Mintel Explains 2025 F&B Trends

What trends will drive innovation and consumer habits in 2025? Global retail analytics firm Mintel released its yearly 2025 Global Food and Drink Trends report, categorizing how CPG companies can better align with future demands.

Mintel highlighted four categories which focused on conscious indulgence, elevated demand for weight management options, consumers’ emerging interest in supply chains and the role of technology.

Rule Rebellion focuses on consumers’ demand for food and beverage that “breaks the rules.” For example, Mintel’s research noted that 75% of carbonated soft drink (CSD) consumers reach for a CSD to treat themselves.

Mintel’s analysts called out Coffee Mate Dirty Soda Coconut Lime Creamer and the Ore-Ida partnership with GoodPop on a Fudge n’ Vanilla French Fry Pop frozen treat as examples of the trend.

It’s not just indulgent foods and beverages but a growing desire for consumers to “control to decide how they’re going to manifest this rebellion,” said Mintel Food & Drink associate director Melanie Zanoza Bartelme on the company’s webinar presentation earlier this week. “People are interested in breaking the rules and bringing something new into their life.”

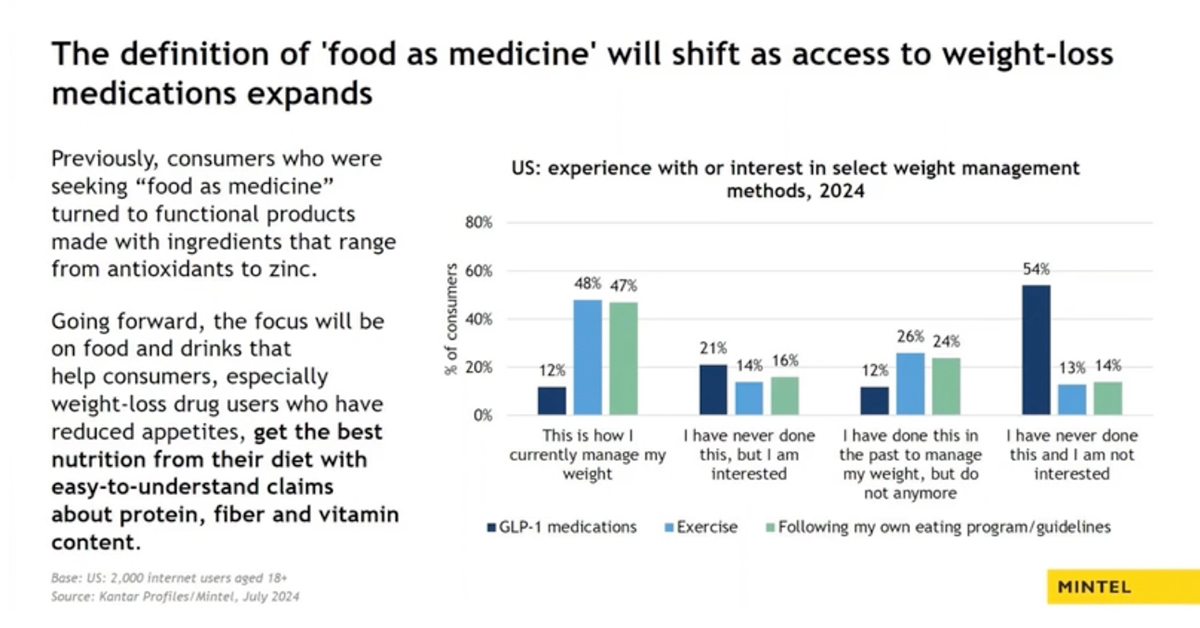

Another trend that has been flagged by multiple groups is the continued emphasis on weight management products ushered in by the rise of GLP-1 drugs and a desire for more products that can be considered food-as-medicine.

Mintel calls this trend “Fundamentally Nutritious,” which is represented by an evolution of consumers making food and beverage choices that directly correlate to health. This translates to an emphasis on more basic nutrition — protein, fiber, vitamins and minerals — in everyday food items and eating occasions, said Jenny Zegler, Mintel Food & Drink director.

“I would argue, if those of us can get these basics, it allows us for a little bit more ‘rule rebellion,’” she said. “If we know we’ve gotten our protein content, maybe we’re more than willing to treat ourselves to something new.”

The third trend, Chain Reaction, stood out in its focus on supply chains and consumer education. Starting with the pandemic and evolving into to cargo ship delays from downed bridges and blocked canals, Mintel’s team explained that consumers have become more familiar with how products get to grocery shelves.

The increased understanding of supply chains has become a way for CPG companies to not only educate consumers better but connect with customers in new ways.

“We have also already been seeing some of these with either new ingredients coming in or a reliance on ingredients that have been around but maybe not celebrated as much,” Zegler said.

Mintel argues that transparency in the supply chain builds consumer loyalty while also exposing customers to new ingredients or innovative ways to create familiar products with more sustainable or cheaper ingredients.

Hybrid Harvests demonstrates how technology and agriculture can work in tandem to benefit consumers, companies and the environment. This trend is rooted in how supply chains can be strengthened to improve accessibility and price while prioritizing environmental sustainability.

This is also related to education and transparency within CPG. Mintel’s report said that if companies can “establish themselves as trustworthy agricultural innovators and educators” then consumers would be more willing to buy products that incorporate technological innovation.

For example, Mintel highlighted Meati’s marketing strategy of comparing its mycelium-based meat alternatives to cheese-making or beer brewing has allowed consumers to be less intimidated by food tech innovation.