GFI: Taste, Price Still Impeding Growth for Plant-Based Proteins

Despite significant gains in recent years, mass-market adoption of plant-based meat, seafood, eggs and dairy remains limited by taste and pricing-related challenges, according to the Good Food Institute’s (GFI) State of the Industry report.

“Taste remains the number one reason why consumers have not tried plant-based meat. It’s also the number one reason why consumers who have tried it once or twice have not come back,” said GFI corporate engagement product manager Maille O’Donnell during a webinar last week. “Taste appears to be both a perception issue and also a real shortcoming.”

Last year, plant-based meat sales were down slightly by 1% while unit sales were down 8%, according to FMI research, indicating an opportunity to further attract and retain consumers in the category with products that meet consumer needs.

Despite this drop, the overall plant-based meat, seafood, milk, yogurt and cheese industry reached $28 billion in sales in 2022, according to Euromonitor data cited in the report. Plant-based milk is the most developed of all categories, with dollar sales of $2.8 billion last year, while eggs is the smallest but fastest-growing category.

As consumer interest in plant-based proteins continues to rise, retailers and manufacturers are introducing new products and new strategic partnerships to stake their claim in the category. Last year, several large food companies capitalized on the aforementioned consumer interest with the release of plant-based iterations of familiar products, including Kraft Singles, Philadelphia Cream Cheese, Kit Kat bars and Babybel cheese.

There were approximately 25 new strategic partnerships in the plant-based industry in 2022, according to the GFI, including Kraft Heinz’s joint venture with NotCO. In addition, six companies opened new or expanded production facilities.

Foodservice has also returned as an attractive go-to-market strategy for plant-based companies, as it allows companies greater control over how their product is prepared. Additionally, foodservice can play an important role in ensuring plant-based products become more accessible and familiar to a wide array of consumers.

“Notably, plant-based foods are joining menus in every segment, with foodservice from QSR chains like Starbucks to KFC to specialty restaurants to college campuses, airlines and school cafeterias,” said O’Donnell.

Seeking to overcome hurdles around taste and pricing, In 2022 the plant-based food industry turned to scientific and technological advancements such as protein sourcing, ingredient and formulation optimization and end-product manufacturing methods.

According to the GFI, a key to unlocking the affordability of plant-based foods will be increasing the scale of production. This can be achieved in part by diversifying protein ingredients and increasing their production to reduce costs. Last year, NUTRIS opened a fava bean and potato ingredient processing factory in Croatia while Eat Just announced plans to build a mung bean protein factory in Spain.

The efficiencies in plant-based production are expected to lead to environmental benefits even without optimized materials, ingredient processing and manufacturing technologies. As research across the technology stack optimizes taste, texture, price and scale, ongoing environmental assets can help companies understand how the adoption of specific food innovations affects their environmental footprint.

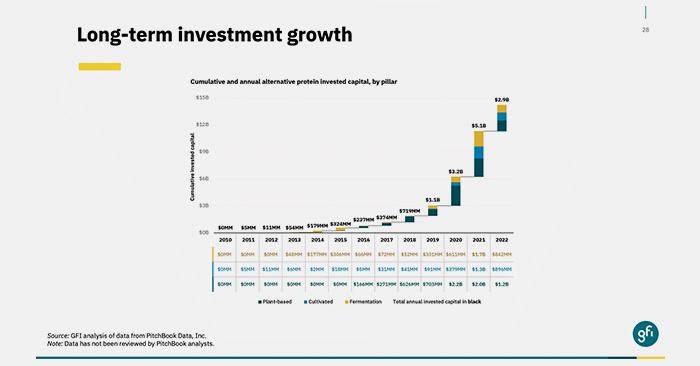

On the investment side, plant-based meat, seafood, eggs and dairy companies raised a combined total of $1.2 billion in 2022, bringing total investment in the space to more than $7.7 billion. Additionally, the number of unique investors in the category grew by 17% to more than 1,500. According to O’Donnell, “nearly every one of the top global food companies” is involved in the plant-based industry through investment, acquisition, partnerships, or manufacturing their own products.

Despite alternative proteins’ Environmental, Social and Governance (ESG) benefits, these companies still face underinvestment as a climate, biodiversity, public health and food security solution, according to the GFI report. Additionally, a report by BCG and Blue Horizon claims investment in plant-based proteins has the highest carbon dioxide equivalent savings per dollar of invested capital of any sector.

Looking ahead, the Food and Agriculture Organization of the United Nations projects the global meat market will grow 26% to 455 million metric tons by 2050 and that cultivated, plant-based and fermentation-derived proteins could significantly reduce risks and improve efficiency of meat production.

“The alternative protein industry is still nascent and is experiencing challenges that align with its early stage,” the report read. “As plant-based companies continue to innovate and fill existing white spaces, as well as scale and optimize production and to improve the taste and affordability of products, sales will likely accelerate and drive additional investment.”