Catalina Crunch Expands Into Savory Snacks, Launches Packaging Refresh

After finding success with its low-sugar cereal and sandwich cookies, keto-friendly brand Catalina Crunch is expanding into new snacking occasions with the launch of its new Crunch Mix line. The brand has also rolled out a packaging refresh intended to create a more unified and recognizable brand identity as it makes a larger push into retail and expands into different aisles of the store.

Catalina Crunch’s new snack mix line features cashews, almonds, pecans, chickpea pretzels and the brand’s cereal, and is offered in Traditional, Spicy Kick, Cheddar and Creamy Ranch flavors with five net carbs, eight grams of protein and four grams of fiber per serving. The products are sold on its website in a variety four-pack of 6 oz. bags for $32, as well as single-flavor five-packs for $39, with a retail launch to follow.

This isn’t the brand’s first foray into savory snacks — Catalina Crunch first launched a cheese crisp product similar to Whisps and Parm Crisps in 2019. But after finding it wasn’t differentiated enough from its competitors, the brand soon discontinued the product, president Joel Warady said, and has been working over the past year to develop a more unique savory offering.

“What we thought was, there’s got to be a better way to develop a savory snack that people are looking for,” he said. “And this idea of a snack mix or party mix, similar to Chex Mix, kept coming up as an alternative.”

Using the lessons learned from that product launch, the brand is offering consumers a low-carb and high-protein alternative to traditional snack mixes, a product Warady says is missing from store shelves. The snack mix line also offers consumers a crunchy low-carb snack — a texture that Warady said consumers following the keto diet often miss given the other keto products on the market, which often are cookies, bars or softer crackers.

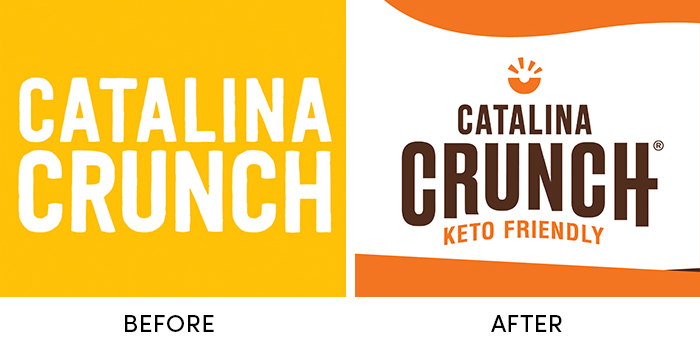

This titular “Crunch” in the brand’s name will be a major emphasis going forward, Warady said, with a larger typeface in the logo and carrying over to other product lines as well. Catalina Crunch has also discontinued the smoothie line it debuted in 2019, both because it lacked “massive growth potential” and didn’t fit into the “Crunch” brand promise, Warady said. The new packaging is set to launch across its cereal and sandwich cookie lines in retail and online over the next few months.

The refresh also places more prominence on the products’ nutritional macros, Warady noted. While the logo still features a “keto-friendly” call out, this attribute is smaller than it was in the previous packaging. The goal is to grow the products’ appeal beyond just consumers that follow the special diet to all shoppers looking for better-for-you options, Warady said.

“We’ve always believed that the idea of people following a keto lifestyle will just become the norm,” Warady said. “And that what people will be looking for is reduced sugar, reduced carbs and higher protein. So this is the first step in doing that and playing down the keto name itself.”

While Catalina Crunch’s direct-to-consumer sales were up triple digits last year, according to Warady, its most significant growth has come from retail, where it’s now in 15,000 doors. Since debuting its cereal in Whole Foods in early 2020, the brand has grown the cereal line’s distribution to Kroger, Publix and, last month, into over 700 Target locations. The brand is also growing in the club channel, with its cereal now in Costco in Texas and Northern and Southern California. Its cookies are also sold at Hy-Vee, Fresh Market and Sprouts. Over 2021, the company hopes to make a significant push into the conventional channel, he said.

To support this retail growth and category expansion, the company has been adding new team members in sales and marketing, quality assurance and omnichannel development. Catalina Crunch — which uses a hybrid co-packer and self-production model — will also move into a new production facility outside of Indianapolis in the fourth quarter of 2021, he said. Warady said this will allow the brand to increase its capacity “dramatically” to handle its growth, especially as it plans to expand into a new sweet category next year, with its next product launch set for the first quarter of 2022.

“We know how hard it is to both launch a product and gain distribution, and we’ve been very fortunate with the consumers that are buying our product and the retail partners that we’ve been able to work with,” Warady said. “That doesn’t happen as often as some companies would like, but we’re seeing great growth, and we look to continue to maintain that.”