J.M. Smucker Raises FY 2025 Guidance on Strong Uncrustables, Jif Performance

The J.M. Smucker Co. announced today it has upgraded its full-year 2025 guidance after robust sales across Uncrustables, Jif, and Café Bustelo brands offset the underperformance of Hostess in its second-quarter earnings.

In the quarter ended Oct. 31, the Orrville, Ohio-based company saw net sales climb 17% year-over-year to $2.3 billion. Gross profit increased 22% to $161.9 million, reflecting a favorable impact from the acquisition of Hostess Brands, favorable volume/mix, higher net price realization, and lower costs.

“Our strong second-quarter performance demonstrates the strength of our categories and continued execution toward our key growth platforms,” said president and CEO Mark Smucker in a statement.

On a segment-specific level, U.S. Retail Coffee sales were up 3% versus the prior-year period, fueled by higher net price realization. In response to higher green coffee costs and the “pass-through nature” of the coffee category, J.M. Smucker implemented price hikes across parts of its portfolio in both June and October.

The company didn’t disclose whether it plans to execute additional price increases to combat ongoing inflation, instead stating, “We will manage our coffee business through a strategy that demonstrates a balance between recovering inflationary input costs while providing consumers with options across the value spectrum.”

Net sales for U.S. Retail Frozen Handhelds and Spreads grew 6%, primarily driven by the Uncrustables sandwiches and Jif peanut butter brands. Smucker said the company remains bullish on Uncrustables, as evidenced by the opening of its 900,000 sq. ft. manufacturing facility in McCalla, Ala., during the quarter.

Now in “demand generating mode,” the brand rolled out a new Peanut Butter and Raspberry flavor that is “far exceeding expectations.” Although it’s still early, data shows the SKU is already becoming a top variety for the brand, per Smucker.

“We expect to hit $900 million [in Uncrustables net sales] this year, and I think it’s safe to say that we’re going to meet or exceed our goal of $1 billion [in net sales] by the end of fiscal year 2026,” he said. “We haven’t put any markers out there for a billion but we believe we’re going to get beyond it with the support of great production, great teams and all three plants.”

Meanwhile, Hostess, which J.M. Smucker purchased for $5.6 billion roughly one year ago, was a relative pain point during the second quarter. The company attributed the brand’s disappointing sales performance to two factors: selective consumer spending related to inflationary pressures and weak distribution/merchandising.

Last month, J.M. Smucker announced it will divest low-sugar cookie brand Voortman to Second Nature Brands in a transaction valued at $305 million. The deal includes all Voortman trademarks and its leased manufacturing facility in Canada.

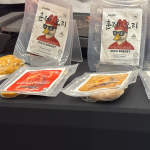

Beyond the Voortman divestiture, the company will employ a multi-pronged strategy to return Hostess to growth: driving displays to capitalize on the impulse nature of the snacking category, launching a new marketing campaign to build cultural relevance, and refreshing product packaging to be more impactful on-shelf. To appeal to consumers seeking value, the brand is releasing new sharing sizes of Donettes and $1 packs of its core donut and cake products sold on display.

The company has seen preliminary success with co-promoting Hostess alongside its legacy brands, including coffee and “less discretionary” brands, said Smucker.

During a Q&A session this morning, one shareholder questioned whether now is the right time to be “aggressively marketing” indulgent snacks, given new messaging from the Make America Healthy Again campaign under President-elect Donald Trump.

But J.M. Smucker executives remain confident about their Hostess marketing push. Smucker said, “The trends are supportive that consumers continue to eat a couple of snacks a day. Whether it’s Hostess or Uncrustables, consumers are going to look for a way to reward themselves at different times throughout the day.”

Based on its Q2 results, J.M. Smucker raised its full-year 2025 earnings outlook, now forecasting adjusted earnings per share (EPS) between $9.70 and $10.10 (previously between $9.60 and $10).

“Looking ahead, we are focused on delivering our strategic priorities, including the integration of Hostess Brands, and are taking decisive actions to grow the Hostess brand. We remain confident in the Hostess brand and its contribution to our long-term growth objectives,” said Smucker.

Explore the Nombase CPG Database

Head to Nombase to learn more about the tagged companies and their offerings.