Report: Rising Inflation, Assortment Influencing Growth In Frozen Food

The frozen food category “remains consistent” but has room to grow with inflationary pricing rising dollar sales nearly 22% this year compared to three years ago, according to a report released this week by the The American Frozen Food Institute (AFFI) and The Food Industry Association’s (FMI)

A biannual report “Power of Frozen in Retail” – which surveyed over 1,700 frozen food shoppers across demographics and U.S. regions – focused on the role of inflation on the category, how brands and retailers can better support core shoppers while bringing more people to frozen food and the strategies driving more consumer adoption.

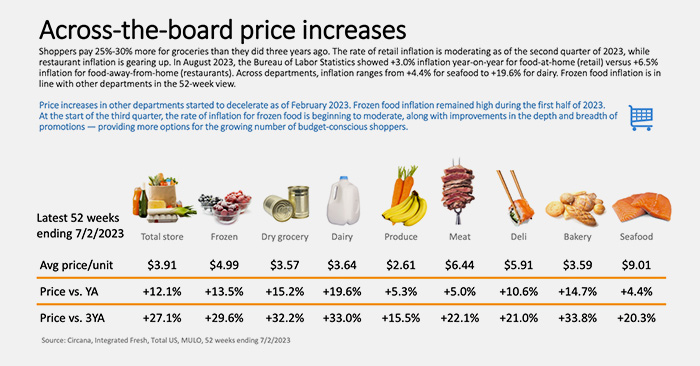

Inflation Is Driving The Narrative

Though the top line numbers show dollar sales gains of $74.1 billion this year, a 7.9% increase compared to the year prior, a closer look shows that high inflation is driving those figures. The big winners in dollar growth within frozen were processed meat/poultry (+19.6%) and fruits/vegetables (+14.8%); yet, unit sales were down across most segments with notable dips in seafood (-8.4%) and unprocessed meat/poultry (-8.1%).

Across all grocery store categories, unit sales of frozen foods (-4.9% YoY) took the biggest hit only behind seafood (-5.4%).

“No section of the grocery store is immune from the inflationary pressures right now,” said AFFI VP of Communications Mary Emma Young.

Yet inflation has also been more stubborn in frozen than other departments. Frozen food price per unit is up +3.9% compared to a year ago, (+8.6% in Q2 and +16.3% in Q1), some of which can be attributed to cold chain challenges in supply as well as a seasonality that moderately fluctuates throughout the year, Young said.

Inflation also continues to motivate consumers to dine off-premise. In September, the share of meals prepared at-home increased to 78.8%, according to Circana data provided to AFFI, upholding the patterns observed in 2021 and 2022 where at-home meal preparation dipped in the summer and then increased month-over-month throughout the fall and holiday season.

Increasing Frozen Market Share Among All Consumers

Increased assortment is also helping frozen recover from inflation’s impact on the category and regain some of the demand that it had during the pandemic. After being down in the double-digits due to pandemic-buying and supply chain struggles for much of the last two years, the average number of items per store (about 1,400 currently) is climbing back up, rising nearly 2% versus last year.

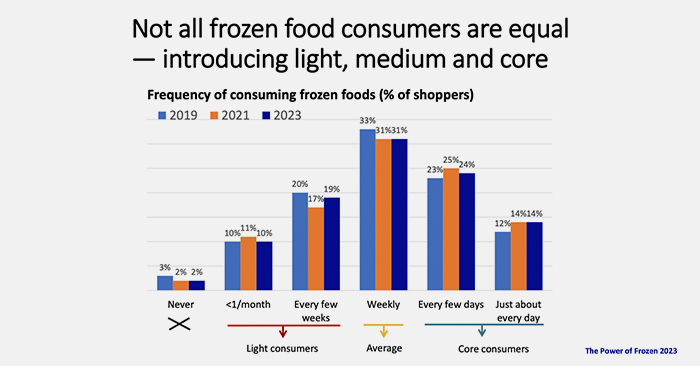

According to the AFFI-FMI report, core frozen consumers – categorized as the 38% of total shoppers who “consume frozen food every few days or daily” – have remained steady since the pandemic.

But the question now is: How do retailers and manufacturers bring in more of the light and moderate frozen consumers?

E-commerce represents one path. While nearly half (47%) of consumers get their frozen foods from mass retailers (Walmart, Target) and club store, online sales have continued to make gains after booming during the pandemic, rising to 3% of channel distribution in frozen dollar sales YTD for 2023, compared to 1.7% in 2020. Yet, household penetration for online grocery shopping has plateaued at around 50% offering an opportunity to grow this channel further for frozen CPG.

The report also highlighted that there was a potential to reach a larger market in convenience, dollar and drug stores in the wake of pricing pressures in other channels.

The category could also be expanded through messaging around food waste reduction, both in cost-savings and sustainability, Young said. Emphasizing the nutritional value of frozen produce, improved through the integration of individually quick frozen (IQF) technology that can better retain nutrient content, is also important for AFFI. Of those surveyed, 74% of respondents look for one or more better-for-you attributes when purchasing frozen foods.

Retailers and manufacturers could use that to bring more natural shoppers to the category, Young said. “Frozen is a temperature state nothing more.”

New Merchandising Strategies

Merchandising can be key to driving this narrative with a focus on multiple product sales.

One suggestion tested among survey respondents was frozen meal solution endcaps to drive multiple item purchases. About 65% of consumers said they would be interested in cross-merchandising promotion where all items for one meal were located in the same frozen case.

That aligns with consumers valuing speed and convenience as part of their value equation for shopping, the report said.

Promos and larger pack sizes remain tried and true strategies to bring more shoppers to the freezer aisle and drive multiple purchases but Young pointed out that assortment is important as well.

“Innovation prompts trial and that prompts discovery,” she said. “Folks might come into the aisle to look for their bag of frozen peas, or their frozen pizza and might see some of the better-for-you options that they weren’t even aware existed.”