Proper Good Closes $3.5M Seed Round To Support Retail Debut

Shelf-stable, direct-to-consumer meal brand Proper Good has closed a $3.5 million seed funding round led by YETI Capital and The Artisan Group with additional participation from Doug Bouton, founder and CEO of Halo Top and Gatsby Chocolate. The new capital will be used to support the brand’s recent expansion into brick and mortar retail with a rollout to over 2,000 Walmart stores nationwide.

“When we were looking for investment partners, capital was only one piece of the puzzle,” said Christopher Jane, Proper Good co-founder and CEO. “More importantly, we were aiming to onboard operators who are equipped with deep expertise and knowledge of consumer behavior, and scaling products and premium brands across both DTC and retail.”

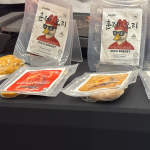

Launched by Jane and his sister Jennifer in 2020, Proper Good garnered a $400,000 investment for 20% equity from Mark Cuban during an appearance on Shark Tank in 2021. Since then, it has grown its product offerings to include breakfast occasions and an assortment of fully cooked and ready-to-eat soups, chilis and curries.

“What excited us from our first conversation with Chris was his experience and charisma, we invest in people first and Chris is the ultimate team player,” said Drew Zang, managing partner at The Artisan Group, in a press release. “The combination of a talented team with a brand and product offering that has mass appeal has positioned the business to scale quickly across multiple channels.”

The brand’s range of clean ingredient, single-serving products, which are available in plant-based, keto and gluten-free varieties, are priced between $5 to $7. It also offers a “spicy seasoning” that was developed per consumer requests for more spice-forward meals. The seasoning contains no calories, salt or sugar, and Jane claims it adds“just heat” rather than flavor so it can be added to any Proper Good meal.

According to Jane, the brand is looking to maintain wide consumer appeal by not tying itself to any specific diet trend. Proper Good communicates with consumers via Slack and Facebook groups to instantly generate feedback on new flavors, products and packaging. Jane said this consumer connection has allowed Proper Good’s innovation pipeline to set a target to launch new products every six to eight weeks.

“We don’t have a very polarized customer set – we have just as many 18-year old female students using our products at school as we do with 80-year old men trying to lower their sodium intake at home,” said Jane. “That broad end of the spectrum literally is our entire customer base, so Proper Good is well positioned to become a household name as a premium shelf-stable brand.”

In order to execute that goal, the founders recognized that Proper Good could not be a “DTC only brand.” That means continuing to build its middle-market position at Walmart, rather than pursuing natural and specialty retailers.

“We’re proud to partner with Walmart as our first entry into the brick-and-mortar scene, given that over 90% of the U.S. populations live within 10 miles of a Walmart store,” said Jane. “However, we’re able to move upstream into more natural, specialty channels in the future since we also offer super premium items made with high protein and low sugar.”

While Proper Good may fill some space in conventional retail for shelf-stable, clean ingredient instant meals, it isn’t cooking up an entirely new category. Plant-based brand Loma Linda currently offers a lineup of ready-to-heat meals at Walmart and Costco. Additionally, companies like The Good Bean, A Dozen Cousins and Tasty Bite have developed similar instant, shelf-stable meal concepts positioned around specific ingredients, diet trends or international flavors.

According to Jane, Proper Good will soon expand into “larger categories” and capture additional day-part-uses. The brand’s Overnight Oats line, introduced in August, matched dollar sales of its top selling oatmeal SKUs within 10 days of its launch, he noted. In March, meal kit delivery service Blue Apron expanded into breakfast and recently expanded subscription-free access with the launch of its Amazon store.

Other DTC-subscription meal delivery brands have worked to build similar platforms that cater to all day-parts, including Daily Harvest, which ships frozen and refrigerated plant-based products, and Kencko, which sells shelf-stable smoothies, snacks and meals. Although Proper Good aims to offer middle-market products, its price points are similar to those for a bowl or soup from Daily Harvest ($8.50 to $9.97) or a meal from Kencko ($4.99 each). However Proper Good’s move into retail subverts the subscription requirement for both Daily Harvest and Kencko.

“The prepared meals sector has been polarized to either $2-3 shelf-stable canned products made with a long list of unhealthy ingredients, or on the higher end, frozen delivery services that aren’t widely accessible from a pricing standpoint or easy to take on-the-go,” said Jane. “Proper Good effectively fills that middle-market need for the mass consumer.”

Disclaimer from Proper Good: YETI Capital is an investment vehicle created by the Founders* of YETI Holdings, Inc. (YETI: NYSE) (“YETI”). YETI Capital is not affiliated in any way with YETI.