Repole’s Impact Capital Acquires Majority of Junkless Foods

Impact Capital, the private equity group of CPG entrepreneur Mike Repole’s family office Driven Capital, has acquired a majority stake in snack bar brand JUNKLESS Foods, according to an announcement today.

“We have poured our heart and soul into getting JUNKLESS to where it is today, but we knew we needed something more to take us to the next level,” said Ernie Pang, co-founder and CEO of JUNKLESS, in a press release. “We could not have asked for better partners in Mike and the Impact Team, who share our passion for JUNKLESS and see the incredible potential of our brand, and know how to get us there.”

Terms of the deal and future operating plans were not disclosed. A press release notes that Impact will “partner” with Pang and co-founder Larry Beyer.

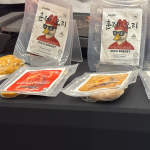

Founded in 2017, Michigan-based JUNKLESS sells five varieties of limited-ingredient, chewy granola bars and two flavors of crispy protein bars. The company previously sold a line of crispy cookies, which have since been discontinued.

According to JUNKLESS’ website, the snacks are available in retailers including Walmart, Kroger, Giant, Stop & Shop and Food Lion as well as on Amazon. As of 2022, the products were sold in more than 6,000 doors nationwide.

JUNKLESS raised $500,000 in 2016, according to filings with the Security and Exchange Commission (SEC). It is also listed as a portfolio company for Quake Capital.

Along with capital, Repole brings expansive expertise in the snack space to the bar brand. In 2009 he acquired a majority share of Pirate’s Booty alongside investment firm VMG; the puff brand was later sold to B&G Foods in 2013 for $195 million. Repole was previously an early investor and board member for snack bar brand KIND. Within beverages, he has co-founded Vitaminwater and BODYARMOR, both of which sold to The Coca-Cola Company for $4 billion and $8 billion, respectively.

In July, Impact Capital also acquired the majority of sneaker and apparel brand Nobull.

“We saw a huge opportunity for JUNKLESS to become a major brand. Everyone is looking for better-for-you versions of their favorite snacks – and that’s exactly what JUNKLESS provides,” Repole said.

Junkless has seen significant growth over the past year. According to IRI data (MULO + c-stores) for the 52-week period ending August 12, the company’s total dollar sales increased 82.6% to more than $18 million. Despite raising prices about 11% (a $4.49 uptick) JUNKLESS has managed to maintain unit velocity with volume growth rising 63.6% over the past year, per IRI.

The brand’s growth rate is outperforming the granola bar category at large, which saw sales increase 9.3% while volumes declined 4.5%, on average, and prices went up nearly $4. But JUNKLESS still has some catching up to do; currently category leaders (in terms of total dollar sales) are Nature Valley ($676 million), Quaker ($453 million) and Sunbelt ($137 million). The broader snack bar category also reported similar sales/volume dynamics.