IQBAR Prepares to “Grow Smarter” With New Funding

Brain health bar brand IQBAR is ready to start thinking bigger after securing a new round of funding led by CircleUp Growth Partners, with plans to expand into a new category and grow its presence in ecommerce and retail this year.

Other investors in the round include Spiral Sun Ventures as well as new and existing angel investors. Karen Howland, managing director at CircleUp, has joined IQ Bar’s board of directors as part of the deal. While the company declined to disclose the raise amount, SEC filings indicate it was nearly $2.8 million.

IQ Bar offers plant-based, low sugar protein bars with ingredients, like omega-3s and MCT oil, that have been found to support cognitive function. Since launching in 2018, the company has raised approximately $2 million through angel investors and crowdfunding efforts. The close of its recent round marks the first institutional funding the company has received founder and CEO Will Nitze said, adding that the company has aimed to be “as nimble as possible in our initial stage of our lifecycle, and dilute ourselves as little as possible.”

“If you could bootstrap something to infinity, you do it, but we’re in a somewhat capital intensive game here, and you could be the most capital efficient bar company ever and you’re still going to very likely need outside investment,” he said. “You don’t take on institutional investment until you have something that’s proven out and you’re just trying to throw gas on the fire.”

As the brand has moved past the stage of “figuring it out” — fine tuning formulation, messaging, packaging and retail strategy — it’s prepared to rapidly accelerate, Nitze said. He felt that CircleUp Partners, with its data-driven approach and strong portfolio of brands such as Nutpods and Liquid I.V., was a smart strategic partner in its next stage of growth, he said.

IQBAR will use the new funding to move beyond bars into new categories, Nitze said, with plans to launch a hydration stick pack product called IQ Mix. The hydration product, set to launch later this spring, is formulated with adaptogens and electrolytes. For its first product launch outside of bars, Nitze said he wanted to avoid what he saw as a mistake by other bar brands: extending into “somewhat cannibalizing” products like bites or granola.

“I’m much more interested in products that are entirely non-cannibalizing and complimentary, and also products that I can sell to the same exact consumer and are solving different functional needs to that consumer throughout the day,” he said.

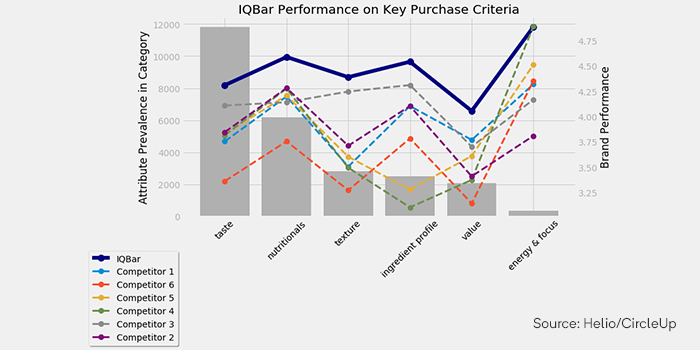

The brand will also use the funding to grow its ecommerce presence, which currently accounts for the majority of its business, Nitze said, and it plans to put more dollars behind digital marketing. Its success online is one of the factors that caught the eye of CircleUp, Howland wrote in a blog post detailing the investment this week. The bar category as a whole, while experiencing declines in retail over the last few years, has been steadily gaining traction online, she noted.

The post also called out brain health is an emerging dietary trend in the natural food space, especially online where brands have more of an opportunity to educate consumers, but Howland wrote that the movement is “still in early innings.” Nitze noted that products targeting brain health lack a “physiological feedback loop,” a tangible experience for a consumer like the energy jolt from a Red Bull, which has challenged the trend’s growth. Howland and CircleUp noted that one way IQBAR has dealt with this challenge is by also embracing key dietary trends like “keto,” “plant-based” and “low sugar” that consumers are already searching for, with its brain health attributes acting as a “hook” for consumers.

“[Brain health] is not a conversation starter, it’s a deal closer,” Nitze said. “You have to be able to win on other elements that just make a bar a good bar.”

Despite its ecommerce-first approach, distribution in brick-and-mortar retail is still essential for IQBAR, Nitze said. The brand is sold in retailers like Kroger and CVS, launched in Sprouts at the end of last year, and will soon roll out in Wegmans. Nitze said he sees the channel “as a billboard” that not only drives sales, but also brand awareness.

“If you’re on a Sprouts shelf, and 500 people walk by you everyday and look at your brand, what would you have paid for that if that had been a Facebook ad?” Nitze said. “Everything’s [about] working backwards from ‘How do I get good impressions that will then drive dollars of revenue?’”

To support its omnichannel strategy, the brand will also look to increase its small team by a third this year, Nitze said, recently hiring new heads of sales and operations, with plans to also bring on a new marketing manager and operations associates. Backed with an expanded team and capital, the brand aims to continue to grow online while also launching into “a few strategic new retail doors” this year, with the overall goal being to “professionalize into a medium-sized business.”

“We’ve been a sort of chaotic startup from the start until now,” Nitze said. “We want to grow smarter and be more focused, especially in the COVID era.”