Hungryroot Announces $40M Raise, Projects $175M in Revenue

Online grocery service Hungryroot announced today that it had closed $40 million in funding from the growth fund of venture firm L Catterton. The company projects it will have $175 million in revenue this year, a figure that’s even more impressive in the face of the fact that four years ago, it almost went out of business.

According to an article by Bloomberg, the deal values Hungryroot at $750 million. In total, the company has raised $75 million, with previous investors including Lightspeed Venture Partners, Crosslink Capital, Lerer Hippeau, and KarpReilly Investments.

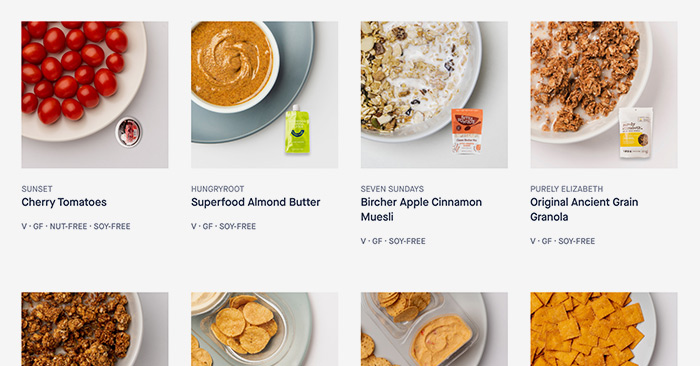

Hungryroot began in 2015 as an alternative to meal kits, initially offering prepared and boxed plant-based meals and then expanding to sweets, snacks and sides. In 2017 the company made a hard pivot, shutting its kitchens and production plants, laying off roughly 70 employees and pausing customer orders to reset. It relaunched in late 2017 not as a food manufacturer, but rather as a retailer that also sold only private label offerings, heavily focused on fresh options. Gone were the meals in place of a menu of items that consumers could mix and match to assemble into a meal.

Since then, the company has continued to grow its assortment. In 2019, Hungryroot decided to open its marketplace to other brands. The move also benefited the company itself, helping answer its own consumers’ requests for more products. In a medium post announcing the expansion, CEO Ben McKean said that Hungryroot saw a “perfect correlation” between the amount of products it offered and an increase in customer lifetime value.

“At Hungryroot, we see food brands’ inability to sell direct-to-consumer as a real issue,” Ben McKean wrote, “[Though] customers spend twice as much now that we have 60 products than they did when we only offered 30…even sixty products isn’t enough to support a truly convenient, direct-to-consumer experience.”

The company was already seeing returns from this new strategy when the Covid-19 pandemic accelerated customer adoption of the platform. The company expects to grow its $175 million in revenue this year to over $300 million in 2022.

Channel Visibility

The funding will be used to expand Hungryroot’s assortment over the next three years, growing even further to 3,000 items available each week. The company said it also plans to invest in hiring and also in marketing technology to improve its algorithms.

Given its focus on new and trendy items, Hungryroot also has become an arbiter of taste — with brands proudly proclaiming their association with the retailer. It’s a familiar sentiment for those who have been in the industry, similar to the “badge of honor” of getting into Whole Foods in years past.

Hungryroot can also be of particular benefit to fresh, perishable brands who would be turned away from online retailers only focused on shelf-stable products.

What to Watch

The company has said that selling on its platform also eliminates the channel conflict brands face when they launch their own direct-to-consumer platforms because Hungryroot is an “innovation platform for emerging products” instead of a “competitive distribution channel to grocery.” However, as the company expands its assortment and begins offering more products, retailers may begin to see the platform as a more traditional competitor; additionally, brands may find themselves in competition on the platform.

Still, it’s a business trend that has crossed over to other delivery platforms as well — both Misfits Market and Imperfect Foods are selling emerging brands. Others are also focusing on faster delivery options, an area where Hungryroot trails the field. For example, online meat retailer Butcher Box announced today that it would partner with Instacart to offer faster delivery in some markets, while Instacart itself is trying to offer under-45-minute delivery in some markets. As consumer expectations begin to change, it will be interesting to see if shoppers continue to order grocery items days in advance — especially once they return to stores.