Boxed To Become Publicly Traded Company

What Happened?

Online retailer Boxed announced today that it would become a publicly traded company via a merger with SPAC Seven Oaks Acquisition Corp.

The proposed deal values Boxed at roughly $900 million, Seven Oaks said in a presentation to investors today, and will leave Boxed with $334 million in cash to invest back into the company. Following the transaction, which is expected to close in the fourth quarter of the year, Boxed will continue to be led by its co-founder and current CEO Chieh Huang while Seven Oaks chairman and CEO Gary Mathews will serve as chairman of the board.

Seven Oaks announced its own IPO in December, with a goal of merging with a company that had “good environmental, social and governance (“ESG”) practices.”

What is Boxed?

Founded in 2013, Boxed sells bulk packages of food, beverage, and other household goods, including 125 of its own Prince and Spring private label products.

The company was backed by investors including First Round Capital, Greycroft, GGV Capital, and American Express, with its total funding to-date at a reported $240 million. Boxed reportedly turned down an offer from Kroger in 2018 and, according to Reuters, first began exploring a sale or potential merger with a SPAC in September 2020.

In 2020 Boxed had over 452,000 customers, the company reported, with an average order size of roughly $100 for consumers and $200 for businesses. Many of its customers (36%) are what the company refers to as “Backroaders” — single individuals, living in rural areas, far from a Costco. Its second largest consumer group is “Small Towners” — married consumers who live in rural or suburban areas and want the value of buying in bulk, but don’t want to order from big businesses such as Amazon.

What Makes Boxed Different?

Unlike its brick and mortar competitors, such as Costco and Sam’s Club, Boxed does not charge a membership fee. Instead customers can opt to join BoxedUp (which provides extra discounts, free shipping and cash rewards) for an additional $49 a year.

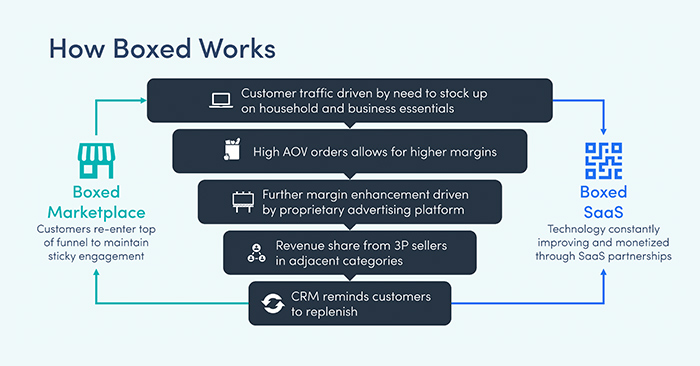

It also eschews the treasure hunt mentality of other warehouse stores, instead offering a smaller, curated selection of merchandise. Seven Oaks said that these efforts, along with Boxed’s mobile-first “basket building shopping experience,” ultimately not only lead to larger basket sizes, but also have allowed the company to streamline fulfillment, increasing profit from each order.

Where’s the Potential for Growth?

Seven Oaks said Boxed is expected to grow at a compound annual growth rate (CAGR) of 33% over the next five years, ultimately achieving $1 billion in net revenue by 2026.

While it’s true that the company has had an excellent year, Seven Oaks noted, with the Covid-19 pandemic driving rapid adoption of ecommerce sales, the group believes there’s even more customer adoption to be had. There’s also room for growth with existing customers signing up for recurring order subscriptions and the BoxedUp platform. As offices reopen, Seven Oaks also plans to focus on increasing Boxed B2B efforts.

To cater to both of these groups, Boxed will also expand its assortment, adding more “healthy” and organic products. Some of this expansion, Seven Oaks said, will come from further efforts around Marketplace third party offerings — such as Boxed wine. The company also will look to increase revenues from brands, further developing its advertising offerings.

However one of the biggest opportunities Seven Oaks identified is to become a larger software-as-service (SaaS) provider. In January of 2021 Boxed agreed to a software partnership with Aeon Group, one of Asia’s largest retail conglomerates and one of the company’s investors, and Seven Oaks see the potential to grow this line of business from $12 million in 2021 to $106 million by the end of 2026.