IRI Identifies Trends and Strategies for Success in Frozen and Plant-Based Meat

Variety Key to Success in Changing Frozen Food Category

The frozen category has seen unprecedented growth since the onset of the pandemic, and with new shopping trends comes new opportunities for success. In a webinar last week, Sally Lyons Wyatt, EVP, Client Insights at IRI, Christine Boule, Principal, Client Insights at IRI and Alison Bodor, president and CEO of the American Frozen Food Institute, delved into the growing frozen food segment and identified ways brands can navigate the category to win in retail.

Frozen food sales grew in omnichannel (9.9%) and brick-and-mortar locations (6.2%) over the last year, outpacing the growth of total food and beverage sales. Frozen also leads in unit sales growth across all food and beverage categories, an indication that growth is being driven by lower pricing, Wyatt said, adding that the segment hasn’t seen quick price hikes like its fresh counterparts in the store such as meat, seafood, fruit and vegetables. Dollars per buyer and product trips per buyer in the frozen category were also up.

The demographics and shopping habits of frozen food consumers have also evolved. Wyatt said frozen consumers are increasingly younger, more diverse and are now made up largely of households with children. These cohorts are all spending more in the frozen segment, she said, particularly in the ecommerce and club channels. However, while these consumers tend to repeatedly purchase staples like plain vegetables and meat online, the brick-and-mortar channel, which still holds 87.5% dollar share for the frozen category, tends to be where shoppers seek more variety. Because of this, “assortment will be key going forward,” particularly online, Wyatt said, especially in frozen snacks and desserts.

“Novelties, pies, ice cream, appetizers, snack rolls, these are categories that consumers might not always want to get the exact same thing they bought before,” Wyatt said. “They may be looking for new variety, new types, new flavors, new innovations that maybe are a little harder to find online, so it’s an opportunity for the industry to find ways to approach the variety seeking consumers online a bit differently.”

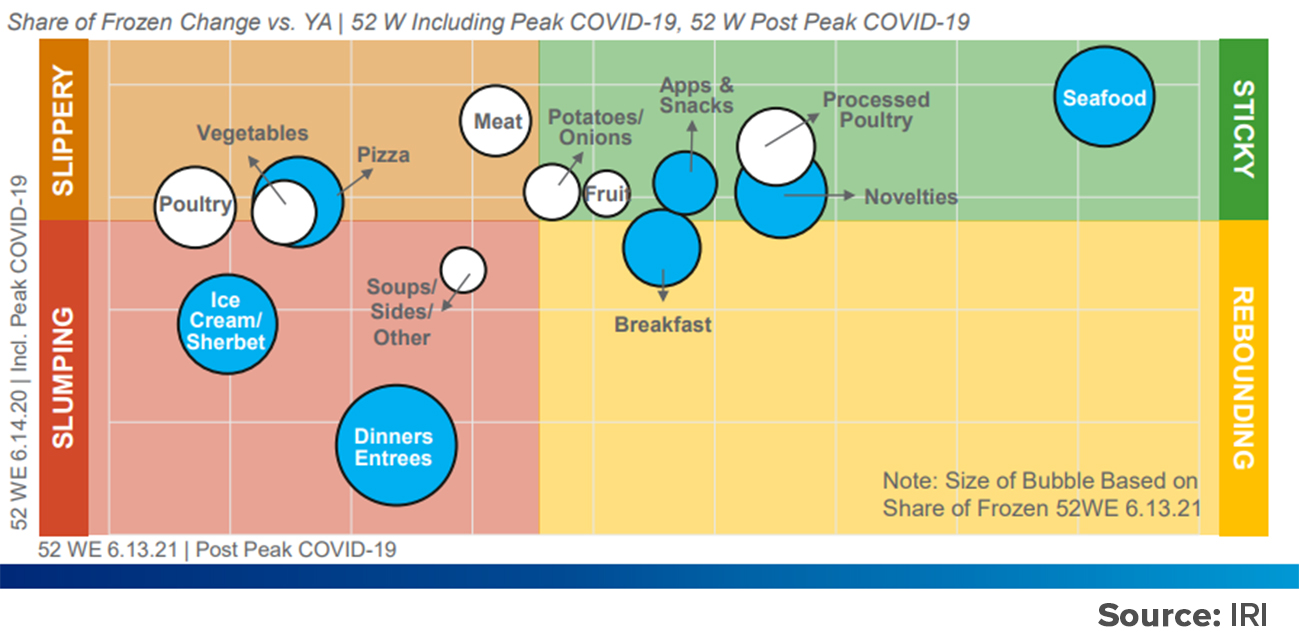

“Sticky” categories in frozen — segments that IRI said not only saw share gains during peak COVID last year but have continued to grow — include seafood, appetizers and snacks, and novelties. Meanwhile, though frozen breakfast items saw sales dip during peak COVID, the segment is rebounding, Boule said. Frozen vegetables and pizzas saw share gains during COVID, but these are “slippery” gains as consumers return to restaurants. Ice cream and dinners and entrees have been “slumping” in terms of share gains in the frozen category both during peak and post-peak COVID, though frozen dinners and entrees have rebounded from early June to July of this year, Boule noted. Still, sales across all categories continue to grow, led by seafood and appetizers and snacks.

Boule also broke down the trends within each frozen segment that have gained the most traction and notched significant growth since peak COVID. In snacks, hot and spicy frozen products and Asian offerings like frozen wontons grew 28%. Within Asian snacks, both “Americanized” favorites and authentic and regional snack offerings expanded, while buffalo SKUs drove hot and spicy growth. Frozen pizza sales were up 21.9% in 2020, but as delivery quickly rebounded, sales have levelled to pre-pandemic numbers and are currently up 3.5% year-over-year. Non-traditional crusts like cauliflower are driving notable growth in pizza, Boule noted.

Single-serve frozen dinners and entrees are contributing to growth in frozen meals, outpacing sales in 2020, Boule said. Both comfort and traditional single-serve meal brands and “adventurous brands” — offering non-European ethnic cuisine — have grown sales over the past year. Within single-serve meals, Boule noted that there’s been an “evolving perception” of what “healthy” means to consumers, as claims like “low calorie” and “fat free” are declining and low carb, high protein and gluten-free are growing.

“We’re seeing this across the store, but the perception of what healthy is is kind of transitioning from deprivation and low fat, low calorie to more of a holistic view of what am I putting into my body? Is it clean? It’s more about holistic thinking, total health and how I’m personalizing my diet to meet my own needs,” Boule said.

In breakfast, entrees and handhelds led dollar growth, and convenience will be “paramount in retaining buyers,” going forward, Boule said. Because of this, portable options like sandwiches and wraps are notable opportunities for brands, particularly in larger pack sizes. While ice cream is still the category share leader, frozen novelties are a growing segment within ice cream, Boule noted, appealing to consumers both because of their portion control and snackable format but also due to the wide variety of flavors, form factors and special diet-specific options like plant-based and keto.

Going forward across categories, brands will need to fine tune their messaging as consumers become more mobile post-pandemic, which includes connecting with consumers through social media, Bodor noted, especially as regular frozen consumers increased their shopping frequency during the pandemic. As a result, consumers have become more adept at pairing fresh and frozen items, so social media presents an opportunity for brands to share recipes with consumers to create full meals.

Opportunities in Growing Plant-Based Meat Segment

Plant-based meat’s popularity continues to grow, bringing in $7 billion in sales last year according to the Plant-Based Food Association. Earlier this week, IRI dug into how brands can capitalize on this growth and what consumers are looking for in meat alternatives going forward in another webinar led by Anne-Marie Roerink, president at 210 Analytics and Jonna Parker, Principal IRI Fresh.

Traditional meat still reigns supreme in retail, bringing in $40 billion in the first half of 2021, and plant-based meat size and growth patterns are similar to those of niche meat offerings, Parker noted. There is a notable overlap between meat and meat alternative purchases, however, as those who purchase meat alternatives in traditional grocery stores are much more likely to also engage with plant-based meat.

While the majority of consumers still consider themselves meat eaters, the percentage of consumers identifying themselves as flexitarian with a “plant-forward” diet is on the rise. This does not necessarily indicate a “freefall from meat,” Roerink said, as the flexitarian diet focuses on protein variety, increasing consumption of plant-based foods and seafood rather than decreasing meat consumption. Still, 34% of the population wants to “eat a little less meat” for reasons such as health, sustainability and social responsibility, IRI found.

Frozen plant-based meat sales brought in $730 million, up 7% in the 52-weeks ending June 27, but the most notable growth is coming from refrigerated meat alternatives, Roerink said. This segment has gained traction over the last year, with $490 million in sales, growing 25%. The number of items in stores is also increasing, now with 17 plant-based items on the average store shelf, up 17%. These products are not only grounds and burgers, but also tofu and jackfruit-based items and entrees, apps and pizzas.

As distribution and assortment of plant-based brands continues to grow, frequency of purchases and dollars spent per buyer have decreased, likely due to the fact that the refrigerated meat alternative case has become “a little bit me-too,” Parker noted. Meat alternatives still offer consumers fewer choices than traditional meat, leading to repeat purchases largely plateauing in the last year. A wider variety of options will be essential for kickstart repeat buys in the segment, Parker said.

“I know from both anecdotally and talking with retailers, as well as talking with shoppers by the back half of 2020, the feedback about those 17 and a half items was that really the only thing that differentiated those refrigerated meat alternatives was form and brand,” Parker said. “Variety and engagement is further needed to not just grab trial, but to keep folks coming back to that refrigerated meat case.”

Furthermore, whether a brand is an established player in the meat space moving into alternatives or a new plant-based brand, Parker said all participants in the segment should understand their consumer base and tailor their media and distribution around those needs to be successful in the space.

“That’s the key. Launching everywhere to everyone is not going to work, especially in this space,” Parker said.