The Checkout: Stonyfield to Hire Former Horizon Suppliers; McPlant Hits the U.S.

Welcome to The Checkout: an express lane for weekly news you need to know, always 10 items or less.

Stonyfield Opens Direct Supply Program to Former Horizon Suppliers

Yogurt maker Stonyfield Organic is stepping in to assist Northeast-based organic farms following Danone North America’s termination of over 89 contracts with regional farmers who supply to its dairy brand, Horizon Organic.

In August, supplier farms from Maine, New Hampshire, Vermont and some regions in New York contracted to produce milk for Horizon Organic received non-renewal notices from Danone, with their contracts set to end in August 2022. The company cited transportation challenges as the reason for the move, as it seeks to source dairy from Pennsylvania, New York and Ohio.

Stonyfield, based in Londonderry, New Hampshire, announced this week it will welcome a group of these family farms into its Direct Supply Program. In a press release, co-founder Gary Hirshberg said the company would establish an internal task force to collaborate with state departments of agriculture, nonprofits and retailers to find additional solutions for farms it’s unable to bring on as a supplier.

“The potential loss of 89 organic family farms would be a devastating loss for our region and our environment,” Hirshberg said. “When we heard about the contract terminations, we knew we had to step up and help as many farms as we possibly could. It’s a challenging time for the organic dairy market to absorb more farms, but we can’t just stand by and watch these farms in our own backyard go out of business.”

The number and names of the farms Stonyfieldis able to work with will be shared over the coming months, the company said. Under current operations, it works with over 200 organic farms in the Northeast through a milk supplier partnership with Organic Valley and its own Direct Supply Program.

Stonyfield’s announcement is among several recent efforts to support these dairy farmers. Last month, U.S. Senate Majority Leader Chuck Schumer joined with several senators in sending a letter to USDA secretary Tom Vilsack asking the agency to support the farmers affected by Danone’s non-renewal notice. This support would include expanding the USDA’s Pandemic Assistance for Producers as well as investments in processing capacity and transportation efficiencies.

“Working landscapes and family farms are foundational to our region, and a healthy, viable organic dairy market is essential to the economic, environmental, and social fabric of our states,” the letter said.

McDonald’s Brings McPlant to the U.S.

McDonald’s is bringing the McPlant, its burger co-developed with Beyond Meat, to the U.S. next month, the chain announced this week. The burger was unveiled last year and has been tested in international markets such as Sweden, Denmark, the Netherlands and the United Kingdom.

Starting on November 3, the burger will hit eight locations for a limited time, including McDonald’s in Texas (Irving and Carrollton), Iowa (Cedar Falls), Louisiana (Jennings and Lake Charles) and California (El Segundo and Manhattan Beach). The burger is made from plant-based ingredients such as peas, rice and potatoes, though it’s served with dairy products such as mayonnaise and American cheese.

“We’re always testing new items and flavors, and this particular test will help us understand how offering a burger with a plant-based patty impacts the kitchens in our restaurants,” the chain said in a statement.

When McDonald’s first announced the McPlant last November, the chain claimed the product was made “for McDonald’s, by McDonald’s,” bringing into question Beyond Meat’s supplier relationship with the chain and raising concerns Beyond Meat amongst investors after it had tested a plant-based burger with Beyond Meat in Canada in 2019. Their supplier relationship was clarified in February, when the two formed a three-year strategic global agreement for Beyond Meat to be the supplier for the McPlant patty. Beyond Meat and McDonald’s will also co-develop other plant-based menu items across chicken, pork and egg to broaden the McPlant platform.

National Confectioners Association Releases Chocolate Consumer Report

The National Confectioners Association (NCA) this week published a report exploring shopping habits and consumption preferences across mainstream, premium and fine chocolate, looking at changes in the chocolate category after COVID-19 “dramatically changed shopping behaviors,” according to NCA president and CEO John Downs.

The report included a survey among 1,506 consumers aged 18 to 75. The survey found that 80% of consumers purchase chocolate in at least two of the three chocolate segments. While 83% of shoppers buy from mainstream chocolate makers like Hershey, 67% purchase premium chocolate like Lindt or Ghirardelli and 29% indulge in fine chocolate. Only 27% of consumers said premium chocolate was their regular chocolate choice, however, while just 5% said they typically buy fine chocolate. Despite this, interest in fine chocolate is growing, the NCA found, especially among younger consumers in urban areas with above-average incomes.

Mainstream and premium chocolate buyers prefer national brands over private label brands, making up 98% of chocolate sales, according to the survey. However, there is no clear preference between European-made or American-made chocolate, with 46% of shoppers reporting they don’t recognize a difference between the two.

Premium and fine chocolate consumers are also increasingly interested in ingredients and sourcing, up from 16% in 2018 to 25% in 2021, with Central American and Africa serving as their top sourcing picks. Consumers, particularly millennials, are also concerned about responsible labor practices (63%), sustainable sourcing (59%) and production transparency (58%). Fair trade certification influenced purchasing decisions for 49% of chocolate buyers, while other on-pack callouts like dairy or nut-free had “relatively little influence” on purchasing, the survey found.

As shoppers consolidated shopping trips during the pandemic and turned to ecommerce shopping, 10% more consumers purchased chocolate at their primary grocery stores than in 2018. Online chocolate shopping increased 15% from 2018 to 2021, with shoppers also buying from brick-and-mortar retailers with online ordering. Still, consumers continued to buy from a variety of other channels such as convenience stores.

Thrive Market Launches Shoppable Cookbook

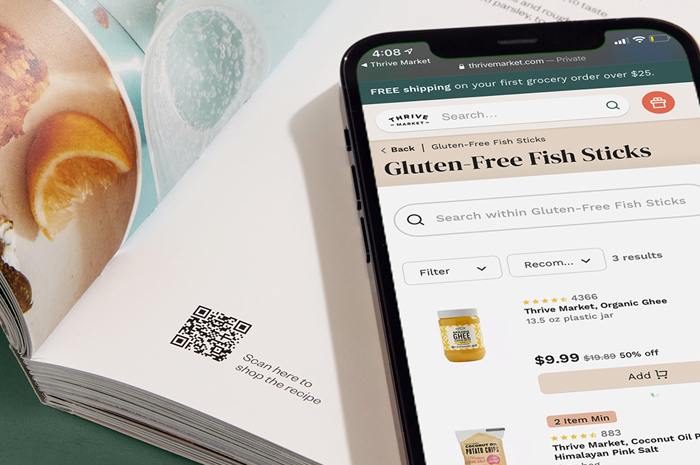

Thrive Market this week launched “Healthy Living Made Easy,” which the online retailer says is the world’s first shoppable cookbook. Available for sale on Thrive’s website, the book features over 60 recipes that allow readers to directly shop for ingredients on its online marketplace.

The book includes recipes created by a number of chefs along with food and beverage founders such as Primal Kitchen’s Mark Sisson, Moon Juice’s Amanda Chantal Bacon and Whole30’s Melissa Urban.

Each recipe features a QR code that shoppers can scan on their phone, bringing them to a list of ingredients they can purchase on Thrive Market. A gluten-free fish stick recipe, for example, links to organic ghee and potato chip products on its site. Recipes are tailored to special diets including gluten-free, nut-free, dairy-free, grain-free and vegan.

“We recognize that this is the time [for consumers] to vote with their dollar: and we’re removing another barrier to entry for shopping for good-for-the-planet goods by sharing sourcing stories and background on hundreds of products throughout the book, highlighting the personal stories behind each,” Thrive Market co-founder and CEO Nick Green said in a press release.