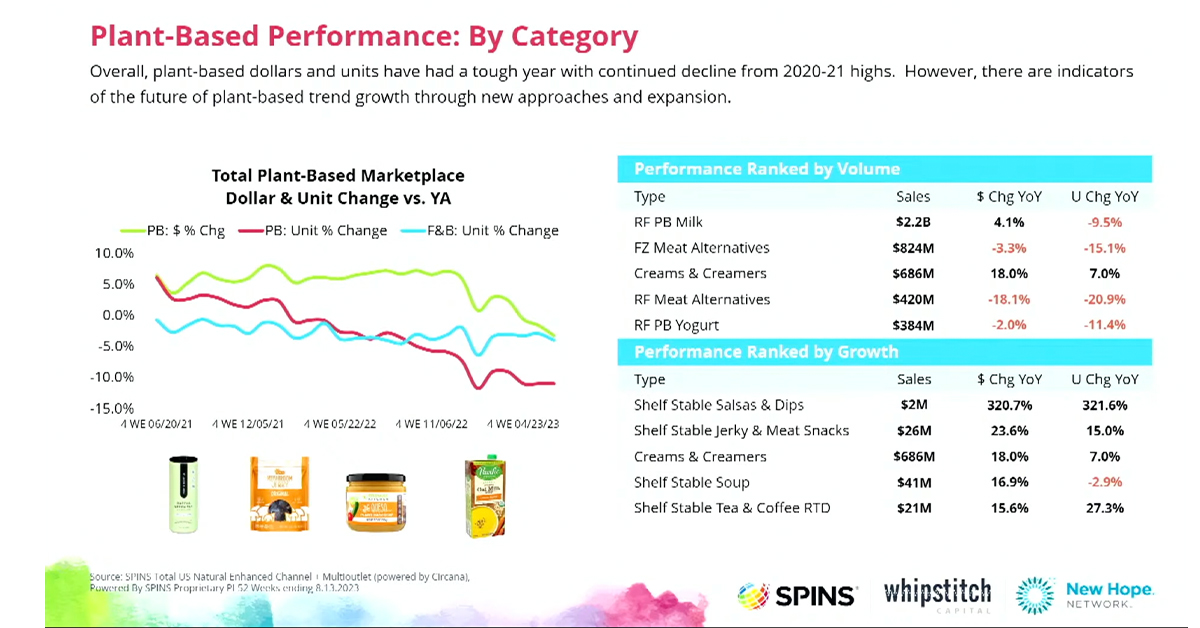

According to Peters and McCoy, despite shaky sales growth in plant-based alternatives the past year, consumer needs for protein and calories –coupled with the physical land constraints of animal agriculture alone –will lead to steady growth for the alternative segment.

Plant-based milk alternatives continue to gain ground on dairy milk and the category reached $2.2 billion (+4%) in sales during 2022 despite volume declines around 9.5%. Gen Z is likely to continue driving that climb, said Stojkovic, noting that the demographic is interested in “eating for the climate and sustainability” and will soon reach an age when they have increased buying power.

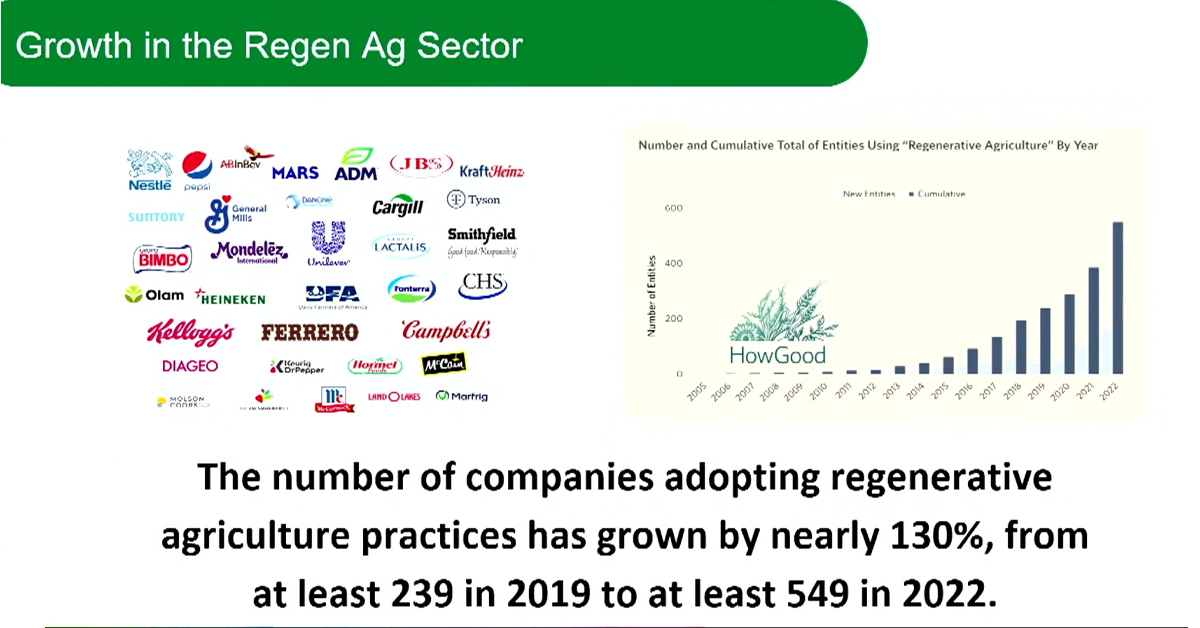

In addition to plant-based purchases, consumers’ understanding of regenerative agriculture is growing – 57% of consumers report that they are aware of the concept, according to Peters. Within CPG, Owens said regen-ag’s connection to higher nutrient density in crops will become a key piece of the regenerative story as more CPG companies enter the space and current research projects conclude and share their findings.

Fifty-eight out of the top 100 food and beverage companies have made some form of a commitment to regenerative agriculture, the Soil & Climate Alliance found, whether it’s a pilot scale research project for a single ingredient, or converting over half of a supply chain to producers using regen practices. This indicates that large CPG companies are recognizing the importance of supporting a shift toward regenerative, Owens said.

“We can actually have sustainable farming benefiting the people, farm health, and population health all at once,” added McCoy.

Beyond the products themselves, the natural food industry has begun to prioritize diversifying the people working within it. While consumer demand is readily supporting that shift, those controlling capital have been slow to move.

Stojkovic highlighted that women receive less than 2% of total food industry investments, despite being responsible for 93% of consumer food purchases overall. That is why she founded Joyful VC; the vegan women’s summit has grown from “250 women in a room” to 11,000 attendees at this year’s event, 25% of which were black women.

Consumer demand for global flavors is also helping accelerate the shift toward more diverse offerings. According to Pham, Omson’s audience online is over 80% white and only about 9% Asian. She sees that distribution as an indicator of success, stating the brand’s goal is to change both the faces behind American grocery, and bring new flavors to a broader public, particularly American consumers who are looking for multicultural flavors.

“When we were kids, we were always minimizing our culture and our cuisine, to try to fit in,’ said Pham. “But fast forward 20 years, and you’re seeing this awesome renaissance in global flavors, Asian flavors, global stories, and Asian stories.”