The Checkout: Hakuna Brands Rebrands to Must Love; Red Clay Hot Sauce Raises $1.5M

Welcome to The Checkout: an express lane for the weekly news you need to know, always 10 items or less.

Hakuna Brands Rebrands to Must Love

Non-dairy frozen dessert maker Hakuna Brands announced this week it has rebranded, combining its two brands, banana-based Hakuna Banana and oat milk-based Totes Oats, under a new moniker: Must Love.

Must Love will continue to offer pints and bars with each of the two original bases and will instead use front of pack callouts to differentiate between the bases. The full range of products, which also use coconut and dates as key ingredients, are now available at Sprouts chainwide, and will also be launching in Whole Foods.

Co-founders Mollie Cha and Hannah Hong launched the company in 2017 with Hakuna Banana and expanded its offerings in 2019 with its second brand, Totes Oats. Hong told NOSH last year the company chose to launch Totes Oats under a different brand name to avoid confusion among consumers as well as to maintain the “playfulness” of the banana imagery for the Hakuna Banana brand. However, Hong said the company ultimately decided to unite the two brands under one name this year because “it was becoming a challenge to keep up with both brands as they were each taking off,” Hong said, especially as a “small startup.”

“They were quite different and didn’t have anything to unify them when it came to names and packaging,” she said. “But the products themselves complement each other—both are plant-based, everyday indulgences without a lot of refined sugars. It just made sense to bring them together to be able to focus our efforts on one brand.”

The new brand name also offers opportunities to expand its dairy-free frozen dessert offerings with different bases and products, Hong said, though the focus for the company will be on growing distribution of its current offerings and increasing consumer awareness about the rebrand.

Red Clay Hot Sauce Raises $1.5M

Red Clay Hot Sauce, maker of cold-pressed, barrel-aged hot sauces, announced this week the close of a $1.5 million seed funding round, which the South Carolina-based brand will use to support expanded retail distribution and the launch of a new product line.

Individual investors in the round included Jay Bush of Bush Brothers & Company, makers of Bush’s canned beans, as well as a number of restaurateurs in the Southern U.S. The funding round was the company’s first equity financing following a friends and family convertible note in 2019, according to co-founder and CEO Molly Fienning.

The brand will use the funding to support the rollout of its hot sauces and hot honeys to 1,200 Publix stores across the Southeast, along with Whole Foods Market Southeast Region and The Fresh Market. Following a test run on its website at the end of last year, Fienning said the brand will also be launching a new seasoning line this year, which will include Spicy Everything Salt, Charleston Harbor Spice, Spicy Red Mash, Spicy Margarita Salt and Spicy Bloody Mary Salt. The brand will also launch its seasonal Red Clay Pepper Jelly to its portfolio full-time after an online test launch in November.

Red Clay also plans to invest in hiring and marketing efforts, Fienning said. The brand recently hired a new VP of operations, Thomas Madjar, formerly VP of supply chain at HighKey Snacks, and plans to add more team members this year.

While the brand was previously focused on foodservice and hospitality prior to the pandemic, Fienning said the brand pivoted to online sales through its own direct-to-consumer website and Amazon last year. In 2020, the brand reached $1 million in total revenue, with a 300% year-over-year increase.

“We finished the year exceeding our revenue goals, which feels good, and launching 4 SKUs in all Publix doors this month, which feels even better,” she said. “In addition, we’re blessed to have investors with confidence and trust in our ability to grow, scale and make thoughtful decisions.”

Hershey’s Reports Q4 and Full-Year 2020 Earnings

On its Q4 earnings call this week, The Hershey Company reported 5.7% consolidated net sales growth for the quarter and 2% growth for the full year.

Growth was driven by strong sales of the company’s chocolate brands, baking items and salty snacks. While Skinny Pop and Pirate’s Booty both experienced retail sales growth in 2020, ONE Brands’ sales declined 5% for the year as retailers shifted shelf space from on-the-go nutrition bars to protein drinks and powders. CEO Michele Buck said the company expects these trends to be temporary and is currently focused on supporting the company’s top SKUs.

Looking ahead, the company said it expects 2% to 4% net sales growth for 2021. Its main focus will continue to be its confectionary business, Buck said, and the company also plans to expand these offerings with new better-for-you products. This spring, the company plans to launch Hershey’s and Reese’s organic lines, as well as relaunching its sugar-free lines for both brands with “Zero Sugar” callouts.

The company has maintained an active M&A strategy, recently acquiring ONE Brands in 2019 and Amplify Snack Brands in 2017. In 2021, Buck also said the company will continue to look for acquisitions that can expand Hershey’s portfolio beyond confectionary items.

“If you look at our M&A strategy, clearly, it is focused on us capturing incremental snacking occasions,” she said. “Some of the ways that we look at that is, clearly, we do have a pretty sizeable business in sweet, indulgent-type products, and as we look at consumers’ broad snacking needs, clearly, salty, savory and better-for-you are opportunities where our portfolio is underdeveloped.”

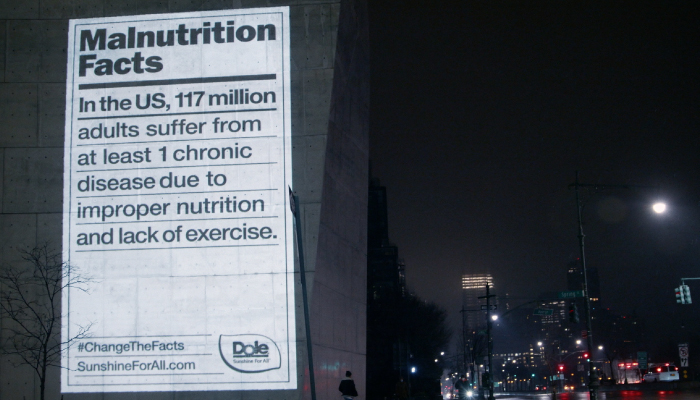

Dole Launches “Malnutrition Label” Marketing Campaign

Dole this week launched a new experiential marketing campaign aimed at raising awareness about the global issue of malnutrition.

The out-of-home campaign features advertisements depicting “Malnutrition Labels,” modeled after the traditional nutrition label found on food packaging, in New York, Los Angeles and Baltimore. The labels highlight facts regarding global food insecurity, obesity and systemic food inequity, citing statistics like the nearly 700,000 annual U.S. deaths due to nutrition-related diseases and the 117 million adults who suffer from chronic diseases related to improper nutrition and lack of exercise.

“We believe that good nutrition should be like sunshine – accessible, available, affordable for everyone, not just a few,” Rupen Desai, Dole global CMO, said in a press release. “Given we cannot do this on our own, Malnutrition labels is our way of raising awareness and calling for systemic change to address nutrition inequality.”

The campaign, which will also be supported by digital and social media content, is part of “The Dole Promise,” a set of goals the company announced last June which include a target to expand access to sustainable nutrition to one billion people and move toward zero processed sugar in all Dole products by 2025. The company plans to do this by improving its end-to-end value chain, forming partnerships with organizations to support sustainable supply chains and nutritional food innovation. The company also launched the Sunshine for All Investment Fund last year, working with innovators and start-ups focused on crop nutrition and protection, food waste, food safety and nutrition and ingredients.

Frito-Lay, Dairy Farmers of Wisconsin Project Super Bowl Snacking Stats

Despite a lack of social gatherings due to the Covid-19 pandemic, Americans still are projected to increase their snacking to celebrate this Sunday’s Super Bowl LV. According to results from Frito-Lay’s U.S. Snack Index, the company estimates that snacking will grow 21% compared to last year’s Super Bowl LIV.

The Super Bowl is consistently one of the year’s biggest snacking days, with 80% of consumers stating the Super Bowl “isn’t complete” without snacks, according to the company. Gatherings will look a bit different this year, however, as 45% of Americans plan to change their typical Super Bowl plans, with 56% planning to watch with members of their own households.

To stock up on snacks, 86% said they plan to shop in the week leading up to the big game, while 25% expected to do last-minute shopping just hours before kickoff. Two-thirds of consumers planned to grab their snacks in-store, while 10% said they would order them online. A little over half of consumers are opting for snacks with classic flavors at their gatherings, while 52% plan to try something new. Topping the list of preferred snacks is salsa, followed by cheese dips and spreads, French onion dip and guacamole.

Elsewhere, Dairy Farmers of Wisconsin projected that football fans will consume 20 million pounds of cheese while watching the Super Bowl this weekend, the equivalent of 1.7 million wheels of cheese. According to Google trends data which looked at most popular Super Bowl snacks by state, 28 states named snacks featuring cheese as a top choice.

The group also noted that cheese sales in 2020 increased 13% year over year.