NuAMP Crowdfunding Platform Launches, Designed For PoC Founders

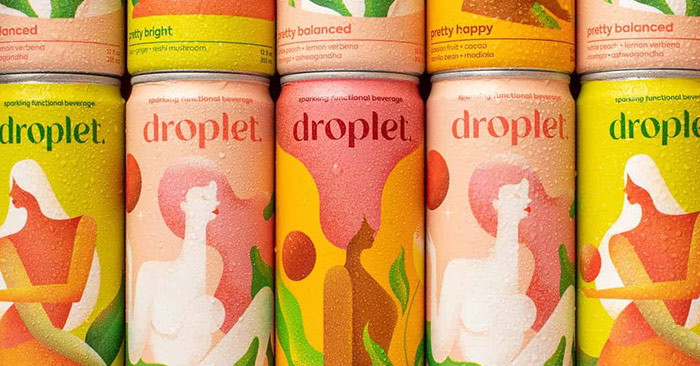

Female PoC-owned sparkling, adaptogen-enhanced water brand Droplet activated a crowdfunding campaign this month on NuMarket, in partnership with AMP, a new platform dedicated to connecting PoC founders with various forms of capital. Created in collaboration with community fundraising platform NuMarket and AMP, a tech company connecting PoC founders with funding resources, the NuAMP program debuted with seven active crowdfunding campaigns to support diverse founders across the country; beyond Droplet, that initial group includes Massachusetts-based grocer Destiny African Market, Tawakal Halal Cafe, and a variety of lifestyle and clothing brands.

“AMP is a technology company that believes strategic use of data can solve a resource allocation problem that has historically limited the potential of underrepresented entrepreneurs,” said Daniel Taylor, CEO and co-founder of AMP. “We’re proud to work with partners like NuMarket who help us establish equitable paths to growth capital for diverse segments of entrepreneurs.”

AMP, which was founded in June 2020 in the wake of the murder of George Floyd, successfully connected 81 businesses with financing during its first year. According to data from Forbes, women and minority owned businesses receive 80% less than the median investment in their businesses compared to businesses overall, despite returning capital at higher-than-average rates. AMP’s goal is to give founders access to the “funding opportunity landscape and prepare them to receive funding, and ultimately it automates their connections to lenders and alternative funding providers as pre-qualified candidates,” said AMP co-founder William Hayden.

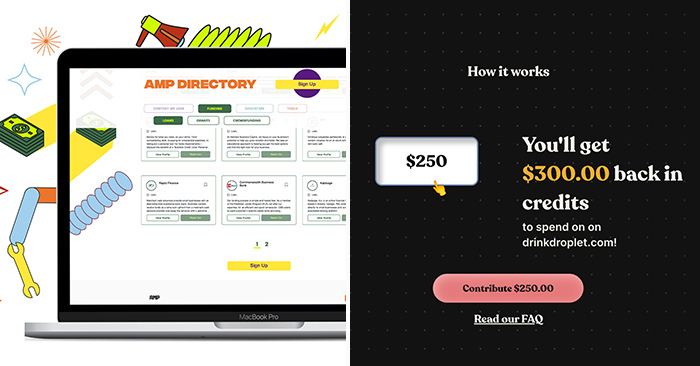

What is NuAMP?

NuAmp is a collaboration between AMP and NuMarket to extend that goal by allowing brands to raise capital from their own communities. Unlike crowdfunding sites GoFundMe and Kickstarter, there aren’t any compensatory product requirements for NuMarket and, even if a project does not reach its goal, all raised capital is still retained. Contributors receive 120% of their donation back in credits to spend on the company after the campaign ends, giving founders both a quick capital boost and continued demand.

“As a direct-to-consumer and product-based company, that’s all you can really ask for – your customer loves you so much that they want to support you and buy more stuff from you,” said Droplet co-founder and CEO Celeste Perez. “It’s like a gift certificate, but because of the way it works, it gives us the cash injection that we really need that comes without all the strings of giving up equity or getting debt capital.”

NuAmp is another significant step toward AMP’s overall goal. The company began by gathering insight from minority and women-owned and operated businesses, aiming to learn about their pain points and create tech to address them. After connecting with over 200 entrepreneurs, the company’s three co-founders built AMP into a “data-driven marketplace” emphasizing education and resources for entrepreneurial founders to increase access to funding.

“Our journey with Droplet is an amazing display of the capability we’re building, where we can help a business secure access to capital in various forms on a journey to sustainable growth,” said Hayden. “We continue to work with entrepreneurs and partners to bridge the gap between communities and funding providers to ensure that every diverse entrepreneur has a clear path to economic equity with equitable financing.”

AMP has partnered with a wide range of other strategic advisors, investors and firms to continue supporting the growth of its “amplifier” brands including Altrinsic Global Ventures, Common Thread Collective, Silver Lining, Boylston Group Investment Firm, Uncapped, 1921 Institute and Ferris Ventures.

What does this mean for Droplet?

Perez has struggled to secure capital, but said that since getting involved with AMP last year, she has been able to facilitate conversations with VCs in addition to being exposed to various alternative funding methods like loan and grant programs. After Droplet “went viral” last summer she said the two year-old company has been seeking outside capital to support its continued growth but related the fundraising process to a second full-time job – one that her lean team couldn’t afford to heavily dedicate time toward.

“First and foremost, that’s how we even got here, to this place, right now – our community really wants us to survive,” said Perez. “We haven’t done any paid advertising and it’s really just been sustained based on our community investing in us, by buying from us so this is one of my favorite ways to approach [funding].”

Aside from a few small checks (“not even the price of a Chanel purse,” Perez said), the company has sustained itself on withdrawals from her own 401k and the revenue it has generated thus far. With this injection of capital, Perez believes Droplet will be able to reach its next level of growth, including expanding its retail presence in addition to launching new SKUs. The campaign, which runs through the end of the month, has raised $5,919 of its $50,000 goal at the time of publication.

Perez, who also works in brand building for venture capital firms and celebrity accounts, said she was shocked by how challenging it has been to secure funding for her company, despite the core tenets of this process being what she does for a living.

“I thought it would be easier to [raise] money,” stated Perez. “I thought it would be easier to put this out there because we’re put together in so many different ways, but there is just an institutional challenge. With AMP community, half that work has been done for me and all I’ve got to do is close the deal.”

According to Pitchbook and PepsiCo, only 2% of venture funding goes to women. The statistics narrow even further, to 0.2%, when you factor in being a woman of color, Perez cited. AMP’s goal for 2022 is to match businesses with “equitable debt to help fill the $76.8B lending gap in today’s market.”

“You don’t want to think that the odds are so stacked against you,” said Perez. “But when you look at the track record of how many people I’ve spoken to and all of that, even though everybody has such kind things to say, they know of us, they know what we can do and they know what we’re going through — opening up their pockets is a different story.”