FMI: Inflation Shifts Consumer Grocery Sentiments and Shopping Habits

Retailers are gatekeepers between CPG brands and consumers, so today we are going to take a temperature check on how shoppers are navigating in store. The Food Industry Association (FMI) recently hosted a webinar to discuss its U.S. Grocery Shopper Trends Spring 2024, in collaboration with Hartman Group CEO Laurie Demeritt, and highlighted some notable emerging patterns as consumers make their way to checkout.

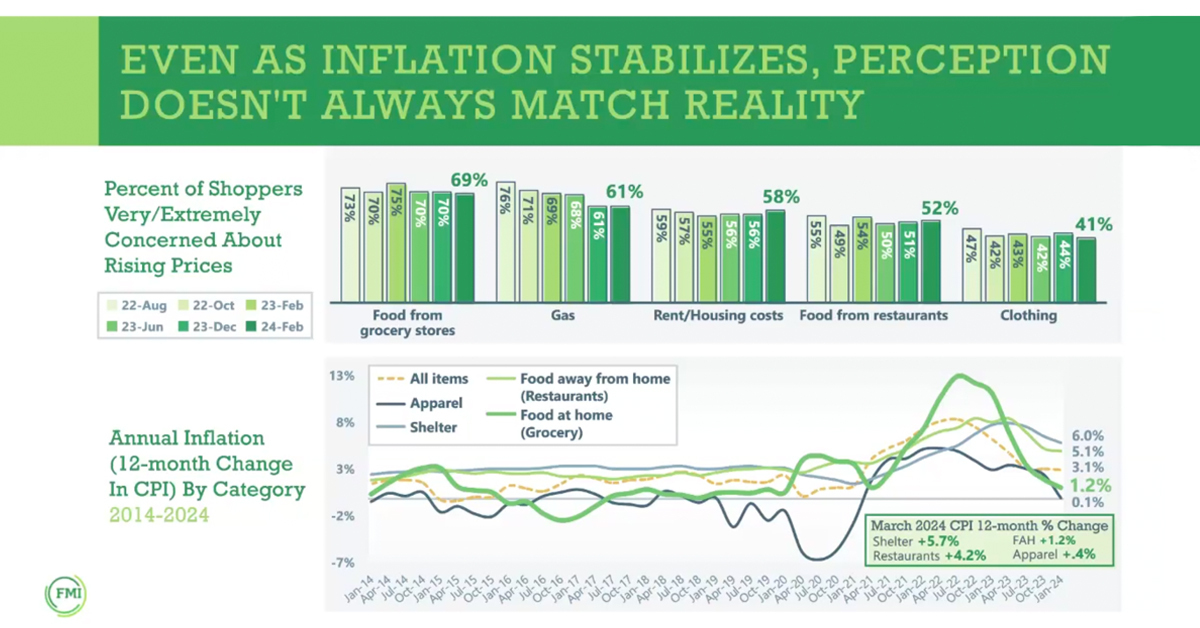

Let’s start with an inflation check. The organization found that while shopper concerns over inflation have stabilized, “they very much still exist.” Those findings align with consistent food-at-home inflation, according to CPI data, over the past two months. However, consumers’ lingering concerns can likely be explained by the less-consistent rollout of food price increases, Demeritt said.

“Almost every category has experienced some form of price change due to inflationary and supply chain pressures,” stated Demeritt. “Some of these price changes have hit particular products very quickly where the cost shot up and then fell, while others have just been on a steady uplift over a period of time. Some items went up 5%, others went up 20%, other products have decreased in price by similar amounts.”

Demeritt said this uneven price growth timing has exacerbated and elongated consumers’ concerns around food prices. Presenters also noted that while food prices have risen “little less than 25% over the last few years,” average wages have also grown at that same rate which, in theory, should keep food affordable for most shoppers.

Now, on to who is shopping where. Historically, the supermarket has been “far and away” the most popular store type for groceries; twice as many consumers primarily shop the channel for food compared to mass retail. But that is changing fast. In the past few years supermarkets’ advantage over mass has shrunk to only 33%, and younger consumers (Millennials and Gen Z) are largely driving that shift.

“Gen Z and Millennial shoppers tend to shop more banners or different stores than older shoppers,” said Demeritt. “The supermarket remains the primary store choice for older shoppers and that’s likely driven by habit and the sheer product variety that a traditional grocery store offers. Millennials on the other hand are more likely to shop at a mass retailer like Target or Walmart as their primary store.”

In other retail-related news:

Walmart is growing its Neighborhood Markets’ footprint. The mass merchant has added two new locations of these smaller-footprint stores in Santa Rosa Beach, Fla., and Atlanta, featuring an assortment of pharmacy items, groceries and general merchandise. The new stores feature a slightly larger and more varied layout than existing Markets and will offer a broader assortment of bakery, produce, meat, dairy, deli and hot case products.

UNFI extends Whole Foods partnership through 2032. UNFI will remain the primary distribution partner for Amazon-owned Whole Foods through at least 2032 after the natural foods giants extended their contract for an additional eight years, according to an announcement this morning.