Chunk Foods’ Alt Meat Goes To Retail

Plant-based meat brand Chunk Foods is making the leap onto retail shelves this week with a launch in independent retailers in Los Angeles and New York City.

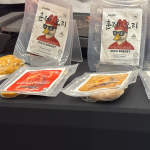

The whole-cut, meat alternative maker is launching four SKUs (Pulled, Slab, Steak, and Steakhouse) into the frozen aisle with plans to significantly expand its retail presence in 2025.

“Moving into retail is a significant milestone for Chunk Foods, marking an expansion beyond foodservice into the CPG space,” said founder and CEO Amos Golan. “It also reflects our strategic commitment to scaling our distribution, increasing brand visibility and tapping into the growing demand for plant-based alternatives at home.”

Based in both Tel Aviv, Israel, and New York City, Chunk Foods was founded by Golan when he was studying at MIT. The company uses bulk fermentation to create whole-muscle substitutes from cultured soy and wheat protein.

Chunk Foods has raised over $24 million in total, with a $22 million seed round led by Cheyenne Ventures that included funding from Latin American meat and dairy company Sigma Alimentos. The food technology company’s investors include Fall Line Capital, The MIT E14 fund, Better Balance, Key1 capital and Robert Downey Jr.’s FootPrint Coalition.

Initially focused on foodservice, Chunk brought its meat alternatives to market in 2023 partnering with restaurants like Slutty Vegan and Pastrami Queen. The company has also co-developed a product with plant-based meat maker BetterBalance that is available in Mexican restaurants.

Chunk unveiled its latest wholesale innovations, Chunk Slab and Chunk Cubes, at the Natural Restaurant Association Show at the beginning of the summer.

“While our foodservice business will continue to be an important part of Chunk, we anticipate that retail will make up 50% to 60% of our total business as we scale our CPG operations,” Golan said.

The opportunity in plant-based meat alternatives remains in flux. The category’s sales peak of $1.3 billion was in 2020 with meat alternatives steadily declining in the subsequent three years to $1.1 billion in 2023, according to a September report from Circana.

Frozen remains the preferred format with 70% of sales coming from the freezer aisle and the other 30% from fresh or refrigerated. Along with the steady contraction of sales has been a reduction in available options in-store.

There were about 39.6 meat substitutes in the average grocery retailer in the last 52-week period ending July 14, down from 45.8 items two years ago, according to Circana’s data.

Providing an alternative for retail shoppers is part of Chunk Foods’ strategy. The brand is starting small with retail partners like Hank’s Organic and Fresco Community Market in the L.A. region and other independent retailers in New York.

These smaller natural and specialty grocers are the “ideal partners” for the brand at this stage because they “prioritize high-quality, plant-based products and have a strong community presence,” Golan said. The brand has plans to target “dozens of retail partners in L.A. and New York by the end of the year.”

Chunk Foods also intends to move into more expansive deals with larger chain retailers and ecommerce by the end of the year.

This expansion is being accompanied by an adjustment to its production and supply chain to meet the needs of CPG.

“A key challenge was fine-tuning our operations and supply chain to handle smaller, more frequent retail orders, while still producing foodservice products at scale,” Golan said. “This meant our factory had to efficiently produce and package both retail and foodservice items, optimizing production schedules, securing consistent materials, and improving delivery logistics — all while maintaining high product quality and operational efficiency.”

Optimizing a supply chain and production structure for a retail launch is an evolving process. Mycelium-based meat alternative maker Meati opened its “mega-ranch” in early January 2023 and has been steadily raising new capital as it has pushed further into retail. Yet, despite those gains, it has also initiated a series of layoffs as it optimizes its production.

Once-category leader Beyond Meat recently announced it was going after the opportunity in whole cuts as it has struggled to win back consumers after production issues and trailing demand have significantly hindered its growth. Competitor Impossible Foods has refreshed its image and formulation to try to bring new consumers to the brand on the back of its health claims.