A2 Dairy Is Gaining Momentum, But Can Suppliers Keep Up?

The A2 dairy milk market didn’t exist in the U.S. two decades ago, but as consumer interest in gut health rises, alongside the ebb and flow of plant-based milk market and overall decline in dairy, interest in this easier-to-digest form of cows milk is on the way up.

“The thing that’s been surprising is how quickly it’s growing,” said Alec Jaffe, founder and CEO of A2 dairy-based brand Alec’s Ice Cream. “It feels like it’s really poised to, in the next two years, even next year, really take off. It feels like there’s this kind of groundswell building around it.”

Jaffe has a front seat to the market’s evolution. In 2022, he transitioned his entire ice cream line from conventional to regenerative A2 dairy; the brand grew 350% year-over-year in the following year and was on track to grow 125% year-over-year in 2024.

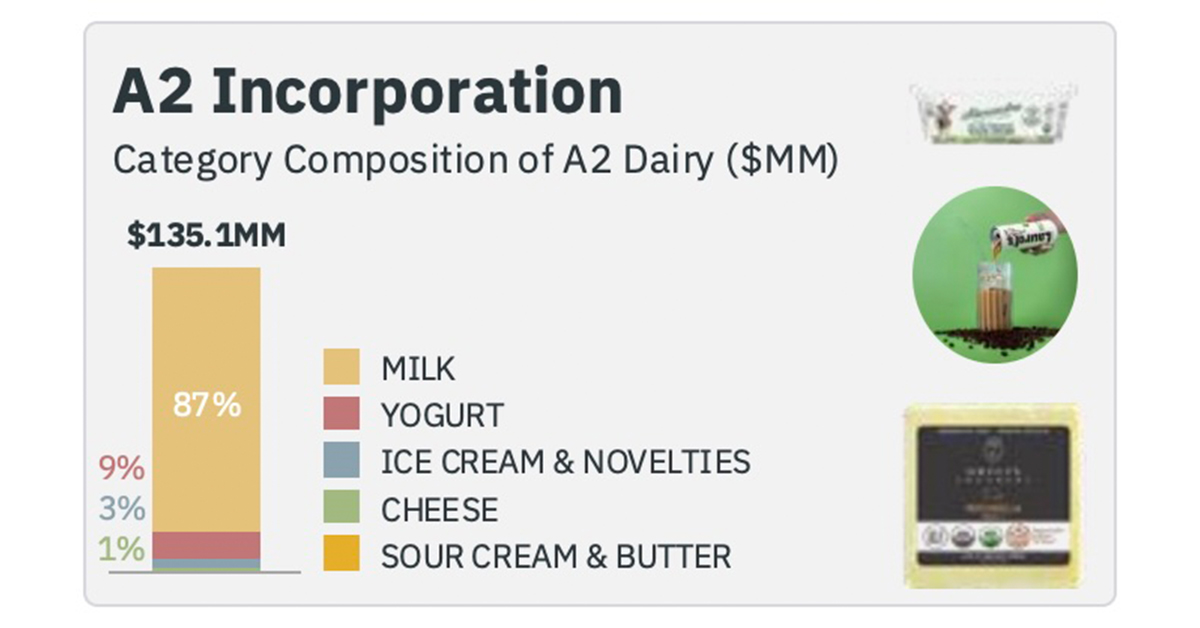

Alec’s trajectory follows the pattern of the A2 dairy market overall. As of the end of 2024, the dairy subcategory garnered over $123 million in total dollar sales, according to SPINS data. While it’s growing fast, and adding CPG support across categories, there is a cow-constrained cap on how quickly the space can scale, a reality some producers are now grappling with.

Counting Cows

The current U.S. A2 milk market represents only a small fraction of the $7 billion in conventional dairy milk dollars, but its market share is growing at a faster pace (+19.4% compared to +2.6%), and is established and accelerating even more abroad including in Australia, New Zealand and Southeast Asia.

Only a handful of companies are responsible for A2 dairy’s stateside growth, including New Zealand-based The a2 Milk Company and California dairy Alexandre Family Farm. While each has their own approach to introducing consumers to this digestion-friendly version of cows milk, they have found that simply having products visible in the market has put the premium, naturally-positioned dairy subsegment on an upward track.

“We certainly didn’t see opportunity in the A2 space because there was no A2 space… [when we started] 17 years ago,” said Blake Alexandre, co-founder of Alexandre Family Farm. “We just knew that breeding cows, selecting cattle to make a healthier, more digestible milk, made sense. I think we just assumed that, well, the market will come.”

That market has arrived and is steadily expanding beyond liquid dairy milk and into CPG applications as producers look for differentiated attributes and functional ingredients that align with the natural products industry.

The A2 market saw a major boost in sales after the pandemic. In 2022, it grew nearly 46% year-over-year, and while that growth decelerated in 2023 (+9.9%) it fell in line with trends in conventional dairy (+0.2%). But A2 has rebounded much quicker, up 14.7% compared to a 0.3% decline in conventional dairy in 2024, according to SPINS.

The A2 market is also outperforming the refrigerated plant-based milk space where, over the course of 2024, sales declined 4.9% and units dropped 4.5%, according to SPINS. While the plant-based milk market remains larger than the A2 space, with sales totaling over $2 billion and $300 million across the refrigerated and shelf-stable segments, respectively, both formats have been declining since 2022. Meanwhile, A2 continues to rise.

Rising Retail Awareness

While it is positioned as a natural product, A2 dairy offerings are capturing equal ground across all retail channels spanning mass, conventional and natural. The a2 Milk Company alone sells its liquid dairy milk in over 27,000 retailers nationwide having only entered the U.S. market in 2015. Private label brands like Ahold Delhaze’s Nature’s Promise sell an A2 Whole Dairy milk product.

“Awareness is rising among both consumers and retailers,” The a2 Milk Company managing director Kevin Bush told BevNET. “Factors contributing to this include the growing popularity of premium and functional foods, the strength of our marketing efforts, and pushing for the endorsement of A1 protein-free milk as a recognized attribute in syndicated data, similar to ‘organic’ or ‘gluten free.”

The a2 Milk Company currently sells six types of milk in the U.S. and received FDA “enforcement discretion” for its A2 infant formula in 2022, allowing it to begin building a market among this new consumer group. Bush claims The a2 Milk Company has become one of the fastest-growing premium milk brands in the U.S. and noted that while it is only focused on its own branded products currently, as interest in the subset grows, they remain open to evaluating potential supplier partnerships.

In contrast, Alexandre Family Farms has a much narrower distribution footprint, primarily selling on the West Coast. The company does have a national partnership with Whole Foods where it sells a selection of its milks, creams, powdered dairy and cultured products like yogurt, kefir and sour cream, but has leaned on other CPG brands to help cultivate demand across categories.

The dairy has also become the go-to supplier for the likes of RTD latte maker Laurel’s; cheese cracker brand Cheddies, baby and kid food producer Once Upon A Farm and baby food maker Serenity Kids. Each sells a product or range of items produced with A2 milk sourced from the Alexandre’s 9,000 acre farm in Northern California.

“Alec’s ice cream was willing to make an ice cream that we weren’t making so it gave our consumers one more product out of the dairy case,” Alexander emphasized. “But it puts a lot of pressure on us to try to keep up with growth from multiple brands. It’s fun to help them start, and then at some point they need to help find more supply.”

Growing Pains

As more CPG brands adopt A2 as an ingredient, there may be a point where producers simply can’t keep pace with demand.

“It’s a long, long process – cows live for a long time,” Alexandre stated. “And of course, they have offspring that live for a long time. We could have just sold all the cows that didn’t qualify [as A2], but we still need to be in business – cash flow wise that wasn’t a good plan.”

Unlike lactose-free or plant-based milk, A2 milk is created naturally from the cow and can not be created via processing. Cows have to be specifically bred to produce milk that contains A2/A2 protein; conventional milk contains A1/A2 proteins and the A1 component is what often makes dairy products difficult for humans to digest.

Alexandre said his farm first learned about A2 dairy back in 2008, some 20 years after the dairy was founded and nearly 10 years prior to the farm putting its own brand name behind its products. It has been working to transition its herd ever since, however, 20% of Alexandre’s cows still don’t qualify as A2, he said. Alexandre Family Farms remains one of the only commercial-scale dairies producing A2 milk in the U.S.

The a2 milk Company, by contrast, sources from a network of farmers with A2 producing cows across the U.S., similar to the sourcing habits of national, conventional dairy cooperative brands like Organic Valley. According to managing director Kevin Bush, as demand continues to rise, with U.S. revenue up 8% in 2024, the company is actively exploring opportunities to grow its farm network, particularly in “key dairy-producing regions in the U.S.”

A Boon For The Brand

While prices across the grocery market have inflated sales gains for many producers in the past two years, Jaffe pointed to the brand’s steadily increasing velocities, continual line expansions and launch nationally at Whole Foods with 14 SKUs last year as proof there’s growing awareness and momentum around A2.

“The trend in just two to three years has grown dramatically,” said Jaffe. “With consumers [while] doing demos and events, it used to be that [I] had to really explain what A2 was and nobody knew what [I] was talking about. Now I’ll be at events and we’ve got multiple people at the table, and someone on the other end of the table is educating the other person.”

According to Google Trends data, searches for A2 Dairy have been rising since November 2017, with a notable spike in January 2022 where it has since maintained momentum with high search activity on the platform.

Like the Alexandre’s and its network of partners, The a2 Milk company has also seen a bump with U.S. revenue increasing 8.2% in 2024. Bush credited the category’s acceleration to a growing and diverse product assortment that has helped further support visibility for the attribute including its a2 Platinum infant formula, Grassfed a2 Milk and a chocolate milk collaboration with Hershey’s.

Laurel’s founder Isabel Washington believes that her RTD A2 dairy-based Classic, Dirty Chai and Matcha Latte line has hit the market at the perfect time. Interest has been steadily increasing since the brand’s launch in August, she said, noting the brand was one of the last CPG partners Alexandre Family Farms contracted to supply due to the growing demand.

But not all have been so fortunate. Washington noted that while Laurel’s is the only RTD A2 latte brand currently on the market, other regional players on the West Coast were technically the first, launching around 2019, but have since gone out of business.

Pricing Pressures

Growing an A2 dairy-based business does come at an additional cost. Jaffe emphasized that Alec’s pays more for its ingredients and has to be strategic about making its margins work, an effort made easier through self-manufacturing.

According to Alexandre, the premiums on A2 milk are about an additional 10% to 12% on top of the price of organic milk; however, organic milk prices can jump during the year with premiums ranging between 10% to 40% of conventional prices, but often “averaging somewhere in between,” he said.

The Alexandre’s dairy also comes with the added bonus of being regenerative certified by Land to Market, adding “another bump on top of that,” [premium]. Alexandre said he doesn’t see that added regenerative price bump sticking around for the long run though, believing that consumer appeal will fade.

“The regenerative principles and practices on farms add value to the farmer’s yields and, in my mind, that’s where the farmer gets repaid, from improved yields and efficiencies,” he said. “It’s hard to just keep going to the marketplace and saying, ‘Hey, I have a new certificate. Pay me for this.’”

Jaffe said he is also in constant conversation with Alexandre’s as they work to grow both brands alongside one another. But Alexandre emphasized “there’s no secret formula” to making this work: “It’s just part of the reality. We have to super plan ahead.”

The Alexandre’s are working to help bring other nearby farmers into their network and get them certified so they can participate in the Alexandre Family Farm premiums. The effort is mutually beneficial as it will allow the Alexandre’s and their CPG partners to maintain their dairy standards and continue to grow their brands alongside mounting market demands.