GFI: Plant-Based Seafood Sales Outpace Total Plant-Based Meat Sales

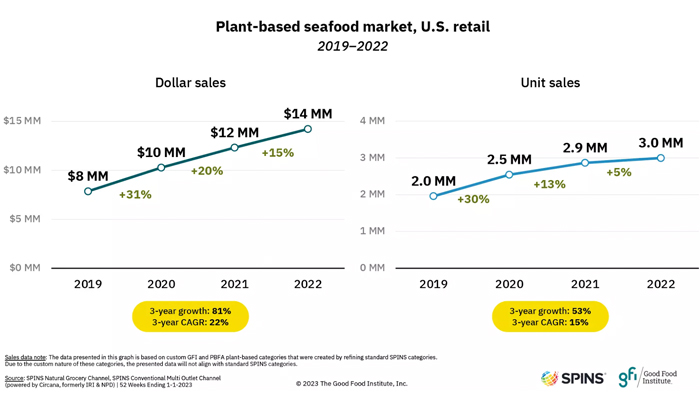

Though still just a small fraction of the total plant-based meat and seafood category, plant-based seafood dollar sales increased by 15% and unit sales grew 5% in 2022, outpacing total plant-based meat sales, according to a new report by the Good Food Institute and the Plant Based Food Association.

Based on retail data from SPINS, the market insights report found that plant-based seafood sales grew 53% between 2019 and 2022, albeit on a small base as several brands and products came to market or expanded distribution.

Today, plant-based seafood makes up 1% of total plant-based meat and seafood dollar sales while conventional seafood comprises approximately 16% of total conventional meat and seafood dollar sales. If plant-based seafood were to capitalize on this white space, retail plant-based seafood sales could eventually grow by an estimated $200 million.

Additionally, as 65% of seafood sales in the U.S. occur in food service, there is a significant opportunity across the greater food sector.

Meanwhile, plant-based meat sales declined slightly by 1% year-over-year in 2022. The three-year dollar growth rate was 43%, primarily driven by substantial growth in 2020, but unit sales were down -8% to $255 million (compared to $277 million in 2021). Aside from plant-based seafood, plant-based chicken was the only other major animal type with positive dollar sales growth.

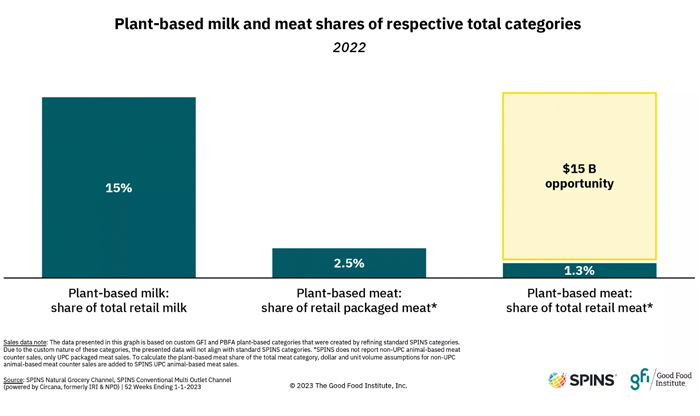

According to GFI, the plant-based meat market today is “reminiscent of the plant-based milk market when it was in its early stages.” Today, plant-based milk accounts for 15% of all dollar sales for retail milk in large part due to its move into the refrigerated milk set which was key in reaching a mainstream consumer base.

Though plant-based meat currently accounts for just 1.3% of the overall share of retail meat, continued product innovation and consumer adoption could help the category earn a similar dollar share of the total meat market. The opportunity represents a 14-point growth in plant-based meat’s dollar share of total meat and is worth $15 billion.

Plant-based meat’s market share is much more significant in the natural channel, where it represents 15% of total packaged meat dollar sales. Frozen products continue to compose the majority of the category by sales, accounting for 63% of total plant-based meat sales, followed by refrigerated at 34% and shelf-stable at 3%.

Historically, refrigerated plant-based meat has been a key driver in the category “as it has been increasingly shelved in the meat case, enabling it to be located in the section of the store where most shoppers are looking for center-of-plate proteins.”

The shift in the popularity of the frozen channel is likely due to several factors, including a lower price point and sustained shelf life and category launches like plant-based chicken nuggets and tenders as well as plant-based filets, steaks and cutlets.

Though 63% of households purchasing plant-based meat made repeat purchases within the category (second only to plant-based milk at 76%), major opportunities still exist to reach more households. In 2022, less than one in five households purchased plant-based meat.