Pete and Gerry’s Former CEO on Sale: ‘We Were at an Inflection Point’

For organic egg brand Pete and Gerry’s, it was time to expand the flock. The company announced last week that it had sold the majority of its business to Butterfly, a Los Angeles-based private equity firm, with British Columbia Investment Management Corporation also becoming a new minority investor.

Terms of the deal were not disclosed but former CEO and owner Jesse Laflamme will retain a minority stake in the business and, although no longer involved in the day-to-day running of the business, will continue to serve as an advisor. Taking over for Laflamme as CEO will be former COO Erik Drake, who previously oversaw the integrations of both Late July Snacks and Stonyfield Farms.

The company plans to maintain its Monroe, New Hampshire headquarters and second facility in Greencastle, Pennsylvania.

With roots dating back to a small family farm established in the 1800s, it was in the 1980s that Laflamme’s parents decided to shift the business to focus solely on organic eggs. When Laflamme took over as CEO in 2000, he evolved the business once again. Rather than produce all the eggs for Pete and Gerry’s and its sister brand Nellie’s themselves, the company developed a network of 130 family farms to assist with production — offering an easier avenue for marketing, sales and distribution.

Animal welfare and sustainable farming practices have always been the company’s point of differentiation. In 2003 the company became the first Certified Humane egg producer in the U.S. and in 2013 the company became the first egg producer in the world to achieve Certified-B corporation status.

Customers, Laflamme said, have flocked to the brand. According to IRI data provided by the company, Peteand Gerry’s is the number one selling organic egg brand while Nellie’s is the top selling free range egg brand. The company is expected to have $260 million in sales in 2021.

Still, despite the growth, Laflamme said he realized there was only so far he alone could take the company.

“With 21 years of doing this and, and a lot of years being a struggle, I just felt like it was time to make a change and look at having a second act,” Laflamme said. “It really occurred to me that we were at an inflection point where we needed to think bigger, and by bigger I mean real capital and big picture thinking…wrapping my head around that level of spending, that leap, I just wasn’t ready for it. I started to realize that for that reason, maybe I was holding the business back for what it could be.”

Once he made the decision to sell, there were plenty of options for partners, Laflamme said. Part of the interest, he believes, was due to last year’s IPO of dairy and egg business Vital Farms, which brought increased attention to what he said was an overlooked section of the store. Butterfly, Laflamme said, stood out from the start, with its 2019 acquisition of Bolthouse Farms lending credibility to its ability to work with large networks of farmers.

At first, the focus will be on investing in distribution, particularly in the Western half of the country, Laflamme said. Pete and Gerry’s has an ACV of 60% while Nellie’s is just over 40%, the brand shared.

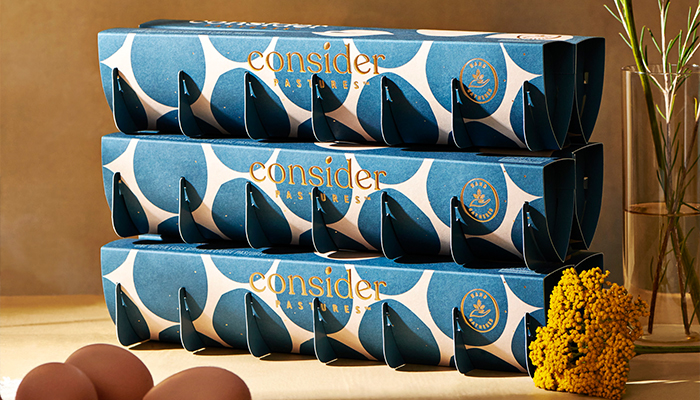

Pete and Gerry’s also launched Consider Pastures, the first regeneratively farmed egg brand, late last month. To date the line has minimal distribution for its unusually packaged eggs, which are sold in Whole Foods Markets in the Northeast region, and Co-op Food Stores of the Upper Valley in New Hampshire and Vermont.

Moving forward, Laflamme also sees an opportunity in developing value-added products such as hard boiled egg kits, breakfast sandwiches, sous vide egg bites and an organic version of Ore-Ida’s Just Crack an Egg microwavable scrambled egg cup. Other producers have already entered into this space, with Egg Innovations acquiring hard boiled egg brand Peckish and Organic Valley launching Egg Bites.

Pete and Gerry’s previously tried to tap into these segments, launching hard boiled eggs and even investing in smaller emerging egg-based products. The company traded equity in shelf-stable omelette bar Scramblers in exchange for egg-based ingredients and previously made a small investment in CleverFoodies Scrambles, a vegetable base designed to be added to eggs for easy omelettes. Though the latter had potential, Laflamme said, Pete & Gerry’s was not able to devote enough attention to it and the product was not convenient enough for consumers.

Now with Butterfly’s backing, he said, the company has the room to invest more in R&D and possibly make investments or acquire other companies.

“We’re seeing the power of [other egg] brands in adjacent categories,” Laflamme said. “If you find where your brand has the right to win, it’s like, why not be in that space? And this partnership is going to allow us to have the resources to understand [these opportunities], pursue them, and support them for success in a launch.”

Butterfly was not able to comment in time for the release of this story.