Hostess Sells To J.M. Smucker For $5.6B

Note: This story has been updated.

J.M. Smucker will buy longtime Twinkie, Ho-Ho, Voortman Cookie and Ding-Dong maker Hostess for $5.6 billion, according to an announcement today.

The deal, still subject to regulatory approval, is expected to close Q3 2024 and has already been unanimously approved by both companies’ board of directors. The cash-and-stock transaction is valued at $34.25 per Hostess Brands share, notes a press release, a 54% premium on the stock from when reports first broke in late August about the potential transaction.

The deal is not subject to a financing condition and Smucker has received $5.2 billion in bridge financing from Bank of America, N.A. and RBC Capital Markets LLC to help fund the acquisition. The cash portion of the deal will be financed through a combination of cash on hand, a bank term loan and long-term public bonds. During Smucker’s earnings report last week, the company reported having over $67 million in free cash flow.

The transaction’s equity value clocks in at around $4.6 billion. Although Hostess stock has surged up 18.77% at the start of trading today, Smucker’s has declined nearly 7% at the time of publication.

On a call this morning discussing the news, Tucker Marshall, J.M. Smucker CFO, said Hostess’ “financials are great.” Marshall expects the deal to contribute $1.5 billion in net sales and bring annual run-rate cost synergies of about $100 million within the first two years following the integration. He highlighted Hostess’ consistent, strong, mid-single digit top line growth and said while he doesn’t expect that to slow, emphasized that its core indulgent snacks business has been proven to support this growth rate long term.

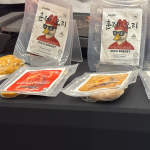

Per terms of the deal, Smucker will assume control of Hostess’ 11 snack brands including Donettes, Twinkies, Ding Dongs, Zingers, and Voortman Cookies. Smuckers will also add the company’s six North American manufacturing facilities, an Edgerton, Kansas distribution center, and all 3,000 Hostess employees to its business.

Mark Smucker, President and CEO of J.M. Smucker, highlighted on the call Hostess’ c-store distribution network, presents a “complementary and strategic” opportunity for J.M. Smucker to grow the presence of its existing brands outside the grocery channel. Smucker noted the company recently launched a new version of Uncrustables into the convenience channel that can be kept shelf-stable for five days.

The news also comes at a pivotal time for large CPG food companies. While volume growth has not kept pace with pandemic and inflation-induced price increases, a few have begun looking to other businesses with supply chain synergies as a mode to continue fueling growth.

Most recently, Campbell’s Soup Company snagged Sovos brand’s premium pasta sauce portfolio. Others like Unilever, which scooped up ice cream maker Yasso in June, and Mars, which recently acquired Kevin’s Naturals, have pursued similar strategies.

“Our companies share highly complementary go-to market strategies, and we are very similar in our core business principles and operations,” said Andy Callahan, Hostess president and CEO, in a press release. “Above all else, [our companies] share a deep commitment to inspiring moments of joy and satisfaction through our products, and we look forward to continuing to do so as part of The J.M. Smucker Co. family.”

Smucker has echoed this rationale too, claiming the acquisition will accelerate its focus on “convenient consumer occasions.” The company’s acquisition history was called into question by shareholders on the call, however, specifically its purchase of Big Heart and associated pet food brands in 2015, all of which were divested earlier this year in order to focus on the core business and drive operational efficiency.

“We believe that we have the right strategic intent and rationale here, starting with category and brand, and we also have the right synergy and integration outlook,” said Marshall, in response to a shareholder on the call. “What we’ve learned over time through M&A is you have to be in the right category with the right portfolio. Hostess absolutely demonstrates that, but what we also have to do is ensure that we integrate with success, we maintain capabilities and competencies, and we put the right people in the right positions, and we do this quickly.”