Report: Healthy Foods Makes Up Less Than 50% Of Sales

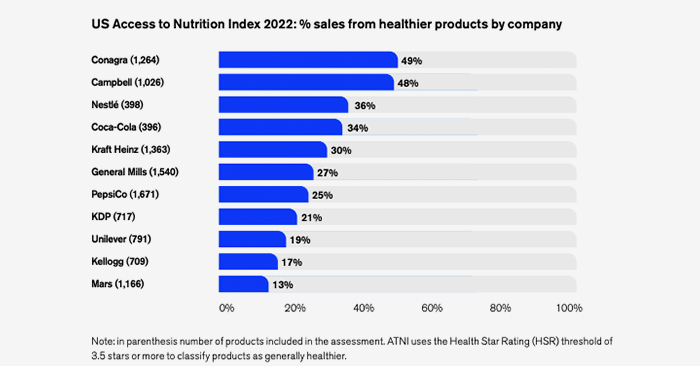

Despite initiatives and promises, healthy products make up less than half of food sales by the 11 largest U.S. food manufacturers, according to the 2022 U.S. Access to Nutrition Initiative (ATNI).

That group – which includes Kellogg’s, Unilever, PepsiCo, Campbell, Nestlé, Coca-Cola, Mars, Keurig Dr Pepper, Kraft-Heinz, General Mills and Conagra – since the last Index report in 2018, but results are still disappointing, the organization reported. The Netherlands-based non-profit group issues its guidance on global nutrition challenges through data gathering and reports such as its country-specific Spotlight Indexes and the Global Index which is conducted every two-to-three years

The combined product portfolios of all eleven companies account for approximately 30% of all US food and beverage sales and represent around $170 billion of sales value in 2021.

When asked what would be considered successful, ATNI executive director Greg Garrett told NOSH that exceeding the 50% threshold of sales deriving from healthy foods would be considered very good.

“None of them are doing that at the moment. The highest is 49%,” he said.

Unilever led the group with an overall score of 5.5 (out of ten) with Kellogg’s ranking second. Kraft-Heinz and Coca-Cola brought up the rear in the 10th and 11th spots respectively.

The ATNI methodology uses seven categories that are weighted to determine a company’s score on healthy products. These include: nutrition governance and management, product portfolio healthiness score, reformulation targets and healthiness criteria, access and affordability of healthy foods, responsible marketing, workforce nutrition, labeling, and lobbying in support of public health interests and engaging external stakeholders to improve companies’ nutrition strategies. The first four categories represent 85% of the scoring system. But Garrett cautioned against using the final score as the true barometer as to how each company is doing.

“What we’re most concerned about is: Are products hitting the shelves that are healthy?” he said. “Some of the things around governance and strategies, responsible marketing are very, very important, but at the end of the day, we want to see the products being healthy.”

The report did highlight some positive changes since the last Index was published. Eight of the 11 companies are evaluating healthiness in their portfolios as part of their ESG frameworks. Nearly all of the companies have also committed to supporting nutrition among their workforces.

Campbell’s has started to track the prices of its healthier products versus its general product portfolio. General Mills, KDP and Unilever are all now disclosing sales from healthy products in the U.S. and Unilever has begun to take into consideration how it produces foods for low income consumers, Garrett reported.

Yet, there is room for improvement. “I don’t believe any of the companies have fully adopted the World Health Organization’s guidelines in their products around salt, sodium and trans fats,” he said.

ATNI focused its recommendations for improvement on better communication between consumers and food manufacturers. Interpretive front-of-pack labeling systems have been implemented by six companies on more than 80% of their products and nine companies display online information for more than 80% of their product portfolios.

A clearer policy on affordability and accessibility of healthy products would also make a difference in diet-related health outcomes, the report suggested.

The federal government has put healthy food and hunger at the center of the public health debate in an effort to move the needle in the right direction. In September, the FDA issued its guidance on “healthy” labeling just as the Biden Administration addressed food policy at the White House Conference on Hunger, Nutrition and Health.

The problem is that profits are often outweighing public health concerns when these issues are prioritized in food company decision making, Garrett said.

“We’d love to see consumers demand healthier foods, but we’d also love to see the government do a better job of subsidizing the right stuff, rather than the wrong stuff,” Garrett said. “That doesn’t let the industry off the hook. The industry needs to self-regulate better and take initiative to make sure their portfolios have more healthy products available.”

The Index report will be used to influence lawmakers on Capitol Hill as well as institutional investors in the CPG food industry. Through ATNI’s investor platform, the organization has access to investment groups who have influence among these food companies and can help emphasize more healthy food marketing, innovation and implementation.

“They hold the money, they hold the investments and they have power therefore to influence much more than we do,” Garrett said. “If we can get them to change company behavior, through their investments. That’s the way to go.”