The VC Playbook Won’t Work For Regen – So What Will?

Regenerative agriculture has become an inescapable buzzword in CPG over the past few years. Entrepreneurial food and beverage brands regularly announce they are planting regen roots – either via financial commitments to support farm transitions or by switching over portions of their ingredient supply chains to purchase from those honoring tenets like soil health and biodiversity, and sometimes they do both.

Large conglomerates including PepsiCo, General Mills, Mars, Nestlé and Cargill have tried various strategies, including lofty acreage targets to transition farmland or creating grant programs for farmers looking to make the switch. However, most regen food startups have had to pioneer their own sourcing networks, starting from the ground up to build brands that support seed-to-shelf regenerative agriculture systems – operations that take a bit of initial capital to get going.

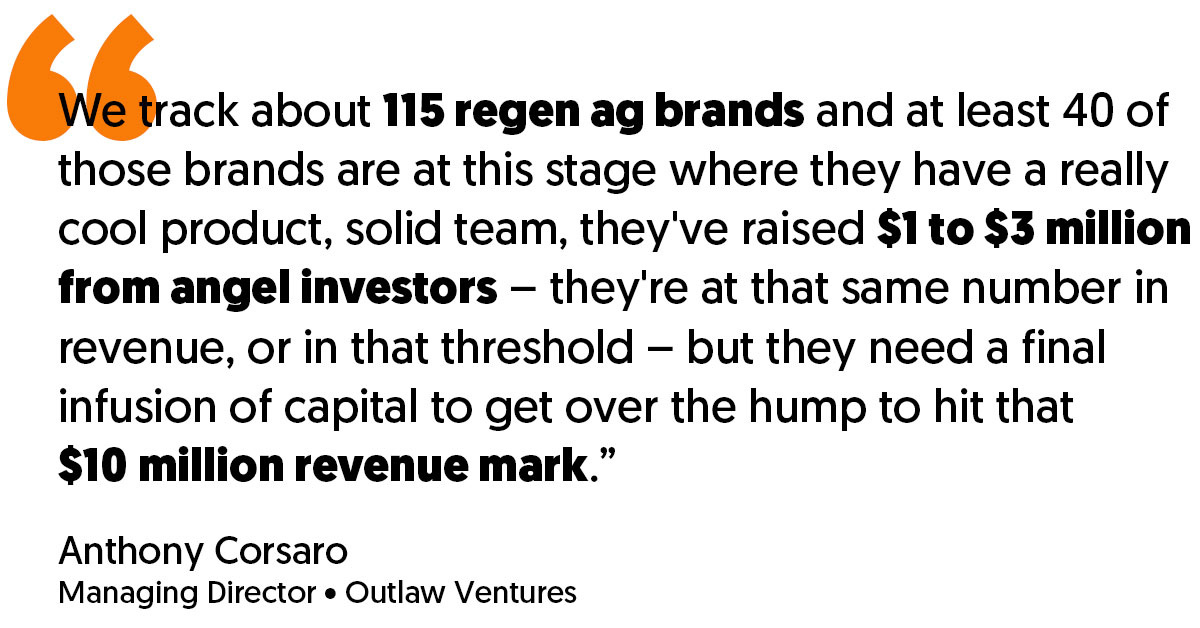

Venture money, already in short supply, seems even harder to come by for the emerging regen space. Many entrepreneurial regen ag brands have been established for about three to five years, putting them within the window where they may begin seeking seed capital; yet even as venture money flooded into plant-based protein startups over the last decade, this niche sustainability-centric segment of the food industry doesn’t seem to be garnering the same rate of investor interest, or the large checks.

“The regen ag transition overall is massively undercapitalized – that’s the macro problem,” said Anthony Corsaro, managing director at Outlaw Ventures, a regen ag CPG-focused firm. “The [second] problem is what I call ‘upstream disease.’ All the money going [into the space] is going to farmland funds, transition financing for farmers, or venture capital ag tech – and we need way more money in those spots – but right now the money that we have in the general pot is too focused on those areas. We’re not putting money into middle infrastructure for processing and distribution and we’re not putting money into brands”

According to Dealroom, the regenerative agriculture market is currently valued at $6.1 billion, but 90% of that valuation is contributed by two agritech unicorns – Indigo and Pivot Bio – both of which sell tech to farmers rather than create and support regenerative ag systems themselves. “VC investment in regenerative agriculture has been relatively small and volatile,” Dealroom concluded.

While investment in regenerative agriculture has been slow, since 2014 there have been 130 transactions in AgTech totaling over $6 billion in M&A activity, according to data from Farrelly & Mitchell, a food and agribusiness advisory firm. But, the firm expects to see $700 billion invested into regen ag by 2050.

Why The Traditional VC Model Won’t Mesh

While regen ag seems to be growing exponentially by the day, in the grand scheme of things, the term and concept are still relatively new to CPG. Both Corsaro and Lara Dickinson, executive director and co-founder of One Step Closer, believe the complex nature of regenerative agriculture itself has likely deterred traditional venture capitalists.

“People with money invest in things that they know,” Corsaro stated.

“The challenge consistently has been – and we all pretty much know this – that to do something that is systems level, it is not quick and [regen ag] definitely doesn’t fit into the traditional venture model,” explained Dickinson. “Especially technology venture models – it’s sort of the death of a small food company.”

Brands operating in the space have also been vocal about the capital hurdles they’ve faced. Some believe that overall awareness and price premiums are necessary for regen ag to sustainably develop and for investors to buy in. Others, like Joni Kindwall-Moore, founder and CEO of millet-based Snacktivist Foods, say investors are not always aligned on what regenerative agriculture-focused businesses should prioritize.

Kindwall-Moore mentioned a conversation at this year’s Expo West with one regenerative agriculture investor who told her that establishing her own small farm network to grow the brand’s hero sorghum ingredient would put the company’s M&A value at risk. When she shared plans to scale that supply chain network through partnerships with a larger food company, the investor said any supply chain collaborations would also be disadvantageous to the value of the company.

“To me these things are really significant, but he was like – that’s the biggest waste of time I ever heard of,” said Kindwall-Moore, who declined to name that investor on the record. While the brand did close a $515k seed round last year, over the course of its eight-year history, the founder said she has come to realize that “if you’re doing regenerative and CPG, there’s almost no one who wants to back you.”

Due to the variability between regenerative ag systems per crop, the supply chain complexities that come with these ventures, along with the nascency of the space, there may be too many critical pain points for venture capitalists, who typically seek a granular understanding of a business’s operations and historical data on deal flow in the space.

Even if interest in a business is established and due diligence is completed, the timeline for returns from a regen ag company is often longer than that of a typical food company. Corsaro believes that a regen ag return timeline may clock in close to the seven to ten-year mark, which may be unappealing to venture capitalists who are used to a three- to five-year return rate.

Success May Look Like Capital Stacks Throughout The Supply Chain

Both Corsaro and Dickinson’s OSC Venture Fund are looking for alternative approaches to capitalizing regen ag brands specifically, and as a by-product, support their supply chains. The OSC Fund is run by mission-driven founders who have “been there and done that,” explained Dickinson. While the fund does not solely focus on regenerative agriculture, she said the wider group within OSC have been discussing how to scale regenerative methods for over a decade. And yet, two big questions remain unsolved.

“The problems are still there,” said Dickinson. “How do we communicate this in a way that’s coherent, pre-competitive and clear. And, there’s so many steps to actually communicating this to consumers, so that’s one [question]. Then, how do we align the value chain to actually be monetized and to value this?”

But the OSC Fund doesn’t operate with the same high risk, high reward mentality of traditional VC, Dickinson explained; “We’re seeking less risk and maybe a more reasonable upside.” Dickinson emphasized that the fund does operate as a venture investment vehicle, but with a mission-aligned mindset and experienced CPG team, she believes it has a built in “de-risking function” that makes regen ag brand investing more attainable.

Corsaro said he has previously made investments across the gamut of the regenerative ag supply chain, but now invests specifically on the brand end as well – even while acknowledging that investing in brands alone will not scale the movement. He said he sees future success in stacking capital within an organization, from multiple funders, deployed to multiple different areas that impact that business.

That “broader ecosystem thing is the future of success,” he said. “We have to find ways to bring in the right capital, at the right time, from the right person, to these regenerative supply chains. Right now, what we’re doing is trying to just solve for bringing that capital to the regenerative farms – which isn’t the answer – we have to solve for the [whole] supply chain.”

Organizations like nonprofit MadAg are working to streamline financing options for regenerative at the farm level while connecting those suppliers to manufacturing and brand partners through its Mad Markets branch. Additionally, the USDA has deployed grant programs at both the farm and brand level with Maple Hill Creamery recently landing $20 million to support acreage transitions and educate farmers within its network about regenerative dairy practices. But aside from some other small investment vehicles and government grants, financing for the space remains limited.

Simultaneously Scaling Within The Value Chain Could Support Success

During the early years of both the organic and grass fed movements, the farm level work, supply chain development and brand growth did not happen in silos. Victor Friedberg, co-founder of S2G Ventures and an early investor in Maple Hill, recounted the early days of the dairy brand’s push to grow the grass-fed milk market and believes that approach – financially rewarding farmers in its supply network for hitting transition milestones – is a reliable method to get regenerative ag growing from the brand level, down.

“[At the time], we as investors said that [supply chain-focused] direction can make the company more investable and also help it make sure that it has a supply to keep growing,” Friedberg explained. Without that program in place, he argued, investors would have viewed Maple Hill’s business model as a hindrance rather than growth opportunity.

“[If] you don’t have a supply that is commensurate to the growth that you’re trying to sell us, even if [investors] believe that the consumer is there, it wouldn’t matter.”

However, in 2023 traditional investors focused on regenerative agriculture may not even see a supply chain-growth focused CPG company as enough of an opportunity. Similar to Kindwall’s experience, Matt Cohen, co-founder of Simpli, said he has spoken with a number of investors over the company’s three-year history and found that generating interest for the space is still a challenge when tech isn’t a component. Simpli did raise an undisclosed sum of seed funding in 2021, led by Eat The Change co-founder Seth Goldman and the Abell Foundation.

“What we noticed is that there are firms out there who say they want to invest in regenerative agriculture, but then once they learn that technology isn’t involved in the business model – they might not be interested.”

Even if they are interested in the business, typically once they begin assessing rate of returns, investors with a tech VC mindset likely won’t find their expectations met.

“Investors need a level set on the rate of return with [regenerative agriculture] because they can still get a healthy return for their shareholders while also being impactful in this world,” Cohen said.

Those same sentiments have led Corsaro to question whether the VC model even works in the food businesses beyond the regenerative space due to those tech venture-heavy mindsets. Particularly within the current macro economic environment and state of many regen ag brands’ growth, he believes the solution to scaling this space likely lies outside the bounds of any existing playbook.

“The challenge with this entire thing comes down to – there are no real, simple solutions,” he said. “[Investors] have to have a deep willingness to enter into nuance and complexity. We’re not going to solve for the whole thing. We’ve got to solve for individual supply chains, individual commodities and individual brands and then look across [for] commonalities. ‘What are the replicable pieces here?’ That’s how you’re gonna solve for it.”