Campbell’s: Betting On Snacks, Sovos Deal To Buoy Margins

Campbell Soup Company executives were “pleased” with the company’s Q4 results marking a fiscal 2023 where the company made key moves to position itself for growth in Snacks and diversify its options in Meals for the coming year.

In the food and beverage company’s earnings report, released Thursday morning, net sales were nearly $2.1 billion, a 4% increase from Q4 2022. Adjusted gross profit margin for the quarter was 31.7% compared to 28.7% in the period last year.

The gross profits were generally in-line with expectations; yet, driven slightly down by unfavorable volumes offset by price realization and supply chain productivity improvements.

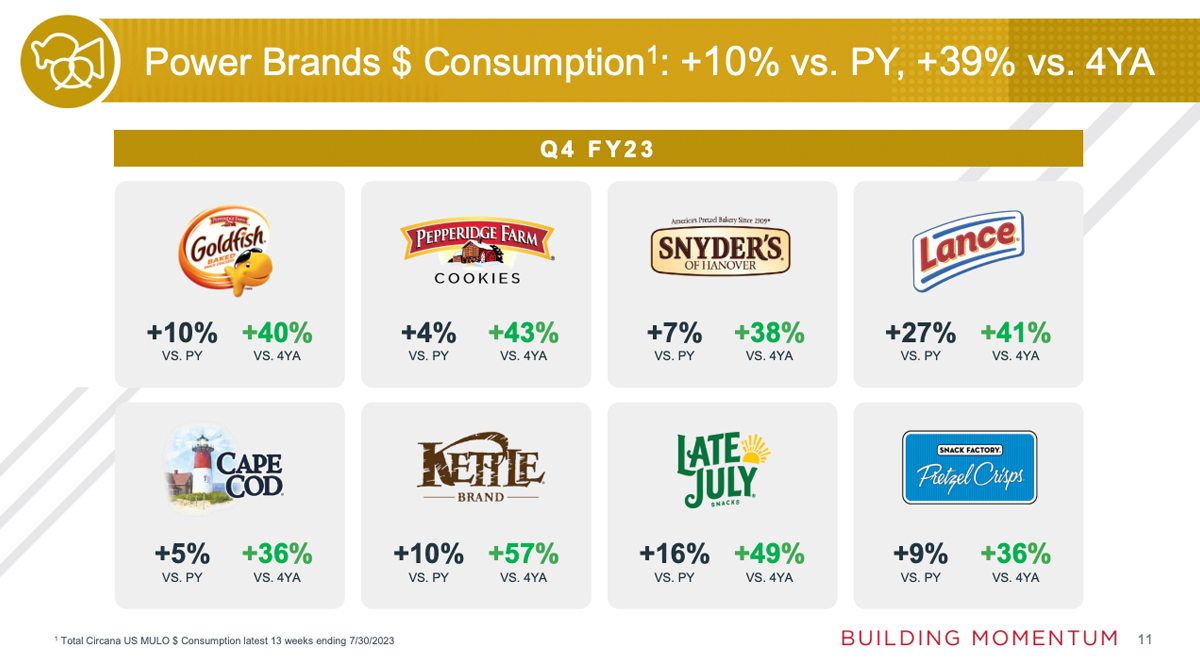

Campbell’s CEO and president Mark Clouse reiterated Campbell’s strategy of prioritizing its snack category, highlighting the “strong in-market momentum” and “remarkable resilience” of its hero snack brands in the face of more value-based competition and rising cost to consumers from inflation.

Snacks showed double digit dollar consumption growth for the fifth consecutive quarter with net sales up 8% in the quarter and +13% for FY2023.

Overall, full year sales were up $9.3 billion versus $8.5 billion in fiscal year 2022.

The company was confident that its recent acquisition of Sovos Brands portfolio would help strengthen and improve Campbell’s Meals and Beverages category, which only grew net sales 1% during the quarter. The deal announced earlier this month is expected to bring “the most compelling growth story” to Campbell’s portfolio providing “significant growth opportunities,” Clouse said in prepared statements.

Campbell’s reported that it had delivered $890 million in savings and remains on track to deliver $1 billion by the end of fiscal 2025 under its multi-year cost savings program.

Clouse flagged that limited volume recovery has been a result of high inflation and has dragged down its Meals and Beverages brands. Consumers are being drawn to value-based options and limiting their basket sizes by prioritizing categories based on more immediate needs, he said. “This pattern of behavior resulted in a real focus on seasonal priorities and has obviously created a headwind on categories like soup in the summer.”

Company leadership warned that the first half of 2024 was expected to be slower as Campbell’s integrates the new brands into the portfolio, but was confident that steadying inflation data and a move into the colder seasons would sequentially improve margins into the back half of the year. Sales guidance for FY2024 is expected to be between -0.5% to 1.5% with adjusted EBIT rising between +3% to +5%.

The company conceded that it did experience declines in adjusted EBIT and adjusted EPS during the quarter given “planned brand investments and the pension headwinds.” Clouse reminded investors on the call that the divestiture of the Emerald Nuts brand in May would most likely “reduce net sales by approximately a half a percentage point and have a one cent per share dilutive impact in fiscal 2024.”