PepsiCo Takes Full Ownership of Sabra For $240.8M

PepsiCo’s healthy snack buying streak continues.

The multinational food and beverage giant announced today it will acquire the remaining 50% share of Sabra Dipping Company and its Geneva-based international arm Obela from Israel-based Strauss Group for $243.8 million. In split terms, PepsiCo will pay $240.8 million for Sabra and $3 million for the Obela business, according to Strauss. The transaction is expected to close by the end of 2024.

PepsiCo has split custody of the hummus and dip manufacturer since 2008 when it first formed the joint venture, right on the cusp of the hummus category’s salad days in the U.S. Today the refrigerated set of the hummus category is valued at $966 million.

Strauss originally purchased a 51% stake of Sabra in 2005 for a mere $9 million. According to PepsiCo, Sabra has generated nearly $400 million in retail sales in the U.S. in 2024; the transaction will accelerate PepsiCo’s aim to focus its portfolio on healthier snacking options and comes on the heels of its recently announced $1.2 billion acquisition of better-for-you Hispanic food company Siete Foods.

“Our aim is to meet the growing demand for positive choices and on-the-go options,” said Steven Williams, CEO of PepsiCo Foods North America, in a press release. “Nutritious, simple foods like refrigerated dips and spreads represent a space we have long desired to expand in the U.S. and Canada. We are grateful to the Strauss Group for our long and successful partnership and look forward to this next chapter for the Sabra and Obela brands, as well as the PepsiCo food portfolio.”

The deal will also leave Strauss with an option to buy a 2.5% stake in PepsiCo’s salty snacks business in Israel, where Strauss already operates the Doritos and Cheetos brands. PepsiCo will also now assume full control of Sabra’s main production facility in Virginia along with the approximately 700 employees that work between both brands.

For Strauss, the sale also comes as it works to focus on its core offerings – a similar sentiment U.S.-based food and beverage conglomerates have also been vying toward. See Campbell’s acquisition of Sovos (and subsequent sale of noosa), General Mills selling off its yogurt segment or Kellogg’s separation of its snack and cereal businesses as evidence.

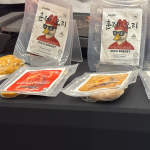

Under PepsiCo’s wing, Sabra has also tapped salty snack synergies, launching co-branded dipper products with PepsiCo-owned snack brands like Tostitos and continued to unlock additional grab-and-go opportunities with its Snackers line.

In 2016, the company made its first foray beyond chickpea-based dips with an expansion into an equally hot category – guacamole – but has since remained focused on these two dips while innovating its core product line via dip-adjacent varieties such as Spinach and Artichoke Olive Tapaneade and Buffalo hummus flavors.

The deal comes as the refrigerated dips and salsa categories continue to outperform their shelf-stable counterparts, according to SPINS data tracking dollar sales growth over the past three years. While the refrigerated hummus set slipped 0.1% in 2024 (compared to 4.3% growth in 2023), the decline is slight compared to a 22% drop in dollar sales and 9% decrease in unit sales of shelf-stable hummus products.

According to Strauss’ half-year earnings reported in August, Sabra and Obela are operating in line with category trends at a “break-even” rate with Sabra sales down 0.6% and Obela down 2.2%.

“The move constitutes another pillar in the implementation of the group’s strategy, which aims to focus on the core business, leverage our resources in the best possible way, and lead significant business moves for Strauss,” said Strauss CEO Shai Babad. “We thank all Sabra employees of all generations and PepsiCo for the extraordinary journey from a small salad company to the leader in the hummus market in the U.S.”