Commercializing The Concept: How ReGen Brands Is Paving A Path Via CPG

While the regenerative agriculture movement may enjoy a surplus of enthusiasm, the tools to turn its economic and environmental potential to reality have thus far been in deficit.

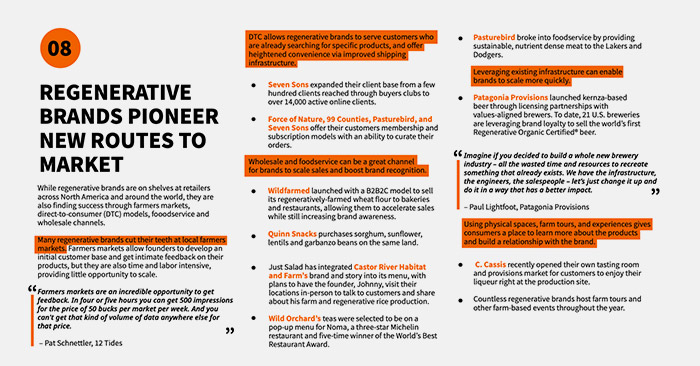

Indeed, regen-ag has been propped up and propelled into CPG by numerous actors spanning farmer-founded brands to upstart entrepreneurs to a handful of retailers and forward-thinking investors. There have also been efforts from large multinationals and mid-sized businesses to transition sections of their conventional or organic supply chains to regenerative practices.

But these well-funded, heavily resourced transitory efforts will only play a small role in the successful commercialization of the overall movement, claims Anthony Corsaro. In co-founding ReGen Brands, the self-proclaimed “regenerative evangelist” is betting big on his belief that the subset, primarily supported by emerging brands, is nearing an inflection point – and in need of a nudge.

“[Regenerative brands] are perfectly at that nascent spot with a lot of opportunity, where there’s really cool, positive momentum and a lot of data points to show that,” he said. “And then there’s some really clear things that if we don’t fix them, this thing is dead in the water.”

That was the motivation behind the ReGen Brands ecosystem, which he co-founded alongside Kyle Krull, senior director of sales at Kettle & Fire, and Arron Mansika, co-creator of Naturally Network. Corsaro and Krull have spent the past two years collecting qualitative research via their ReGen Brands media platform with actors and stakeholders in the space.

Those insights influenced the new three-pronged platform which has been designed to address the most pressing, regenerative-specific needs of CPG brands. “Ultimately, these ended up being problems that we could define really well, and we had a level of conviction that we needed to solve them or help solve them,” Corsaro said.

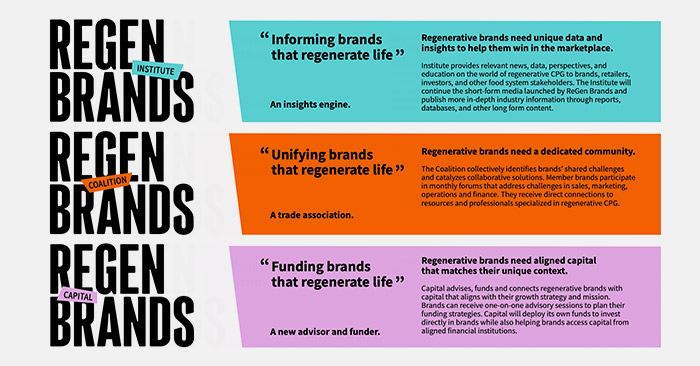

Launched in mid-October, the ecosystem consists of three arms: ReGen Brands Institute, the ReGen Brands Coalition and ReGen Brands Capital. Corsaro originally intended to launch just a regen ag-focused trade association, now known as the Coalition, but said it was clear that the space needed more than just community, but rather “clarity and coherence” around the commercial and financial needs necessary for the movement to succeed.

“We had these three buckets that brands needed support in, and we did not feel as though there was some really simple, easy-to-replicate, short-term for-profit model to apply to solving those needs… there was a level of nuance, complexity and economics,” Corsaro said.

“In America, the best way to subsidize or try and realize economics that aren’t there is as a nonprofit,” he continued. “The best way we thought we could do that across various parts of the business were these two nonprofits [Coalition and Institute] and this eventual for-profit [Capital] working in unison in this whole ecosystem.”

Building the Coalition

The community-focused arm of the nonprofit platform currently consists of 31 members, all of which represent CPG brands; Krull serves as the board chair alongside Daniela Jensen, co-founder of Big Picture Foods, and Hayley Painter, co-founder of Painterland Sisters. Corsaro emphasized it hopes to find ways to interface with retailers, distributors, investors and other stakeholders down the line, but currently, membership is only open to third-party validated, not necessarily certified, regenerative brands.

“That [validation requirement is] really key because you have to sell and market at least one SKU with a regenerative claim that has been third-party validated by one of eight third-parties, seven being the seven regenerative certifications, and the eighth being the Whole Foods regenerative assessment.”

That membership criteria was designed around one of the community’s most pressing challenges: a lack of agreement around what constitutes a regenerative brand. The broad ranging requirements between different certifications and a lack of unity around how those messages are disseminated to consumers has created an even more divisive space with little consensus on how to define the concept as it matures in the market.

“Every retailer we talk to says they want a more unified approach to consumer education and messaging, and so does every brand,” Corsaro stated.

The coalition represents the first certification-agnostic trade association for regenerative brands and will work with a “rising tide lifts all boats” mindset that will help businesses scale through peer-to-peer support and working forums as well as partnerships and collective action. Corsaro believes this approach can collectively create more commercial value for regenerative.

“We need to create some sort of heightened ROI for the regenerative work that they’re doing,” he said. “I need to be able to show ‘Hey, we did a social media giveaway and we increased your number of email subscribers, and we got you XYZ impressions,’ or, ‘We figured out how to do a joint end cap with this retailer, which increased velocities and increased awareness at the store’… things like that.”

Driving Analytics

Developing the market for these products will take more than simply growing and establishing regenerative CPG businesses. ReGen Brands’s second arm, the Institute, aims to fill those gaps by engaging a wide variety of stakeholders with open-sourced data and reports, beginning with its inaugural publication: The State Of Regenerative CPG.

Looking ahead, the Institute aims to continue publishing data and insights as well as sharing news and perspectives with and from farmers, brands, investors, retailers and more. The philanthropic Institute is chaired by Kevin Dowdell, a seasoned investor in the space and partner at RGD Partners; Ben Fenton, a partner at BFG Partners; and Caroline Noble, director of The Monarch Foundation.

Efforts may include the potential creation of an interactive certification database to help brands compare and contrast which program best fits their needs. It will also work to generate additional research on consumer awareness around regenerative and hopes to make aggregated retail data on the growth of these brands easier to understand and access.

He sees the platform as an advocate for the space, able to make “fact-based” calls to action for the industry, agnostic of individual brands’ needs and performance.

“Brands are not really allowed to say, ‘I don’t like Sprouts’ new 6% charge’ or ‘I don’t like how much Whole Foods charges for end caps,’” he detailed. “But if we could publish research that is completely fact-based, we might be able to move the needle on some of those topics that sometimes get stunted by emotions and personalization.”

Capital Gains

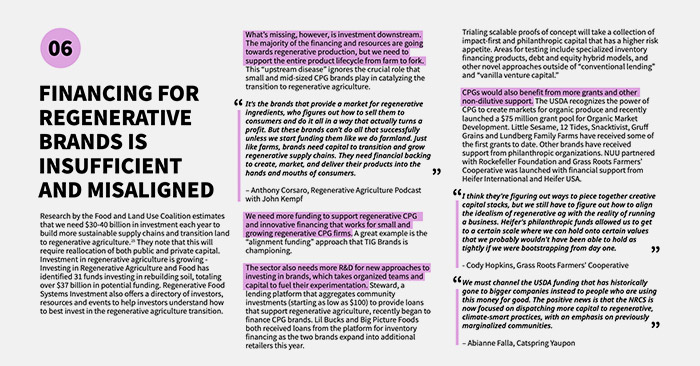

Access to capital is the final component that will support the success of these brands, Corsaro said, yet how that looks in practice is still in the works. ReGen Brands Capital is set to officially debut in 2025 with the goal of advising, connecting and eventually, actually funding regenerative CPG brands.

The intention is to work with brands to create and execute a capitalization strategy, but that could be subject to change. Down the line Corsaro hopes this for-profit entity will develop a fund that does transactions, backed by insights from the nonprofit arms. In the meantime, the platform will act like a consultancy and work to unearth new financial models to effectively support this space.

“We fundamentally believe that venture, typical equity investments and typical debt investments are important for this ecosystem and these brands, and they will continue to be so,” Corsaro said. “But the opportunity for industry changing work is not going to lie in doing transactions of that type. It’s going to lie in either creating or championing innovative financial products that we don’t use at all or we don’t use enough right now.”